Monthly Salary Calculator Ontario

Now you can go back to the Dues or Strike Calculator you were working on and enter the appropriate calculated amount into the Pay box on the left side. Hourly Pay Rate.

Merix Mortgage Calculator Android App Playslack Com We Know Mortgages Aren M Full Amortizati Amortization Schedule Mortgage Amortization Mortgage Calculator

If you are paid an even sum for each month to convert annual salary into monthly salary divide the annual salary by 12.

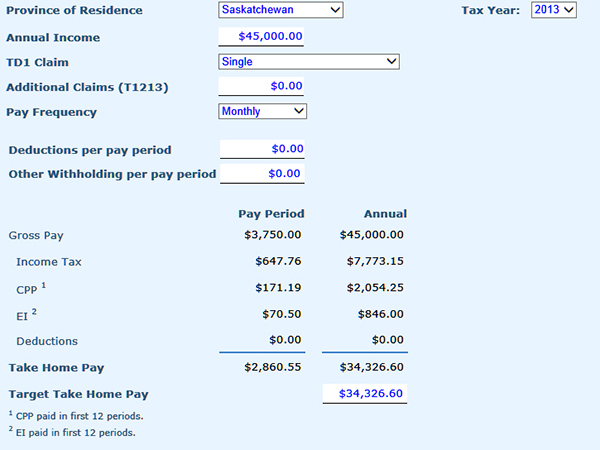

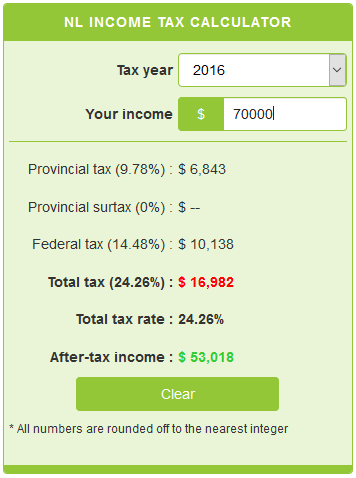

Monthly salary calculator ontario. You can calculate your Monthly take home pay based of your Monthly gross income and the tax allowances tax credits and tax brackets as defined in the 2021 Tax Tables. The calculator is updated with the tax rates of all Canadian provinces and territories. Gross annual income Taxes Surtax CPP EI Net annual salary.

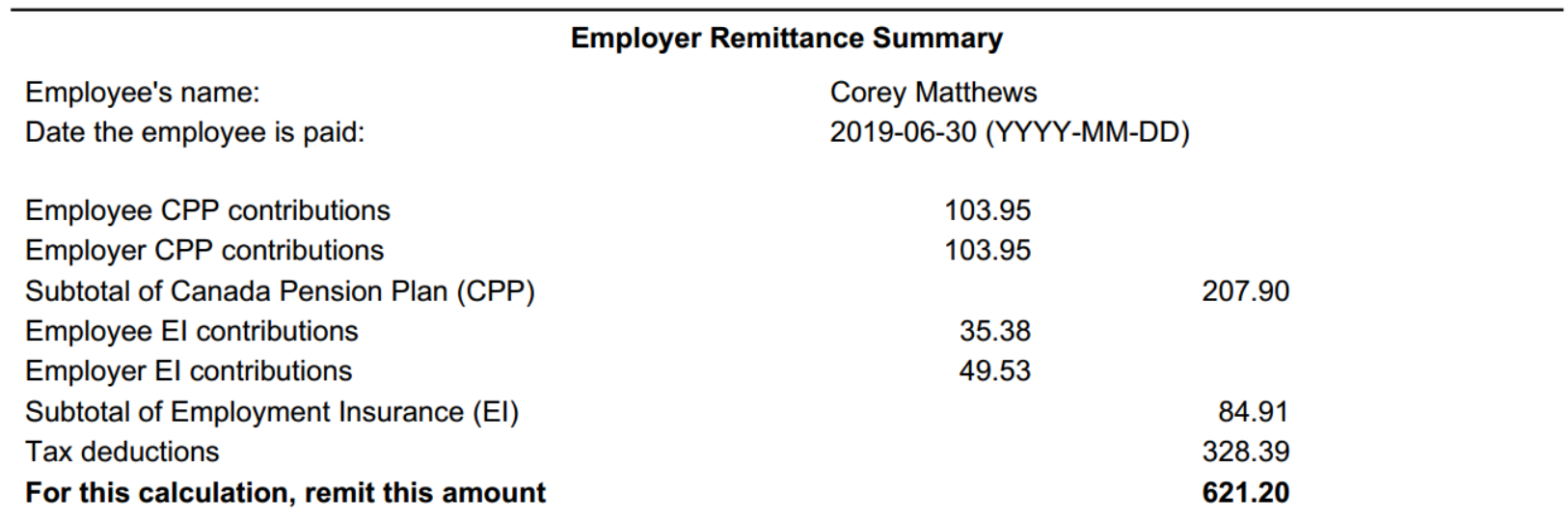

The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and Ontario Tax the Ontario surtax the Canadian Pension Plan the Employment Insurance. The following table shows the equivalent pre-tax hourly income associated with various monthly salaries for a person who worked 8 hours a day for either 200 or 250 days for a total of 1600 to 2000 hours per year. Our calculator allocates you to calculate the grossnet salary over the period based on the number of weeks worked that you entered.

