Total Gross Annual Income W2

However you can easily figure out your annual salary from your W-2 forms in a matter. Similarly where do I find my annual income on my w2.

Gross Wage Calculation Defined Contribution Plan Auditor

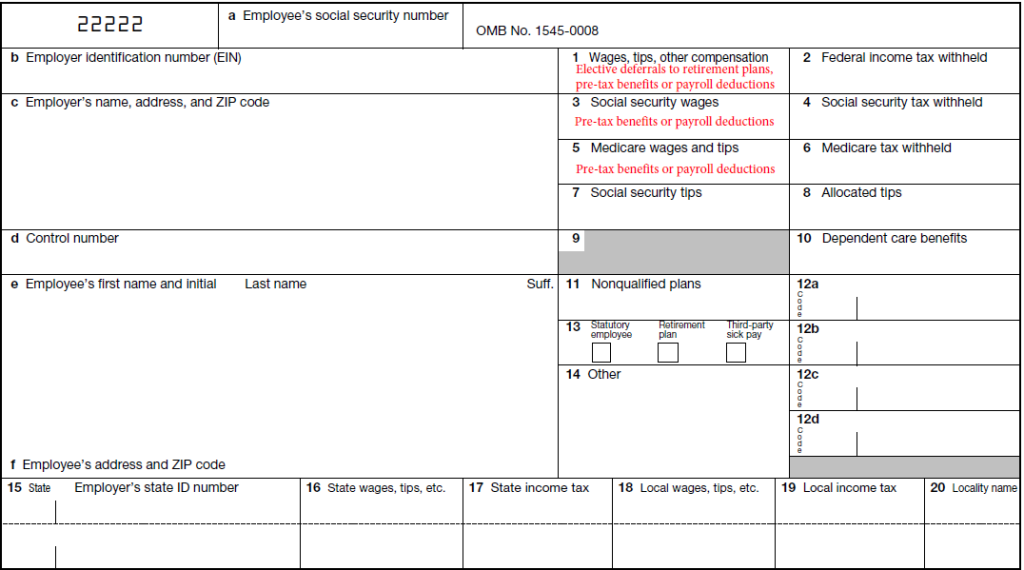

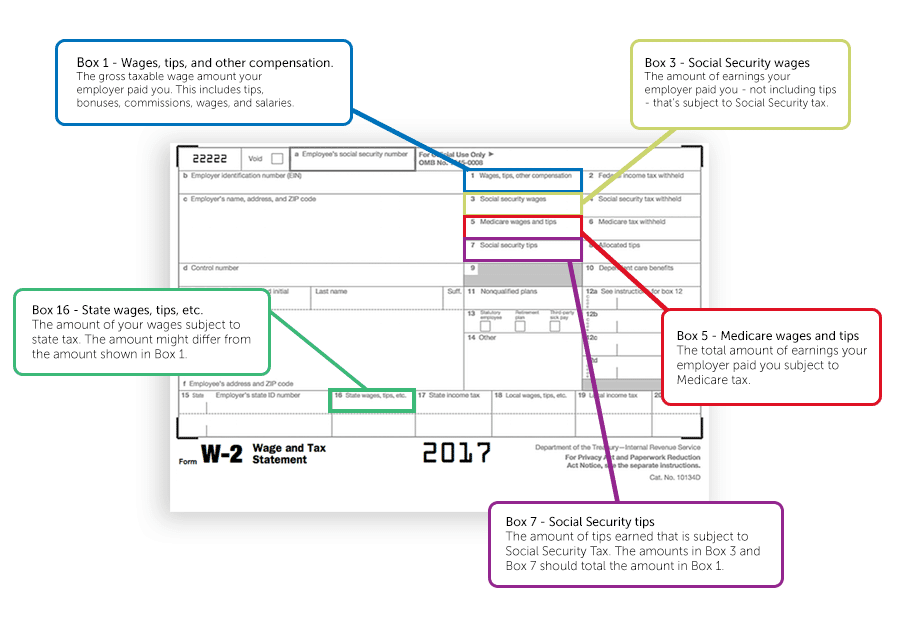

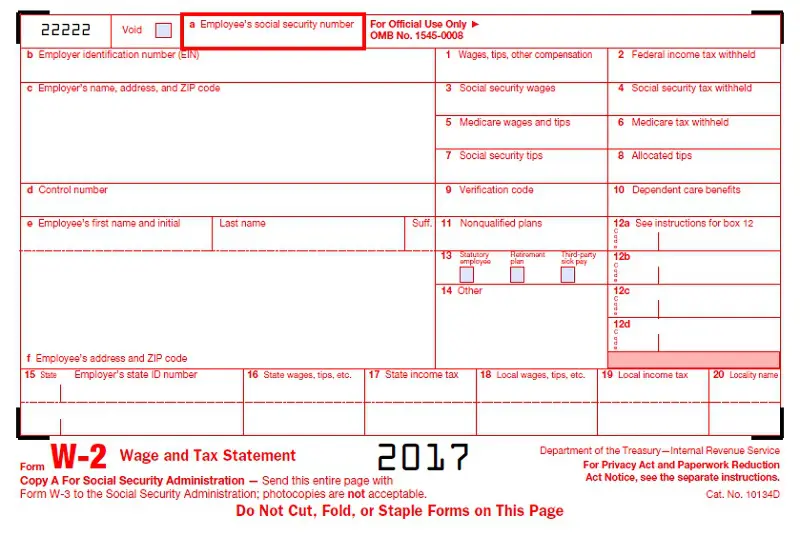

Your W-2 gives a lot of information but the most important is that it shows your total income and your salary as taxable wages.

Total gross annual income w2. Click to explore further. How do I calculate adjusted gross income from w2. Gross Income Salary Rent Dividends Interest All Other Sources of Income.

Your gross income stated in Box 1 of your W-2 is essential in filing your taxes as it shows your wages subject to federal income tax. 35 x 16 x 52 29120. What to put in gross salary when you collect disab.

