Ca Salary Requirements

Salary requirements depend on a few different factors like the industry the benefits package your salary history and work experience and the cost of living in a specific area. Paydays pay periods and the final wages.

Chartered Accountant Ca Is A Designation Granted To Professionals Whose Specialization Is Accounting And Is Chartered Accountant Accounting Learn Accounting

Although there are some exceptions almost all employees in California must be paid the minimum wage as required by state law.

Ca salary requirements. Additionally similar jobs can be suggested. Find jobs based on your education. A list of job recommendations for the search ca minimum exempt salary requirements 2021 is provided here.

As of January 1 2019 the minimum wage in California increased from 1100 to 1200 per hour for employers with 26 or more employees the increase is from 1050 per hour to 1100 per hour for employers with 25 or fewer employees on January 1 2019. Job bulletins show the salary range for various job descriptions. Chartered accountants can work.

The average salary of Chartered Accountants in India ranges from 6-7 lakhs to 30 lakhs. To see the salary for various job descriptions and what jobs you might qualify for check out these links. All of the job seeking job questions and job-related problems can be solved.

Your salary depends on what job you do and whether your position is full-time part-time or intermittent. Sometimes employers ask for your salary history instead of your salary requirements and sometimes they ask for both. Although each section of this chapter lists a salary and the positions that are to receive that salary the Department of Human Resources may adjustsome of these salaries per Government Code 198255.

From January 1 2017 to January 1 2022 the minimum wage will increase for employers employing 26 or more employees. A salary history lists your past earnings and usually includes the companies youve worked for. Be paid on a salary basis 63 Be paid a monthly salary of at least twice the state minimum wage for full-time employment 64 and.

In California wages with some exceptions see table below must be paid at least twice during each calendar month on the days designated in advance as regular paydays. The employer must establish a regular payday and is required to post a notice that shows the day time and location of payment. 1 California employers are required to comply with California Labor Code Section 4323 which prohibits employers from asking job applicants about their salary.

Effective January 1 2017 the minimum wage for all industries will be increased yearly. The Chartered Accountant according to survey in 2019 is paid the average hourly salary of Rs 700 ranging from minimum of Rs 500 to 3000 monthly average salary Rs 55000 ranging from a minimum of Rs 10000 to 150000. For the administrative professional and executive exemptions under state law employers with 26 or more employees must pay a salary of at least 1120 per week beginning January 1 2021.

When to Include Salary Requirements in a Cover Letter. To meet the requirements of a generally-exempt employee the employee must meet all of the following requirements. According to May 2018 BLS salary data most accountants and auditors earned between 43650 and 122840.

International packages are even higher ranging up to 75 lakhs. Any adjustments must be reported. If a job application does not require you to include salary information such as your salary history a salary requirement or a salary range do not do so.

On the other hand if you request too low a salary they may offer you less than you are. I have a bachelors degree I have a bachelors. The current salary threshold is.

Cagov About Us Contact Us. If you request too high a salary the employer may not even look at your application. Specifically exempt employees must earn a fixed monthly salary of at least double the minimum wage for full-time employment.

The salary of a Chartered Accountant in India depends on hisher skills capabilities and experience. Last years stats show that the average salary of CAs in India was offered around 736 lakhs pa. In the campus placement conducted by ICAI.

Employers with fewer than 26 employees must pay a minimum salary of at least 1040 in 2021.

