13th Month Pay Prorated

Thirteenth-month pay is calculated by taking 112 of the employees total basic salary earned for the year excluding overtime holiday and night shift differential pay. Kapag nagtrabaho ka ng12 monthsmeron kang1 montho13th month.

10 Things You Should Know About 13th Month

851 as amended by Memorandum No.

13th month pay prorated. Metro Manila CNN Philippines October 19 Workers awaiting their 13th month pay might not receive it in full this year as the benefit will be pro rata based a labor official said. 13 th month pay is one of the mandated benefits by law. The proportionate 13th-month pay shall be computed as follows.

Aileen Cerrudo March 16 2020 4623. The 13th month pay shall be in the amount not less than 112 of the total basic salary earned by the employee within the Calendar day. You can now provide your salaries from January to December and Thirteenth Month will compute your 13th-month pay.

President Rodrigo Duterte appealed to employers on Monday March 16 to help their employees financially survive the enhanced community quarantine imposed on the entire Luzon region due to the coronavirus outbreak. The Department of Labor and Employment Dole said that every rank-and-file employee in the private sector has the right to receive 13th-month pay provided they worked for at least one month in a year. Minimum service required is one month.

When an employee pays direct income tax and the 13th months salary and bonus are paid in the same month a higher tax rate is paid. Let say an employee basic salary is Php15000 per month and had worked for 10 months. The 13 th month pay shall not be less than 112 of the total basic salary earned by an employee within a calendar year.

While it may be unusual to pay prorated or 13 th month bonuses in your organization situations may arise where your company needs to do so. Before you start keying on your calculator it is important to note what constitutes basic salary. Employers may pay one-half of the bonus in the middle of the year at the beginning of the regular school year.

If an employee resigns what should be the computation. 13 th month pay is 112 of basic salary earned during the calendar year. Basically the amount of the 13th-month pay is 112 of the employees annual salary.

This is also known as the prorated 13th month pay which is paid to a permanent employee who has worked less than 12 months. In the first and last years of employment the thirteenth salary is prorated for partial years. Thirteenth-month pay is a form of monetary benefit given to every rank-and-file employee.

It should be given not later than December 24. Thirteenth Month by Sweldong Pinoy is a tool for Filipinos in computing their 13th-month pays. Monthly salary x 6 12 Proportionate 13 th -month pay Php1309383 x 6 12 Php654692.

How is 13 th month pay computed. Some employers pay an additional annual bonus based on employee performance or employer profits. For example if your basic monthly salary is PHP 20000 and you started working for your company last September your 13th month computation should look like this.

This means your 13th month pay is monthly basic compensation computed pro-rata according to the number of months or days you have worked in your company. Duterte urges employers to release pro-rated 13th month pay amid COVID-19 crisis. Total basic salary earned for the year proportionate 13 th month pay 12 months.

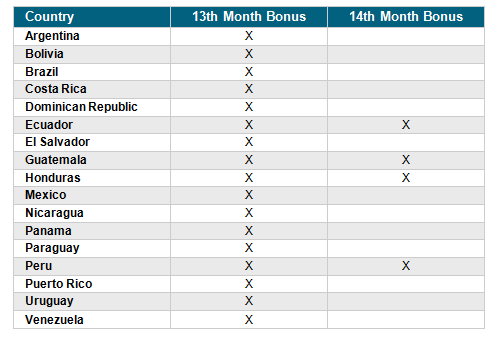

This is based on PD. Consult employment law in each of the countries where your company does business to ensure that your organization is making these 13 th month payments correctly. Your 13th month pay should be not less than 112 of the total basic salary you earned within the calendar year.

Basic salary within a calendar year 12 13th month pay And the way to compute for a prorated 13th month pay if you only work several months lets say 3 should look like this. All rank and file employees regardless of their designation or employment status who have worked at least one month during the calendar year are entitled to a 13th month pay. Of days reported since January to March 23 2017 x your daily rate divide by 12 then it is your 13th mo.

This means the 13th month pay is based on the actual salary earned by the worker Labor Undersecretary Benjo Benavidez explained adding the minimum amount of the benefit is computed by adding all actual salaries and dividing it by 12. For employees who worked less than 12 months they will receive a prorated 13th month pay based on the number of months you worked for the company. What is 13th month pay.

How To Calculate Prorated 13 Month Bonus

Everything You Need To Know About 13th Month Pay Sunstar

Dole Guidelines For 13th Month Pay In Private Sectors

13th Month Pay Computation Dole Labor Advisory

Release Of 14th Month Pay From Nov 15 To Dec 31 Pushed Depedtambayanph

How To Calculate Prorated 13 Month Bonus

How To Compute 13th Month Pay Explaining In Details Kami Com Ph

How To Compute 13th Month Pay 13th Month Pay Months Computer

How To Calculate Prorated 13 Month Bonus

How To Compute 13th Month Pay In The Philippines An Ultimate Guide

Here S What You Need To Know About 13th Month Pay In The Philippines Jobstreet Philippines

13th Month Pay In The Philippines Computation And Guide

How To Calculate Prorated 13 Month Bonus

13th Month Pay An Employer S Guide To Monetary Benefits

How To Check The 13th Month Pay Settings Sprout Solutions

10 Things You Should Know About 13th Month

How To Compute Your 13th Month Pay 2020 Jobs360

How To Compute Your 13th Month Pay Blog

How To Calculate Prorated 13 Month Bonus

Post a Comment for "13th Month Pay Prorated"