Gross Pay Period Meaning

Gross pay is the total paid to an employee each pay period before any deductions for taxes or other purposes and it is determined in different ways for salaried and hourly employees. You can think of it as a summary of all the payroll activity during a period.

Gross Vs Net Income Importance Differences And More Bookkeeping Business Accounting And Finance Finance Investing

It includes the full amount of pay before any taxes or deductions.

Gross pay period meaning. If all of the components of gross earnings are not included in the relevant calculations for holidays and leave the employee will likely be underpaid and. Gross Pay. Gross pay is the total amount of money an employee receives before taxes and deductions are taken out.

In other words a payroll register is the document that records all of the details about employees payroll during a period. Gross pay also called gross income is the individuals total pay from his or her employer before any taxes and deductions. For salaried employees gross pay is stated as an annual amount.

The exempt or salaried employee is paid gross pay based on the amount of her annual salary divided by the number of pay periods in a year usually 26. Gross pay is the amount of money an employee earns for time they worked. The EPF in India is an employee-benefit scheme recommended by the Ministry of Labour which provides employees with.

It gives a better idea of what youre worth to the company than net pay which can vary from person to person. This estimator will help you to work out an estimate of your gross pay and the amount withheld from payment made to you as a payee where. What Does Gross Payroll Mean.

All calculations for employee pay for instance over time withholding and deductions are based on it. An employees gross pay is the amount of wages before any deductions including taxes and benefits. For example when you tell an employee Ill pay you 50000 a year it means you will pay them 50000 in gross wages.

Gross pay is the amount of money your employees receive before any taxes and deductions are taken out. An employee does not need to be paid a salary to earn gross pay -- someone paid by the hour only when working still earns an amount of gross pay. To arrive at gross payroll for the pay period add all cash payments and non-cash wages made.

Gross salary refers to the full payment an employee receives before tax deductions and mandatory contributions are removed. For example a salaried employee who makes 40000 per year is paid by dividing that 40000 by the number of pay periods in a year. Net pay is the amount of money your employees take home after all deductions have been taken out.

Gross pay includes any overtime bonuses or reimbursements from an employer on top of regular hourly or salary pay. A pay period can be weekly fortnightly or monthly. Gross pay is what your employer pays for your time.

The gross pay estimator will give you an estimate of your gross pay based on your net pay for a particular pay period. In the example the employee would receive 26 paychecks that each total 153846. Gross pay may also include pay.

Gross pay may be determined by the amount an employee works as in hourly pay or at a set rate as in a weekly salary. It is not limited to income received in cash. Gross payroll applies to payments made daily weekly biweekly semi-monthly monthly quarterly or.

Notice I didnt say it was the total amount paid to each employee. A payroll register is the record for a pay period that lists employee hours worked gross pay net pay deductions and payroll date. In other words Gross Salary is the amount paid before deduction of taxes or deductions and is inclusive of bonuses over-time pay holiday pay etc.

It also includes property or services received. It can be used for the 201314 to 202021 income years. This amount is equal to your base salary plus all benefits and allowances such as special allowances overtime pay medical insurance travel allowance and housing allowance.

For example when an employer pays you an annual salary of 50000 per year this means you have earned 50000 in gross pay. For the purposes of calculating payments for holidays and leave gross earnings means all payments that the employer is required to pay to the employee under the employees employment agreement for the period during which the earnings are being assessed. You can easily compare your gross pay with salaries in other positions and see if youre earning your full market value.

English words and its meaning improve word power and learn english easily. Gross pay typically consists wages salaries commissions bonuses and any other type of earnings before taxes. Gross pay often called gross wages is the total compensation earned by each employee.

Any reimbursements bonuses or other payments would also be added to gross pay.

Small Business Income Statement Template Fresh Free Downloadable Excel Pro Forma In E Statement For Income Statement Statement Template Financial Statement

The Islamic Script For The Word Aql Meaning Reason Or Understanding Symbolic For Trust Meant To Be Words Understanding

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

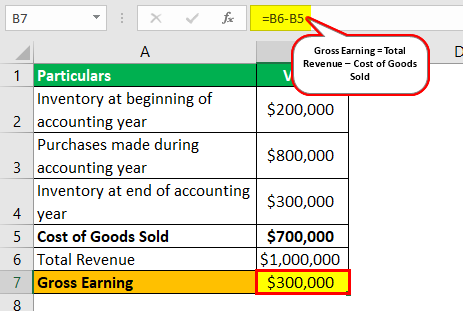

Gross Earning Meaning How To Calculate Gross Earning

Gross Earning Meaning How To Calculate Gross Earning

Gross Vs Net Income Importance Differences And More Bookkeeping Business Accounting And Finance Finance Investing

Chart Of Accounts Meaning Importance And More Chart Of Accounts Accounting Bookkeeping Business

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Pin By Adriana Piacesi On Nomes Names Names Akira Jamal

What Are Gross Wages Definition And Overview

Genevieve Wood I Picked This Diagram Because Of The Side By Side View Of The Contribution Margin And T Contribution Margin Income Statement Cost Of Goods Sold

Margin Definition Gross Profit Margin Profit Margin Formula Operating Profit Margin Infographic Economics Lessons Finance Investing Accounting And Finance

Tangible Assets Meaning Importance Accounting And More In 2021 Accounting Basics Accounting Learn Accounting

Sales Cost Of Goods Sold And Gross Profit Cost Of Goods Sold Cost Of Goods Cost Accounting

Post a Comment for "Gross Pay Period Meaning"