Chartered Accountant Average Salary In Canada 2021 The Complete Guide

How Much Does A Ca Chartered Accountant Earn In India In 2020 Quora

Chartered Accountant Average Salary In Canada 2021 The Complete Guide

Cpa Vs Ca Chartered Accountant Which Career Salary Is Better

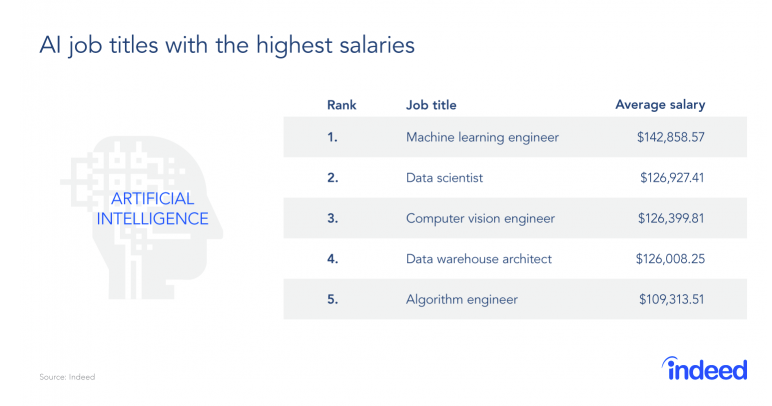

Ai Engineer Salaries What You Can Expect To Earn In 2020 Udacity