A Felix Has A Gross Income Of 18000. A Form W-2 includes an employees wages and tax deductions for a specific calendar year--January 1 through December 31. If playback doesnt begin shortly try restarting your device.

How do I calculate adjusted gross income from w2. This decreases your taxable income which can have an impact on your tax bracket. How to Find Your Gross Pay on Your W-2 Form.

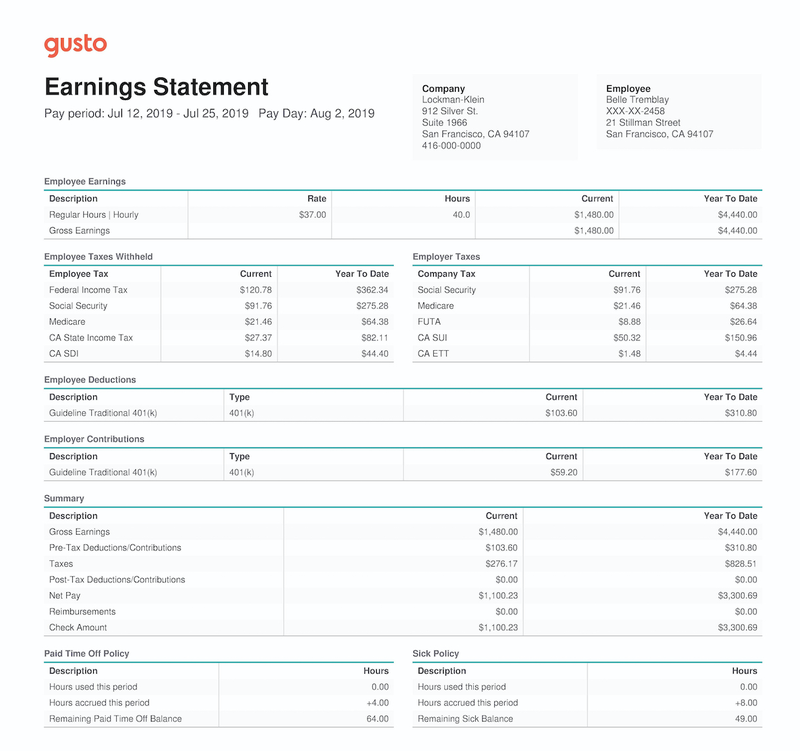

W-2 Wages for Income Taxes In box 1 of the Form W-2 your company reports the total taxable wages of the employee for IRS record keeping. Annual Income - Learn How to Calculate Total Annual Income. Where your annual net income is how much you bring home in your actual paychecks after deductions are taken out your gross income is how much you earn before deductions and taxes are.

