Total Annual Income Credit Card Spouse

43 have annual incomes of 1 to 4999. Most ask for it to be expressed in annual terms so if your gross monthly pay is.

10 Certificates Of Employment Samples Business Letter For Baby Dedication Certificate Template Letter Templates Baby Dedication Certificate Lettering

The vast majority of card applications surveyed used the phrase annual income or some variation of it instead of household income None included the words personal or individual The imprecision leaves room for interpretation.

Total annual income credit card spouse. The requests from Bank of America and Targets retail card ask for your income. For millions figuring out what counts as annual income for the sake of a credit card application can be surprisingly murky. 79 have annual incomes of 25000 to 39999.

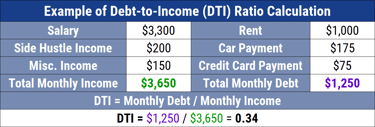

If your spouse is the breadwinner and has solid credit scores most lenders will. For example if you earn 12 per hour and work 35 hours per week for 50 weeks each year your gross annual income would be 21000 12 x 35 x 50. On a credit application youll use the gross figure.

Spouse A who makes 150000 in income individually knows that it is OK to list household income on a credit card application and submits an income of 200000. Net income is what youre left with after those deductions. 47 have annual incomes of 5000 to 14999.

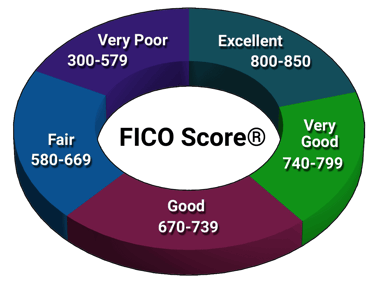

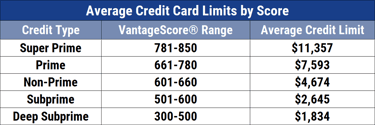

Thats because there are tools that help credit card issuers estimate income based on your credit history and other information you provide. Some may ask for proof of your income so have a copy of your pay stubs bank statements or other income available If your credit card application asks for your annual income and youre paid weekly multiply your weekly amount by 52. When it comes to your credit card application there are several types of income you can include besides money from your regular 9-to-5.

If one spouse earns 20000 per year and another earns 150000 both have the same access to. How Much Annual Income Do You Need to Be Approved for a Credit Card. That might involve having to submit copies of your pay stub W.

Add your net annual income. Just one major card issuer Wells Fargo specifies that spousal income cannot be included in the total. It took 3 years but finally in April 2013 an amendment to the CARD act was finally passed which allows credit card issuers to consider income that a stay-at-home applicant who is 21 or older shares with a spouse or partner when evaluating the applicant for a new account or increased credit limit Signing up for cards in 2-player mode.

However there are other ways to go about things. You cannot typically list your spouses incomeour household incomeon your application as if it were your own. Total annual income credit card.

Heres the bad news. Heres a guide to the process. Come up with an honest estimate.

If your annual salary is 48000 your gross monthly income would be 48000. 83 have annual incomes of 40000 to 49999. Your gross annual income is the amount you earn before any deductions such as income tax withholding employee benefit costs or retirement plan contributions are deducted from your pay.

Couples with disparate incomes can also benefit. As a rule of thumb you should only include another persons income on your application if you have access to it says Mitchell for example if your spouse makes regular deposits into a. In fact the Consumer Financial Protection Bureau amended CARD Act regulations in 2013 so that applicants age 21 and older could include third-party income such as a partner or spouses income as long as they have a reasonable expectation of.

64 have annual incomes of 15000 to 24999. So if the net income or gross income you report is way off you can expect that the issuer will ask for verification. One of the most popular methods of obtaining credit is signing on to a joint credit card account with your spouse.

If it asks for monthly income multiply your weekly amount by 52 and then divide by 12. Even stay-at-home parents can get a credit card if they report shared income from a working spouse or partner. From there you can come up with an estimate of your annual net income thats based on your income history.

It is after all a personal loan. If youre paid hourly multiply your wage by the number of hours you work each week and the number of weeks you work each year. That is credit card fraud and could cost you 1.

Sadly No You Cant Simply List Your Spouses Income. As per ValuePenguins research the collection of people who own at least one credit card are as follows. Part-time or full-time income Alimony or child support.

If you make 70000 a year you dont want to say you make 200000 Griffin says. Whatever you do dont be tempted to lie about your annual net income on a credit card application.

15 Faqs Annual Income On Credit Card Applications 2021

Cleared Of Gender Bias Apple Announces Apple Card Family For Spouses And Teens Techcrunch

Tuesday Tip How To Calculate Your Debt To Income Ratio Debt To Income Ratio Paying Off Credit Cards Credit Counseling

15 Faqs Annual Income On Credit Card Applications 2021

15 Faqs Annual Income On Credit Card Applications 2021

15 Faqs Annual Income On Credit Card Applications 2021

Can I Use My Spouse S Income On Credit Card Applications Bankrate

Suze Orman Archives Money Musings In 2021 Suze Orman Personal Finance Budget Budgeting Money

Can I Use My Spouse S Income On Credit Card Applications Bankrate

Why To Change Your Withholdings Saving Money Budget Budgeting Money Money Advice

Sample Printable Budget Templates Home Budget Template Budget Template Budget Template Free

How To Talk About Money With Your Partner Debt Free Guys Debt Debt Relief Programs Debt Settlement Companies

In204 Life Insurance Basics How To Plan Estate Planning Home Planner

Don T Let Credit Card Debt Get You Down Get It Paid Off And Regain Your Freedom I Credit Card Debt Payoff Paying Off Credit Cards Consolidate Credit Card Debt

Including Spouse Income On A Credit Card Application

How To Survive On One Income Frugal Living Tips In 2020 Best Money Saving Tips Budgeting Budgeting Tips

His Hers Envelope Systems Envelope System Cash Envelope System Budgeting Tools

Including A Spouse S Income When Applying For A Credit Card Nerdwallet

Post a Comment for "Total Annual Income Credit Card Spouse"