Chartered Accountant Average Salary In Canada 2021 The Complete Guide

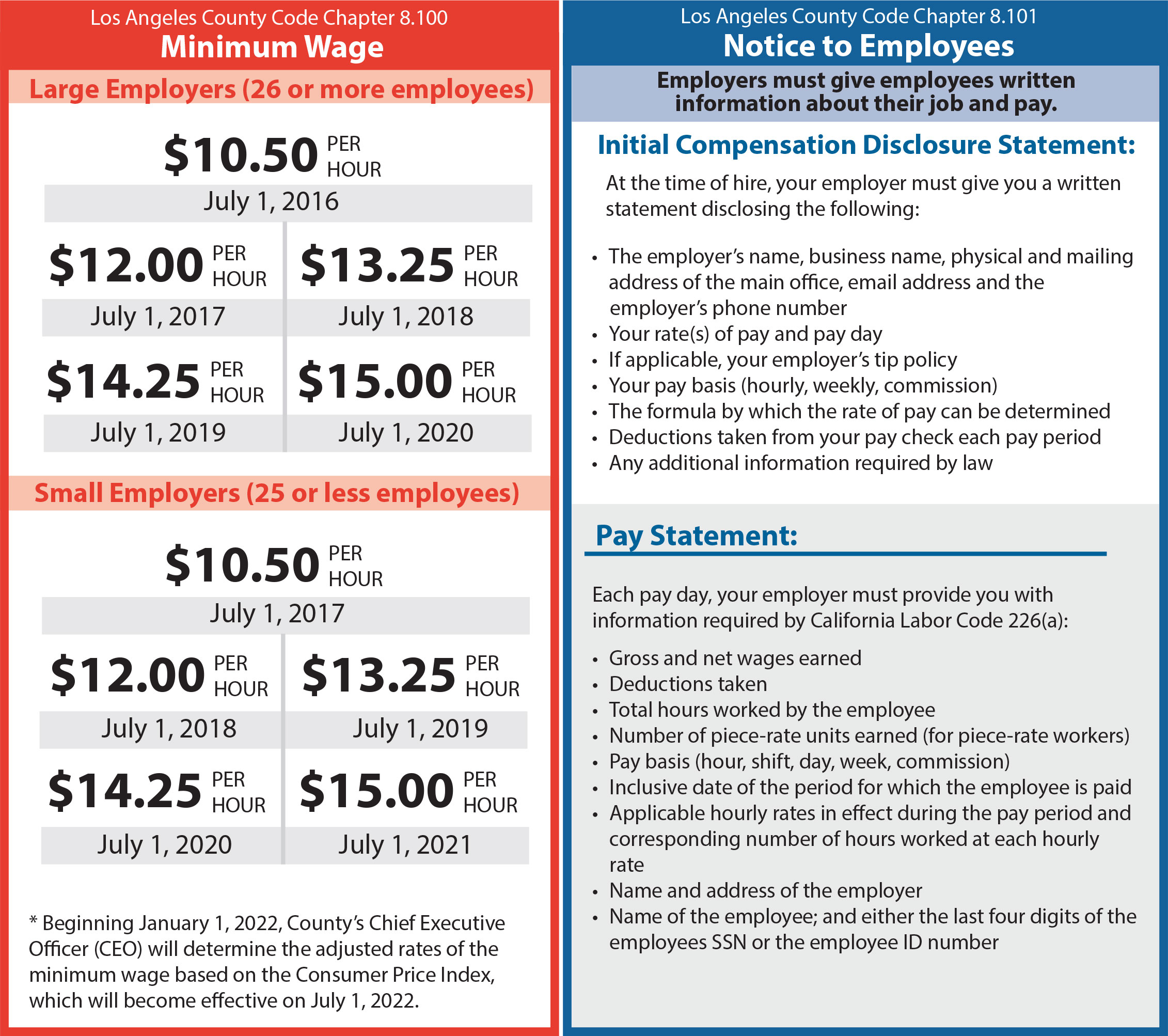

Minimum Wage Information Planning Community Development Department

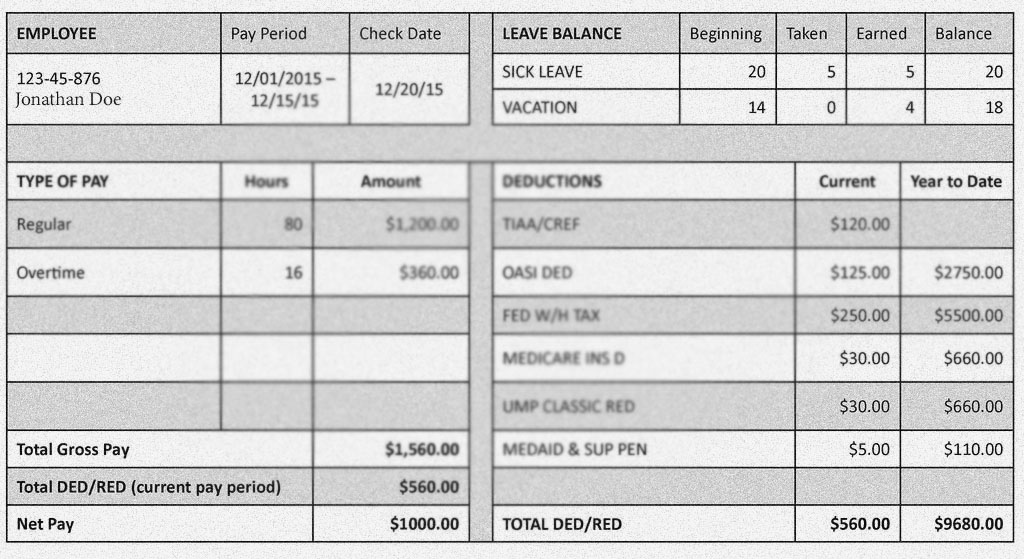

California Paystub Law 2021 Ca Employer Refuses To Give Paystub

What Is The Average Ux Designer Salary 2021 Guide

