Net Income Meaning Bank

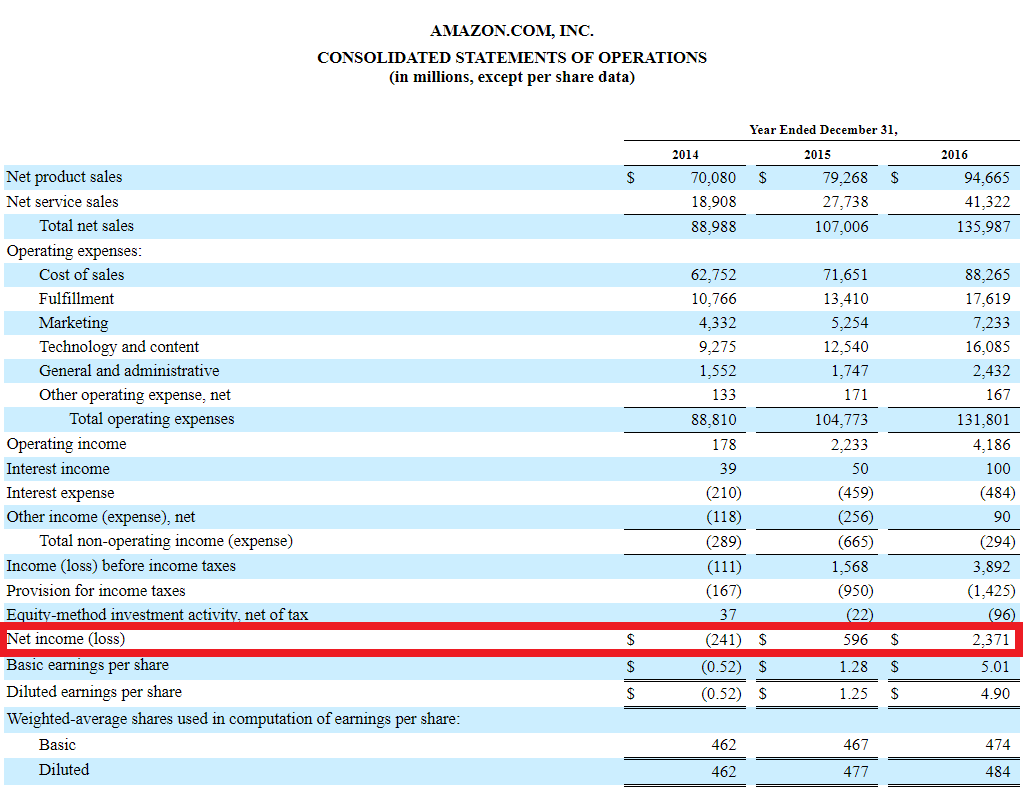

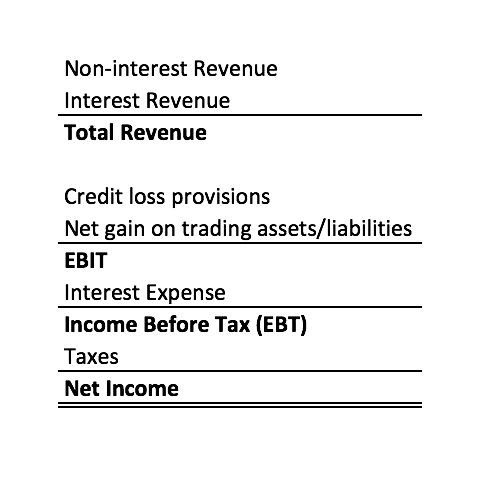

The reason for this anomaly is your income statement in short shows the details of revenue expenses and net income or loss revenues minus expenses. Operating income of banks include.

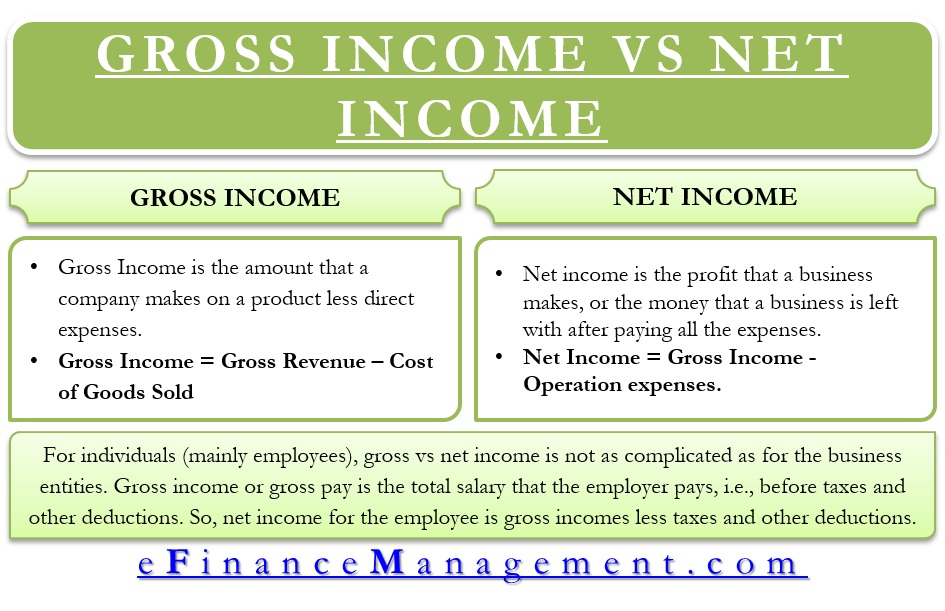

Difference Between Gross Income Vs Net Income Definitions Importance

Net banking income measures the balance between bank operating revenues and expenses.

