13th Month Pay Slip Format

You can download free payslip template from this page. The 13th-month pay is computed based on 112 of the total basic salary of an employee within a calendar year or your basic monthly salary for the whole year divided by 12 months.

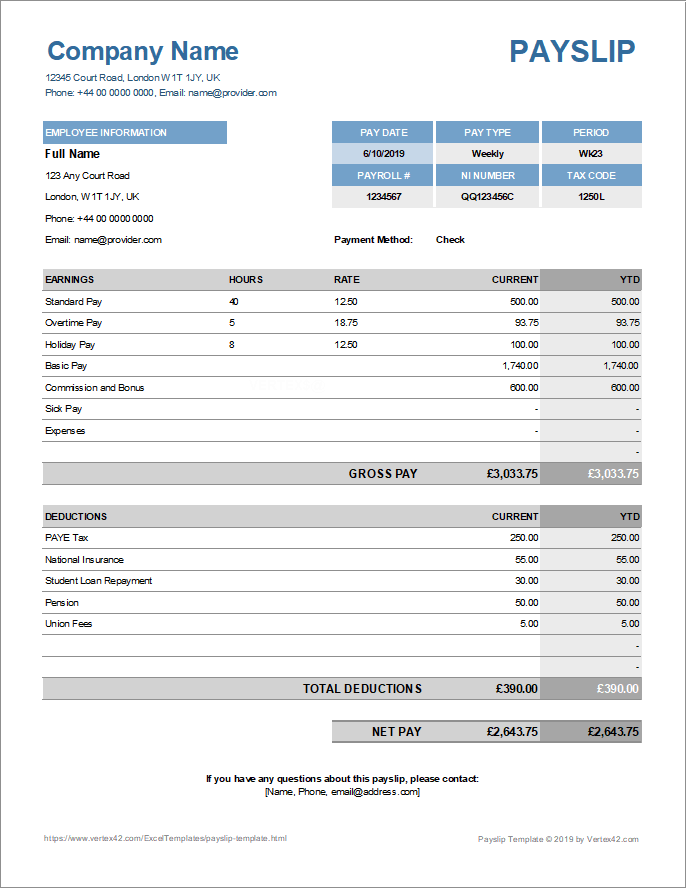

Excel Templates Stress Free Jobs Payroll Template

This will be included on the employees payslip once you generate the payrollIf you would like to edit the payment you can hover your mouse pointer to the employee name and click on it to open the 13th month payment.

13th month pay slip format. Payslip Template in Excel Build a Free Excel Payslip. You can then set them to be accessible to employees via email or print depending on your companys preferences. Salary slip format in word free download Verified 8 days ago.

Others tardiness loan received by. Others company name incentive 9252009 000 000 000 000 000 000. Payslips for your employees are automatically generated after completing and finalizing your payroll.

Payslip serve employees as basic salary document to track salary payments received by the company or. Payslip Template Format. It is worthy to say that the 13th-month payment is not new.

The computation formula is as follows. TOTAL BASIC SALARY IN A MONTH EARNED IN THE YEAR 12 MONTHS PROPORTIONATE 13TH MONTH PAY. Minimum wages vary by industry and region.

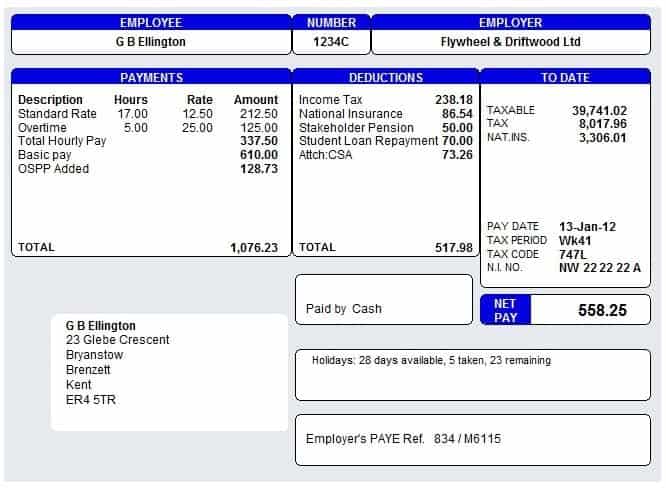

The 13th month pay shall be in the amount not less than 112 of the total basic salary earned by the employee within the Calendar day. The payslip lays out all the essential pay period information as well as tax and company-specific bonuses and deductions. Payslip Format for download includes all the options like Basic Pay Allowance Arrears Income Tax Van Fare Security Deposit and a deductions Section.

It works much like a mandatory bonus. Payslip can be a printed piece of paper or soft copy sent to the employee via email. This slip is used for writing the detail of the salary like name of employer and employee date of payment day and total amount of payment allowances and other important information about the employee salary.

Under the income section comes basic salary dearness allowance house rent allowance conveyance allowance leave travel allowance medical allowance performance bonus and special allowance. The minimum 13th Month Pay payment under law must not be less than 112 of an employees total basic salary earned during 2020. You can actually view how much you stand to redeem your 13th month pay on your payslip.