California Salary Laws And When Must A Company Pay You By The Hour

Minimum Wage For Businesses Consumer Business

California Salary Laws And When Must A Company Pay You By The Hour

Https Www Dir Ca Gov Dlse Paystub Pdf

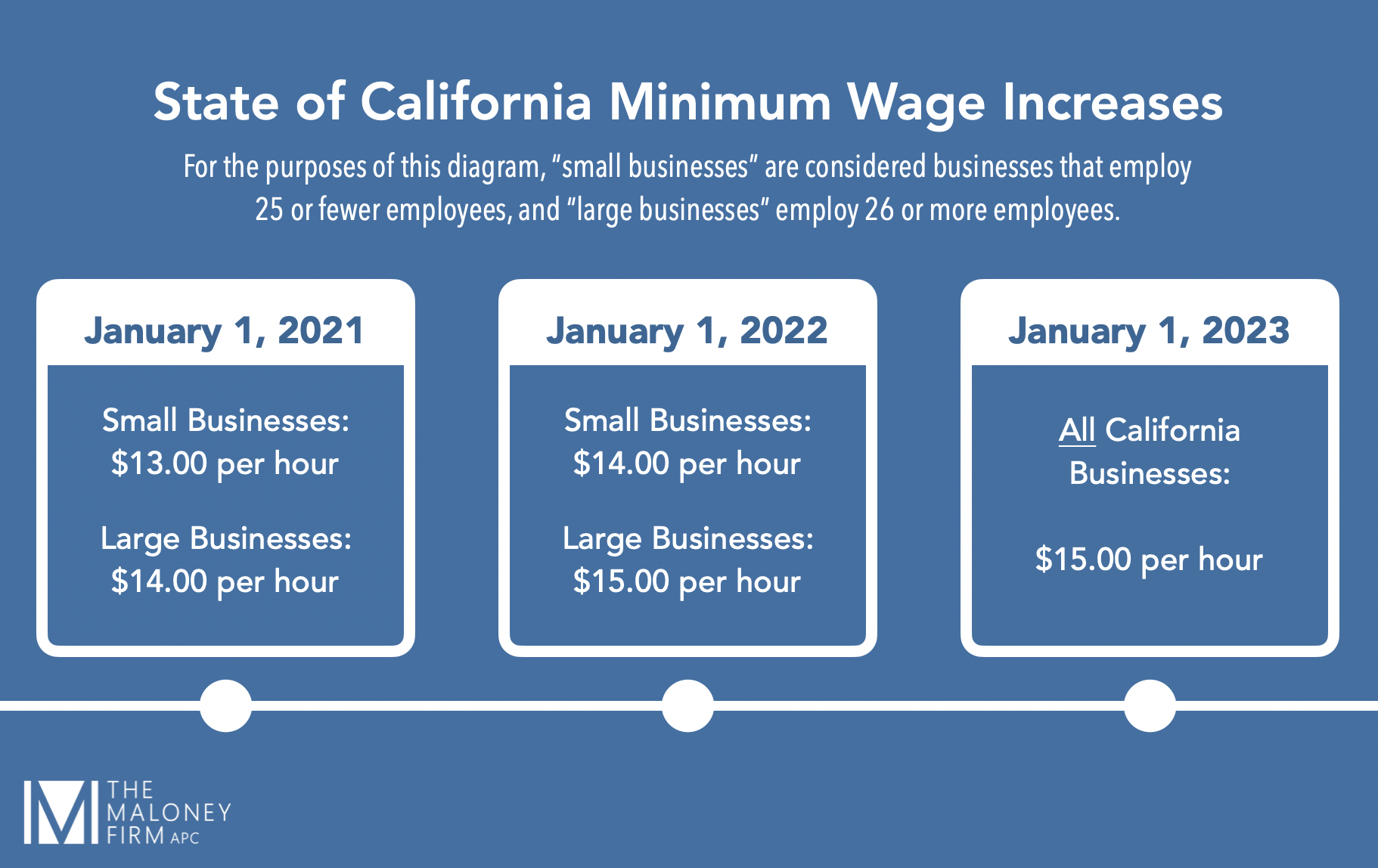

Employer Alert California Minimum Wage Increases January 1 2021 The Maloney Firm Apc

![]()

