13th Month Pay Upon Resignation

The employer upon whom no such notice was served may hold the. This amount is equal to the fraction of your 13th month pay based on the number of months rendered if you left the company before the year ends.

13th Month Pay In The Philippines Computation And Guide

Thirteenth month pay is a form of compensation in addition to an employees annual 12 month salary.

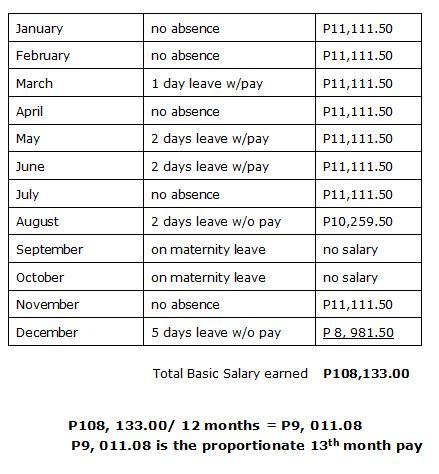

13th month pay upon resignation. An employee who has resigned or whose services were terminated at any time before the time for payment of the 13th month pay is entitled to 13th month pay in proportion to the length of time he worked during the year. Basic monthly pay12 x number of months actually worked. Tax refund you must receive a tax refund if the tax you owe is less than the sum of the total amount of your withholding taxes and estimated taxes.

A bonus which is stipulated in your employment contract may be a contractual bonus or a discretionary bonus. Theres no such law that says companies are required to pay for outgoing employees. XXXXXX 12 13th month pay of the resigned employee.

Usually this applies equally to foreign companies that are. As per the Presidential Decree employers should hand the 13th month pay not later than the 24th of December each calendar year. 18-2018 all employers are required to pay their rank-and-file employees the 13th-month pay regardless of the nature of their employment and irrespective of the methods by which their wages are paid provided that they worked for at least one month during a calendar year.

An employee who has resigned or whose services were terminated at any time before the time for payment of the 13th month pay is entitled to this monetary benefit in proportion to the length of time he worked during the year reckoned from the time he started working during the calendar year up to the time of his resignation or termination from the service. When should employees receive the 13th month pay. Under Hong Kong law there is a general presumption that a bonus is not of a discretionary unless your employment contract.

It was legally introduced in the Philippines in 1975 where it is still enshrined in employment law. Resigned employees are still entitled to 13th month pay it said. The computation is still the same and the 13th month pay for resigned employees should be given as part of the back pay.

If the resigning employee is one of them then they are entitled to the pro-rated 13th month pay depending on what time of the year they chose to leave the employer. Thus if he worked only from January up to. Prorated 13th month pay.

There are exceptions for overtime resignation without notice and other situations. In accordance to the Employment Act your employer must pay your salary at least once a month and within 7 days after the end of the salary period. It is also known as 13th month salary or 13th salary and in some countries a 14th month salary is also common.

An employee may terminate without just cause the employee-employer relationship by serving a written notice on the employer at least one 1 month in advance. The 13th month may be demanded at the time of effectivity of the resignationtermination. Pro-rated 13th month pay you must receive a pro-rated 13th month if you resigned before the year ends.

The law prescribes 13th month pay for a certain class of employees as well. The 13 th month pay of a resigned or separatedterminated employee is in proportion to the length of time he or she has worked during the year reckoned a from the time she has starting working during the calendar year or b the time the last 13 th month pay was given up to the time of hisher resignation or separationtermination from the service. However an employer can pay their employees staggered giving half of it before the opening of the regular school year SY and the half on or before the 24th.

3 When is the 13th month pay given to resignedterminated employees. These things make up an employees final pay upon resignation. Yes resigned or terminated employees will still receive their 13th month pay as long as you worked for your employer or company for at least a month.

You may be entitled to bonuses also known as double pay end of year payment or 13th month payment depending on the terms of your employment contract. Under Labor Advisory No. Since according to you you have served your employer for a total of five months prior to your resignation you are entitled to receive a prorated 13th month pay from your employer which is equivalent to one twelfth of your total basic salary for the five months that you were employed.

If the 13th-month pay is mentioned in the statute then the employer needs to pay it.

Here S What You Need To Know About 13th Month Pay In The Philippines Jobstreet Philippines

Dole Guidelines For 13th Month Pay In Private Sectors

Everything You Need To Know About 13th Month Pay Sunstar

How To Compute Your 13th Month Pay 2020 Jobs360

10 Things You Should Know About 13th Month

Facts About The 13th Month Pay

Hr Talk Top 10 Questions That Many Angry Employees Ask During The Pandemic Answered Tina In Manila

13th Month Pay An Employer S Guide To Monetary Benefits

Https M5 Paperblog Com I 106 1064677 13th Month Pay L Wlwizk Jpeg

Here S What You Need To Know About 13th Month Pay In The Philippines Jobstreet Philippines

How To Compute Your 13th Month Pay 2020 Jobs360

Dole Guidelines For 13th Month Pay In Private Sectors

10 Things You Should Know About 13th Month

13th Month Pay An Employer S Guide To Monetary Benefits

13th Month Pay An Employer S Guide To Monetary Benefits

How To Compute 13th Month Pay In The Philippines An Ultimate Guide

New Dole Advisory On 13th Month Pay Requirements For Employers In The Philippines In 2020 Cloudcfo

13th Month Pay Law Employee Benefits Piece Work

Post a Comment for "13th Month Pay Upon Resignation"