This places Canada on the 12th place in the International Labour Organisation statistics for 2012 after France but before Germany. Select the province. Net annual salary Weeks of work year Net weekly income.

This is required information only if you selected the hourly salary option. Enter your pay rate. This marginal tax rate means that your immediate additional income will be taxed at this rate.

The average monthly net salary in Canada is around 2 997 CAD with a minimum income of 1 012 CAD per month. For using the calculator you have to select the Worker type then enter the Hours of work week and Weeks of work year then enter your gross annual income this figure will be on your income statement or latest pay slip and click Calculate. The reliability of the calculations produced depends on the accuracy of the information you provide.

Enter the number of hours worked a week. PaymentEvolution provides simple fast and free payroll calculator and payroll deductions online calculator for accountants and small businesses across Canada. All bi-weekly semi-monthly monthly and quarterly.

Where NI 151978 BPAF 13808. That is the compensation the worker will receive at the end of the month. Net annual salary Weeks of work year Net weekly income.

Take one of the two calculated amounts from the boxes on the right. 14hour 120 hours 1680. Use the Payroll Deductions Online Calculator PDOC to calculate federal provincial except for Quebec and territorial payroll deductions.

Enter the number of pay periods. This view is better suited to those who are doing a quick salary comparison or quickly estimating their monthly tax withholdings in Canada. Average monthly pay without commas average weekly hours.

For 2021 until september 30 2021 the province of Ontario as decided to make an increase in the minimum wage of 025 over 2020 from 14 to 1425 per hour. According to the Fair Labour Standards all hourly workers are non-exempt and have to be paid overtime. Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of working days a year.

Free rent calculator to estimate the range of affordable monthly rent based on income and debt. Presents ideas for decreasing rental cost. Where 151978 NI 216511 BPAF 13808 - NI - 151978 1387 64533 Where NI 216511 BPAF 12421.

Use the simple monthly Canada tax calculator or switch to the advanced Canada monthly tax calculator to review NIS payments and. The Normal view allows you to use the Canada Salary Calculator within the normal content this means you see the standard menus text and information around the calculator. That means that your net pay will be 40512 per year or 3376 per month.

Formula for calculating net salary. The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and Ontario Tax the Ontario surtax the Canadian Pension Plan the Employment Insurance. If you are paid in part based on how many days are in each month then divide your annual salary by 365 or 366 on leap years then multiply that number by the number of days in the month to calculate monthly salary.

You assume the risks associated with using this calculator. For 2021 employers can use a BPAF of 13808 for all employees while payroll systems and procedures are updated to fully implement the proposed legislation. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11488.

The Canada Monthly Tax Calculator is updated for the 202122 tax year. Formula for calculating net salary. The category of fishing and hunting guides is not considered in this calculator as it is very specific.

Lets assume that hourly rate equals 14 and the employee has worked 120 hours per month with no overtime. Enter average monthly pay and average weekly hours. The adjusted annual salary can be calculated as.

So the salary looks like this. Your average tax rate is 221 and your marginal tax rate is 349. These hours are equivalent to working an 8-hour day.

The amount can be hourly daily weekly monthly or even annual earnings. Also experiment with other financial calculators or explore hundreds of other calculators covering topics such as math fitness health and many more. Gross annual income - Taxes - Surtax - CPP - EI Net annual salary.

It will confirm the deductions you include on your official statement of earnings. 30 8 260 - 25 56400.

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

Pin By Naomi Shaw On My Board Mortgage Amortization Mortgage Payment Mortgage Payoff

Small Business Payroll Software Free Payroll Calculator Payroll Software Payroll Small Business

Average Monthly Income At Every Level Of Selling Monat Monathaircare Monatmarketpartner Monat Monat Hair Monat Hair Care

If He Or She Passes Away Within The Term Of The Policy The Life Insurance Coverage Business Will Pay The Recipien Budgeting Money Budgeting Budgeting Finances

How To Calculate R2 Excel Techwalla Com Chart Tool Excel Calculator

Avanti Gross Salary Calculator

Salary Calculation Sheet Template Payroll Template Spreadsheet Design Excel Budget

Hehehehehe Boodle Moneytalks Money Doesnt Buy Happiness Managing Your Money Bring Happiness

Mortgage Tips And Tricks How A Mortgage Calculator Can Save You Bundles Of Dave Ramsey Mortgage Mortgage Payoff Pay Off Mortgage Early

Ontario Income Tax Calculator Wowa Ca

Pin On Credit Card Debt Payoff

Calculate If That New Job Is Right For You Knowledge Bureau

Editable Blank Check Template Unique New Payroll Template Free Konoplja Co In 2020 Payroll Template Templates Printable Checks

Newfoundland And Labrador Income Tax Calculator Calculatorscanada Ca

Extra Payment Mortgage Calculator Making Additional Home Loan Payments Mortgage Payment Calculator Mortgage Mortgag Mortgage Loan Calculator Mortgage Loan Originator Mortgage Amortization Calculator

A Hint On The Tds Calculator And Rent Or Buy Calculator Best Home Loans Simple Mortgage Calculator Home Loans

Post a Comment for "Monthly Salary Calculator Ontario"