Cpa Salary Guide 2021 Find Out How Much You Ll Make

Ca Vs Cs Which Is Better For Your Career Salary And Wallet 2021

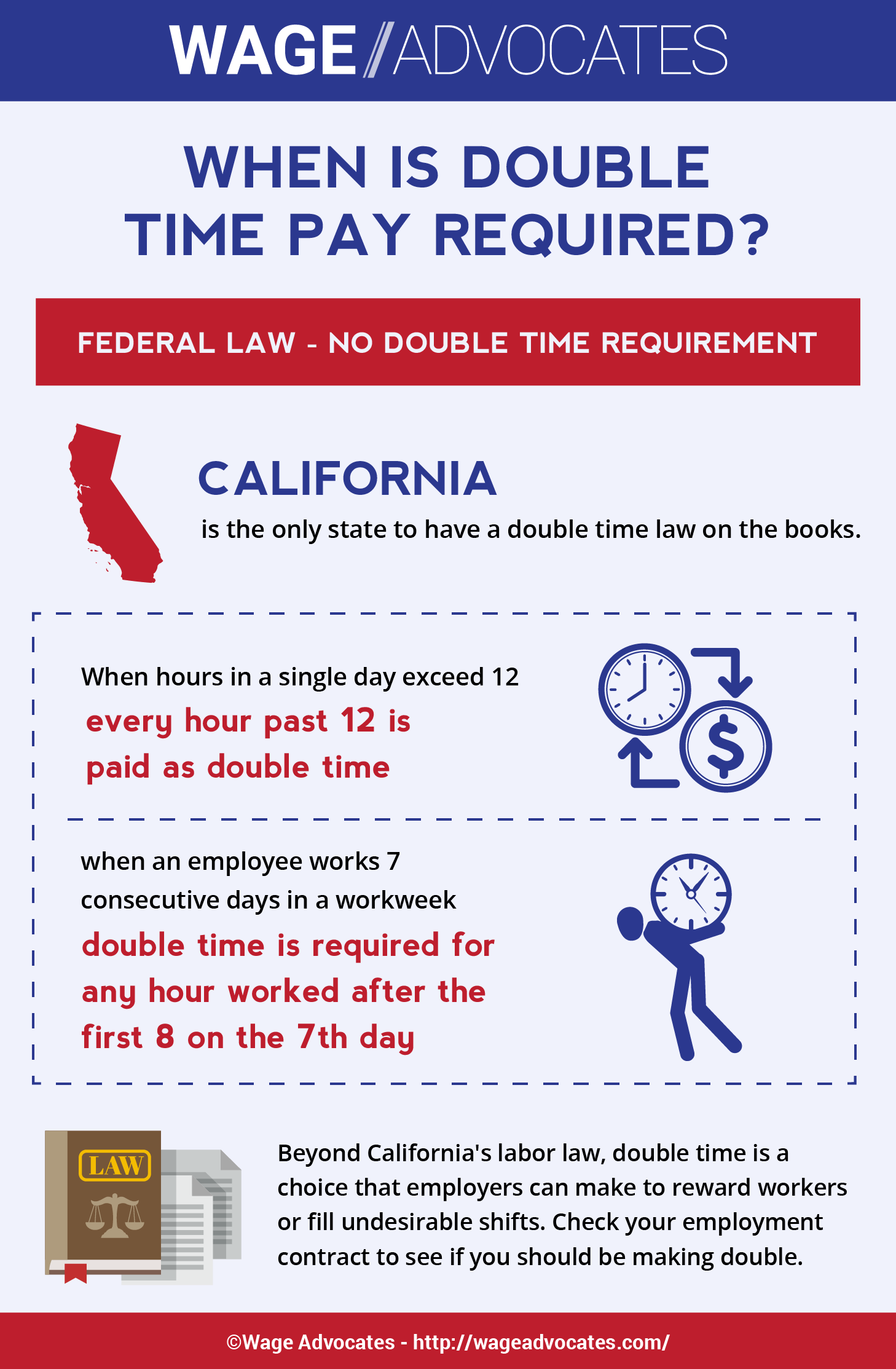

What Is Double Time Pay When Is It Mandatory Overtime Lawsuit

Chartered Accountant Course Ca Jobs Ca Salary Ca Course Collegedekho

Understanding California S Overtime Laws Hourly Inc

Post a Comment for "Ca Salary Requirements"