Where Is Your Total Annual Income On W2

THESE COMMENTS ARE NOT LEGAL ADVICE. Gross annual income is your earnings before tax while net annual income is the amount youre left with after deductions.

Get Educated Learn How To Read Your W 2

Gross annual income and net annual income.

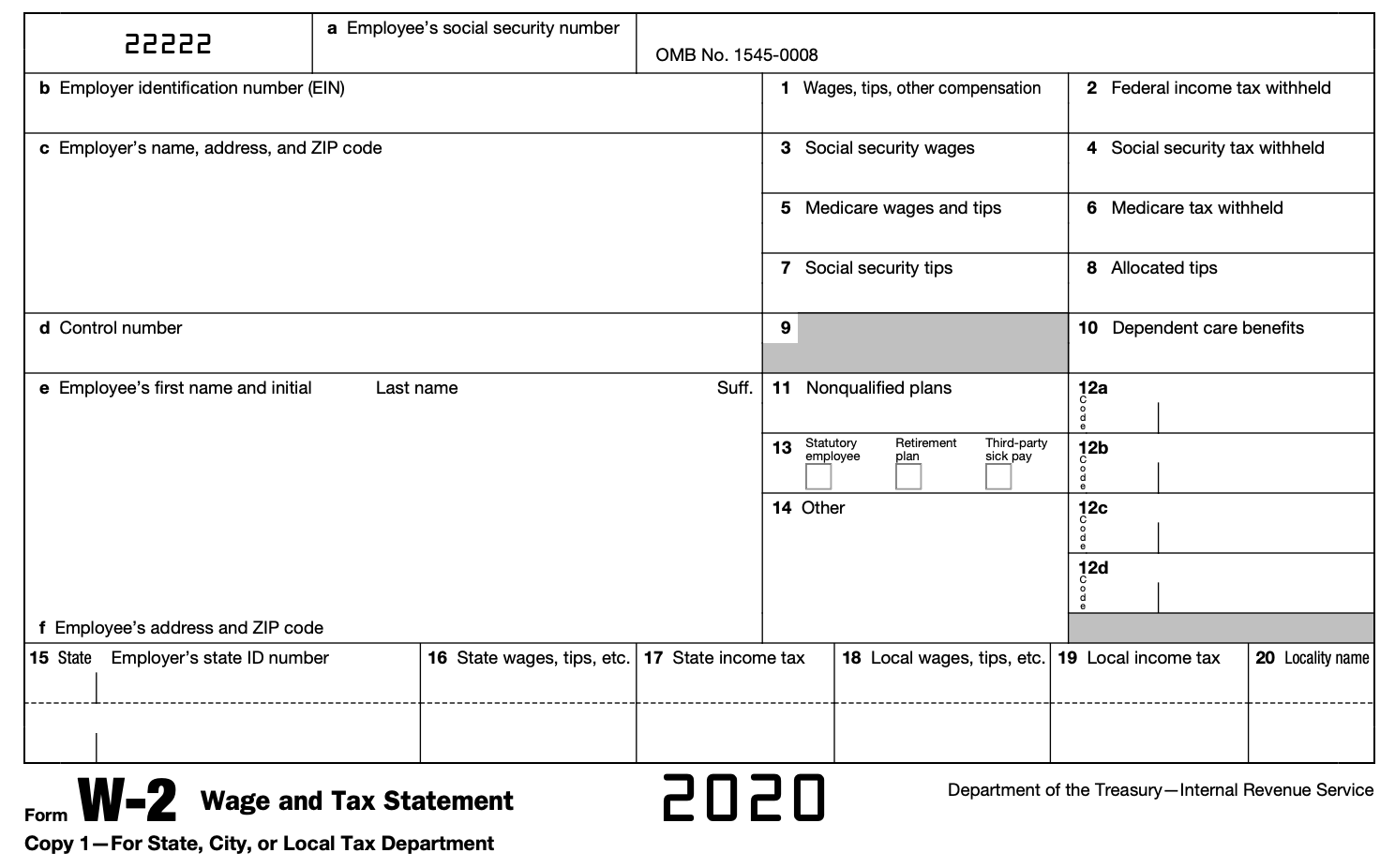

Where is your total annual income on w2. Add your other sources of income rent lottery etc into it. Federal income tax withheld. Each employer reports annual taxable wage or salary based earned income to employeesworkers via a W-2 Form by January 31 for the previous tax year ending on December 31.