You must add up all your income sources including stock dividends interest business income etc. To do the calculation for an individual use the following steps. For instance say your gross income is 45000 but you have 2000 worth of deductions for the year.

On a W-2 tax statement an employees federal taxable gross wages appear in Box 1 which is located near the top-center of the form. For example if you work roughly 35 hours per week every week and you earn 16 per hour your gross annual income would be. If you only want to figure the total amount your employer paid you for the year your last pay stub of the year should show all of the earnings you received.

How do I find my adjusted gross income without a W-2. Your gross income will be stated clearly on the W-2 but only for THAT specific employer. Your total deductions will be 300700100005000 16000.

Additionally there are other situations in which an employer may be required to file a W-2 on your behalf. What Is Hi. Publication 17 2020 Your Federal Income Tax Internal.

Aggregate all these sources of income obtained in the first step. New Adjusted Gross Income Federal Income Tax Line For. By contrast an employee who is paid 25 per hour is paid 2000 every two weeks only if they actually work 8 hours per day 5 days per week 25 x 8 x 5 x 2.

When you calculate this number take out any pretax deductions from an employees pay because they do not count as income for federal income taxes. It lists gross income and includes amounts paid to the differing agencies for taxes and social security. For the purposes of.

Videos you watch may. Range of total gross income 2017 - DoctorsManagement. Now subtract deductions from your annual income 100000 16000 the value 84000 will be your adjusted gross income.

Anytime you work for an employer that employer is required to send you a Form W-2 for federal income tax purposes. For all the income sources that you have in order to determine your true Gross Taxable Income. A W2 form is an employers statement of your annual earnings.

If you have pretax deductions or nontaxable wages. Your adjusted gross income is your gross income on your W2 minus your major deductions for the year. De très nombreux exemples de phrases traduites contenant total gross annual income Dictionnaire français-anglais et moteur de recherche de traductions françaises.

The 52 represents the number of weeks you work throughout the year. Predicting the future - Yummy Math. Boxes 3 and 5 of the W-2 show your gross income that is subject to Social Security and Medicare taxes.

Find out all the sources of income like salary dividends rent etc. It is easy to lose track of your total annual earnings if you have more than one job. If you want to find out your adjusted gross income but you have not received the W-2 form do not worry.

Or if your employer withheld income Social Security or Medicare tax from your paycheck it is required to file a Form W-2 even if they paid you less than 600 during the tax year. If you work fewer weeks you want to use that number instead. Gross wages are the amount a company pays an employee before any deductions are withheld.

The individuals gross income every two weeks would be 1923 or 50000 divided by 26 pay periods.

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

W 2 Box 1 Wages Vs Final Pay Stub Asap Help Center

W 2 Vs Last Pay Stub What S The Difference Aps Payroll

Understanding The Contents Of A French Pay Slip Fredpayroll

Did You Know There Was Medical Tax Deductions Available To You Healthcare Savemoney Business Tax Deductions Tax Deductions Tax Help

Form W 2 Explained William Mary

Understanding The Contents Of A French Pay Slip Fredpayroll

Gross Wages What Is It And How Do You Calculate It The Blueprint

3 Ways To Work Out Gross Pay Wikihow

How To File Taxes The Easy And Organized Way Filing Taxes Tax Organization Tax Prep

How To Calculate Adjusted Gross Income Agi For Tax Purposes Adjusted Gross Income Health Savings Account Tax Accountant

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

How To Calculate Agi Adjusted Gross Income Using W 2 Exceldatapro

Tax Forms Deductions Net Income Vs Gross Income

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Understanding Your W 2 Controller S Office

Post a Comment for "Total Gross Annual Income W2"