Is Total Annual Income Pre Or Post Tax

Lets say you make 50000 this year and you decide to put 5000 into your 401 k. 240 multiplied by 52 weeks in a year is 12480.

Annual Income Learn How To Calculate Total Annual Income

Your annual income includes everything from your yearly salary to bonuses commissions overtime and tips earned.

Is total annual income pre or post tax. Earnings loss before provision for income taxes of the Bank is the amount reported in the schedules to the. Gross annual income is your earnings before tax while net annual income is the amount youre left with. Both pre-tax and post-tax deductions from payroll are voluntary deductions.

You contribute to the ESPP from 1 to 10 of your salary. For example if you earn 800 per hour and work 30 hours per week you have 240. The contribution is taken out from your paycheck.

Unless the application specifies otherwise this is usually what the issuer is looking for. You may hear it referred to in two different ways. Since both your annual salary and gross income refer to the total amount of money you make before tax you dont need to do this calculation if you know your annual salary.

What is your combined annual income meaning the total pre-tax income from all sources earned in the past year. The annual net income is the yearly sum you. Pre-tax deductions reduce taxable wages and the amount of tax owed.

Means the earnings loss before provision for income taxes of the Bank for each Fiscal Year determined in accordance with generally accepted accounting principles as adjusted for unusual andor non-recurring items as determined at the discretion of the Board. An ESPP typically works this way. For the 2020-2021 tax year the first 18200 you earn is tax-free.

Rather than paying income taxes on 50000 youll only have to pay it on 45000 of your income. Pre-Tax Account Considerations Your pre-tax contributions lower your taxable income by the amount deposited. Define Annual Pre-Tax Income.

Gross annual income and net annual income. Annual income is the amount of income you earn in one fiscal year. In this way do you pay tax on Espp.

Multiply your answer by 52 weeks in a year. For example if your taxable income was going to be 40000 for a given year and you put 2000 of it in a pre-tax account such as a traditional IRA then your reported taxable income for that year would be 38000. If you dont know your annual salary use these steps to calculate your individual annual income before taxes.

Gross means before taxes and net means after deducting taxes. Lets say you are an hourly employee. To sum up - gross annual income is the amount of money your employer spent on you in a year.

For instance your pre-tax deductions would include your retirement investment accounts such as a Roth IRA 401k 403 b and health savings accounts. You do not need to include alimony child support or separate maintenance income unless youd like for it to be considered as a basis for repaying the amount you borrowed. Your gross income minus taxes and other expenses like a 401k contribution.

What you receive in your bank account is net income. Gross annual income is your. This means you are not legally required to offer the deductions and employees do not have to agree to them.

500 25 475 total wages taxable by federal income tax Based on IRS Publication 15-T a single person who earns 475 and is paid weekly owes 25 in federal income tax. In other words what you end up taking home in your paycheck multiplied by the number of times youre paid each year. Post-tax deductions have no effect on taxable wages and the amount of tax owed.

Here is an example of how to calculate that figure. Multiply your hourly pay rate by the. If you are self-employed youd use the income that you allocated to the year under cash or accrual accounting basis.

Therefore annual income means the amount of money obtained during a year. You take post-tax deductions also called after-tax deductions out of employee paychecks after taxes. Is annual income pre or post tax.

We ask for your individual gross income or the annual amount of money you make before taxes and deductions. First of all when you put money in there you do not have to pay income taxes on that money that year. When you buy stock under an employee stock purchase.

This is calculated on pre-tax salary but taken after tax unlike 401k no tax deduction on ESPP contributions. Now what is net annual income and gross annual income. Anything you earn above 180001 is taxed at 45.

Click to see full answer. You have your annual or yearly salary. The 401 k contribution is taxable for Social Security and Medicare taxes.

Is Espp pre or post tax. Youll then pay 19 on earnings between 18201 and 45000 325 on earnings between 45001 and 120000 and 37 on earnings between 120001 and 180000. Pre-tax income is your total income before you pay income taxes but after your deductions and is also known as gross income.

Your total annual income before anythings taken out. 500 total wages taxable by Social Security and Medicare taxes.

Total Income How To Calculate Total Income Tax2win

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

How Do Operating Income And Revenue Differ

Gross Income Definition Formula Examples

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Ebit Vs Operating Income What S The Difference

42 000 After Tax 2021 Income Tax Uk

/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)

Income Statement Definition Uses Examples

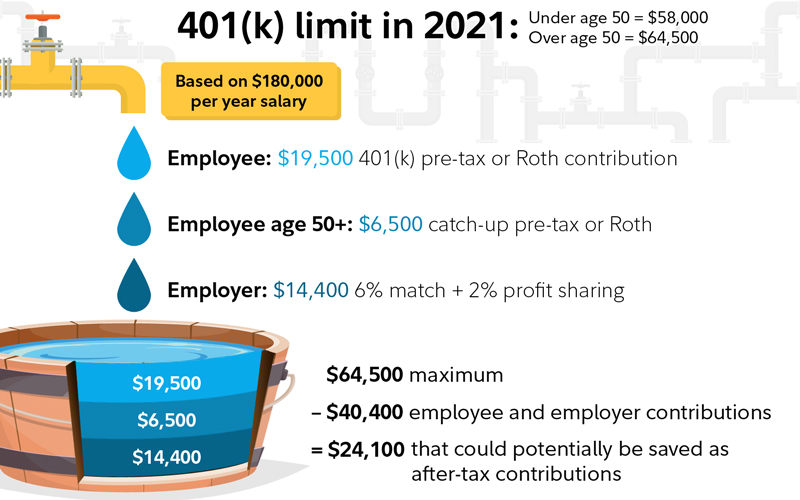

After Tax 401 K Contributions Retirement Benefits Fidelity

Taxes In France A Complete Guide For Expats Expatica

6 Essential Words To Understanding Your Business Finances Business Management Ideas In 2020 Small Business Bookkeeping Bookkeeping Business Small Business Finance

Annual Income Learn How To Calculate Total Annual Income

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Post a Comment for "Is Total Annual Income Pre Or Post Tax"