You also file a Schedule C to fully. For instance say your gross income is 45000 but you have 2000 worth of deductions for the year. Gross earnings include any withholdings or adjustments that may have reduced payouts throughout the year.

A copy of this same report is sent for each employeeworker by the employer via the W-3 Form to the IRS by January 31 as well. You can find your annual income from the paystub. Your annual income includes everything from your yearly salary to bonuses commissions overtime and tips earned.

The truth is that so long as you have. This decreases your taxable income which can have an impact on your tax bracket. Annual net income is the amount of money you earn in a year after certain deductions have been removed from your gross income.

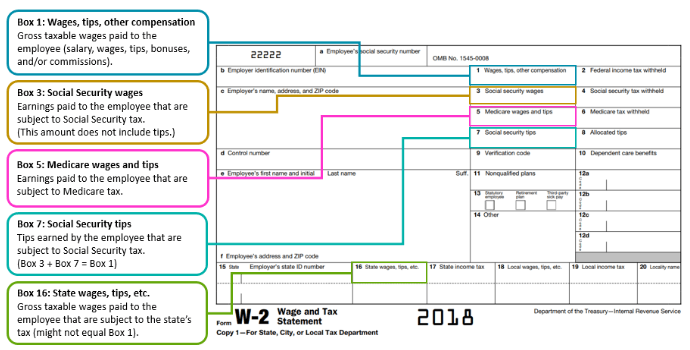

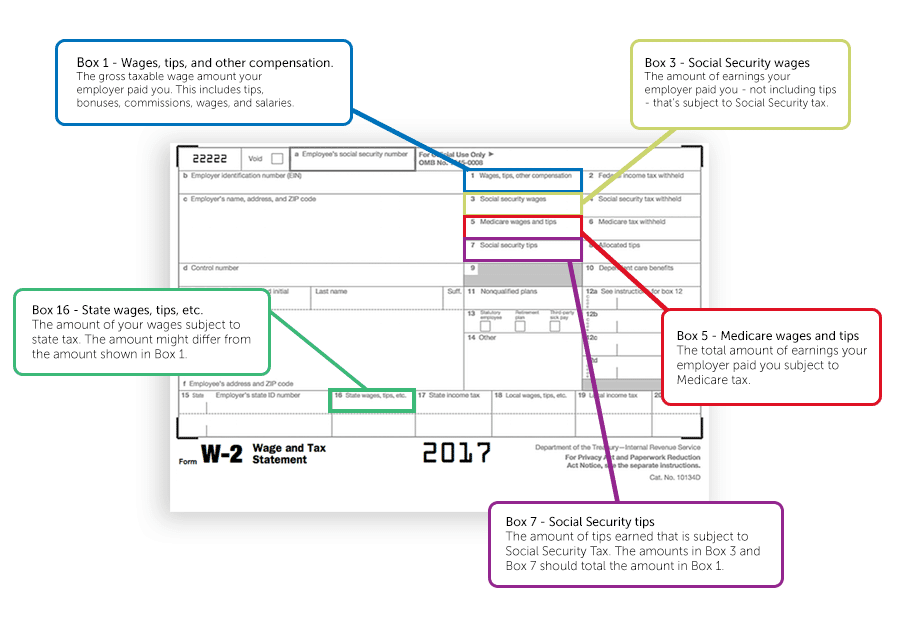

Box 2 represents your total amount withheld from your paycheck by your employer for federal income taxes. They are provided for informational purposes only. This amount is determined by the elections on your form W-4.

Assuming you are a W2 employee then your 1040 will have a taxable income amount and an adjusted gross income amount. You would file a schedule C if you were self-employed. Social security tax withheld.

The amount of federal income tax the employer withheld from your wages for the tax year. These amounts can be useful for income tax reporting purposes. Part I of Schedule 1 deals with Additional Income.

In addition Copy A of the W-2 is submitted by the Employer to the Social. The total wages paid that are subject to Social Security tax. Total wages that are subject to social security tax.