13th Month Payment for 1 month 13th Month Bonus Payment. While in the Philippines it is defined as one-twelfth of workers basic salary within a calendar year. However the bare minimum wage for all employees in Brazil is BRL 1039 a month.

Download Sample Payslip format in MS-Excel from the below link Details of the Payslip. Pasyslips are usually prepared for employees when they receive salary as direct deposit. The figure from the previous month is them added to next months redeemable and the next month and so on.

5 Leave Travel Allowance LTA The Leave Travel Allowance covers the cost of the travel when the employee is on leave along with a family member. Employees also receive overtime pay paid sick leave and vacation days. P83333 5000 12 months x of pay periods 4166666666667 x 2 pay.

Paid leaves philhealth holiday pay pag-ibig net pay. Depending on how the payment has been set up the 13th month redeemable is taken from 112th of your monthly basic pay worked. Here is the basic 13th month pay formula in the Philippines.

Total basic salary earned during the year 12 months Proportionate 13th Month Pay Value. To put it simpler just get the sum of your basic salary for the calendar year then divide it by twelve. Let say an employee basic salary is Php15000 per month and had worked for 10 months the 13th month computation is.

The 13th month pay should not be less than 112 of the basic salary of the worker. It impacts the take-home pay of those at lower levels of pay strata. It has been in practice in Italy as far back as the 1930s and to a very large extent it is a.

To give you an illustration of how the formula looks like. To compute your 13th month pay multiply your basic monthly salary to the number of months you have worked for the entire year then divide the result to 12 months. The components of a payslip can be seen in two parts - Incomes and deductions.

INR 1600 per month. Overtime min pay adjustments amount deduction 13th month wh tax gross pay. A payslip contains a huge amount of information and can be confusing quite times.

So PayrollHero keeps a record for every employee on how much has been accumulated for 13th. 13th Month Payment is now generated on the employees payments page. This slip is prepared in a professional manner it is.

Excel format of payslip includes the formula for autopay calculations. After the ouster of Marcos former President Corazon Aquino amended the law removing the Php1000 cap and thus allowing more people to avail of the 13th-month bonus According to Philippine Law the 13th month pay is one-twelfth 112 of the basic salary of an employee within the calendar year and should be paid in cash ONLY and NOT in kind products airfare other non. OF WHAT VALUE IS THE 13TH MONTH PAY.

Conveyance amount component in your salary slip. Payslip - semi-monthly payroll period. One unique benefit to Brazilian employees is the 13th Month Salary.

Monthly Basic Salary x Employment Length 12 months. For instance in Italy the 13th Month Tredicesima Mensilit is defined as extra months salary. So the number of calendar years a specific employee has worked for the company is a major factor in the computation.

But it is very important to note that. How to compute 13th month pay. Yes depending on the amount you spend.

Pay Slip or Salary Slip template in excel is the receipt given by the employer to their employees every month upon payment of salary to the employee for the services rendered in the month. Paysllip helps employees to check that whether the company or employee is making payment accurately or not. 9112009 to basic pay.

Payslip is given to the employee after a month when the employer paid the employee salary. For this example the employer used base pay to. Php15000 X 10 months 12 Php1250000.

You can add anything else that you want as per your requirements. Essentially after a full year of work that employee is entitled to an extra full months salary.

Important Things In Your Payslips Need To Check In 2021 Payroll Template National Insurance Number Payroll Software

50 Salary Slip Templates For Free Excel And Word Templatehub

How To Compute The 13th Month Pay Payrollhero Support

Payslip Template For Excel And Google Sheets

50 Salary Slip Templates For Free Excel And Word Templatehub

50 Salary Slip Templates For Free Excel And Word Templatehub

A Salary Template Or A Salary Slip Format Is A Formal Archive Issued To The Employees At The Time Of The Payment Salary Payroll Template Invoice Template Word

Salary Voucher Templates 10 Free Sample Templates Free Printables

10 Payslip Templates Word Excel Pdf Formats

Basic Payslip Template Images And Template Business Letter Template Word Template Payroll Template

Simple Salary Slip Format In Word Free Download Microsoft Word Invoice Template Payroll Template Salary

50 Salary Slip Templates For Free Excel And Word Templatehub

Download Free Employee Salary Slip Format In Excel Only At Exceltmp Com Excel Excel Templates Microsoft Excel

Salary Voucher Template Business Letter Template Doctors Note Template Salary

41 Excellent Salary Slip Payslip Template Examples Thogati Payroll Template Salary Templates

Free Payslip Template Payslip Generator Xero Za

Camping For Beginners Some Tips For Success More Info Could Be Found At The Image Url Camping Registration Form Word Template Words

Simple Salary Slip Format Without Deductions Payroll Template Salary Schedule Template

Printable Invoice With Remittance Slip Template Pdf In 2021 Payroll Template Word Template Office Templates

Post a Comment for "13th Month Pay Slip Format"