If you earn deposit interest or dividend income you must use the gross figures when calculating total income. Box 2 reports the total amount of federal income taxes withheld from your pay during the year. EBT is found before any deductions are made and net annual income Net Income Net Income is a key line item not only in the income statement but in all three core financial statements.

The number in this box represents your total federal gross income. This includes any 1099 income as an independent contractor or your net income as a sole proprietor. Click to explore further.

You can determine your annual net income after subtracting certain expenses from your gross income. Subtract deductions from the annual income. The total amount of federal income tax that was withheld from your wages tips and other compensation.

However you can easily figure out your annual salary from your W-2 forms. You may hear it referred to in two different ways. All transactions paid out in a calendar year are included in your Earnings Summary including both net and gross earnings.

This amount should be equal to 62 of the wages listed in Box 3 up to the maximum. W-2 Wages for Income Taxes In box 1 of the Form W-2 your company reports the total taxable wages of the employee for IRS record keeping. They are probably seeking your adjusted gross income.

If you are married or in a civil partnership and jointly assessed your spouses or civil partners income is included in total income. Gross annual income refers to all earnings Earnings Before Tax EBT Earnings before tax or pre-tax income is the last subtotal found in the income statement before the net income line item. Box 2 reports the total amount of federal income taxes withheld from your pay during the year.

Box 1 of the W-2 shows your taxable wages for federal income tax purposes. The amount of social security tax withheld from all OASDI taxable wages. Your annual net income can also be found listed at the bottom of your paycheck.

This value will be your adjusted gross income. A Form W-2 includes an employees wages and tax deductions for a specific calendar year--January 1 through December 31. For example if you are self-employed.

This means your adjusted gross income is 43000. Your adjusted gross income is your gross income on your W2 minus your major deductions for the year. Your total income is your gross income from all sources less certain deductions such as expenses allowances and reliefs.

To arrive at your total salary using Box 1 add your federal taxable wages shown in. Because certain income may be subject to Social Security tax but not income tax dont be alarmed if its higher than Box 1. Anytime you work for an employer that employer is required to send you a Form W-2 for federal income tax purposes.

Actual legal advice can only be provided after consultation by an attorney licensed in your. Similarly where do I find my annual income on my w2. It is easy to lose track of your total annual earnings if you have more than one job.

The elections on your form W-4 determine this amount and its based on your exemptions and any. When you calculate this number take out any pretax deductions from an employees pay because they do not count as income for federal income taxes. There is no net income on a form 1040 unless you file a schedule C.

Box 1 of your W-2 form accounts for wages bonuses gifts taxable benefits and all other forms of compensation. This topic is important if youre a wage earner or a business owner particularly when it comes to filing your. Line 3 of Schedule 1 is where you enter your business income or loss.

Now add up all of your deductions like you did in the above steps. All income that cannot be entered directly on Form 1040 W2 income goes on Schedule 1.

How To Read Your Military W 2 Military Com

Why Is My Final Pay Stub Different From My W 2

How To Fill Out A W 2 Tax Form For Employees Smartasset

W 2 Wage And Tax Statement Data Source Guide Dynamics Gp Microsoft Docs

What Is Form W 2 An Employer S Guide To The W 2 Tax Form Gusto

Understanding Your W 2 Controller S Office

W 2 Vs Last Pay Stub What S The Difference Aps Payroll

How To Fill Form W2 Tax Forms Accounting Services W2 Forms

W 2 Box 1 Wages Vs Final Pay Stub Asap Help Center

So You Have Stock Compensation And Your Form W 2 Just Arrived Now What The Mystockoptions Blog

So You Have Stock Compensation And Your Form W 2 Just Arrived Now What The Mystockoptions Blog

How To Read Your W 2 Justworks Help Center

How To Read Your W 2 University Of Colorado

Have Your W 2 Form Here S How To Use It The Motley Fool

Pin By Paul Lionetti On Quick Saves In 2021 Tax Forms Internal Revenue Service W2 Forms

Form W 2 Explained William Mary

W 2 Vs W 4 What S The Difference Seek Business Capital

This Annual Tax Reference Guide Is For Any Business That Has Employees And Contractors Or That Have Sales In 2021 Bookkeeping Business Business Tax Small Business Tax

What Is Form W 2 An Employer S Guide To The W 2 Tax Form Gusto

Post a Comment for "Where Is Your Total Annual Income On W2"