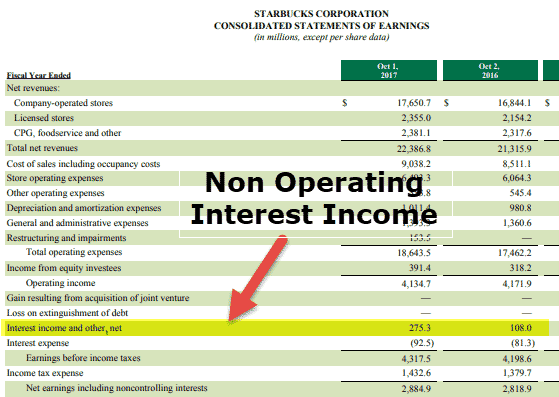

Net income meaning bank. For example a well-known financial indicator for banks net banking income includes property income and capital gains and losses induced by own-account financial transactions. That is the difference between an assets profitability the credit lines and loans that the institution has on its balance sheet mainly and the interest that the bank pays for the resources it needs to finance that asset such as customer deposits and wholesale financing. Economic Policy Debt.

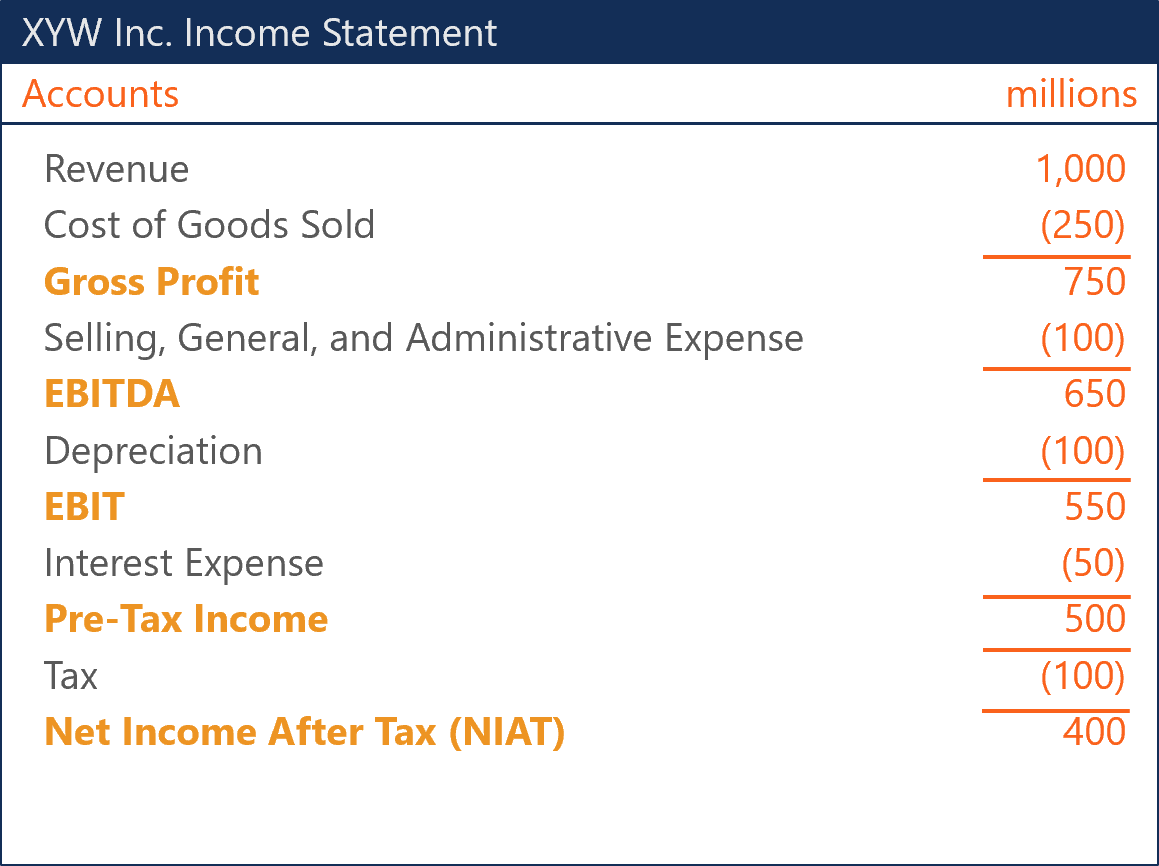

Depending on the nature of your business you could have extended credit to a customer allowing them to pay you later no cash received at. Net income can also be called net profit the bottom line and net earnings. Net Operating Income NOI Net Operating Income NOI earnings reported by a bank or bank holding company after deducting normal operating expenses but before taking gains or losses from sale of securities other losses and charge-offs and additions to the reserve account for possible loan losses.

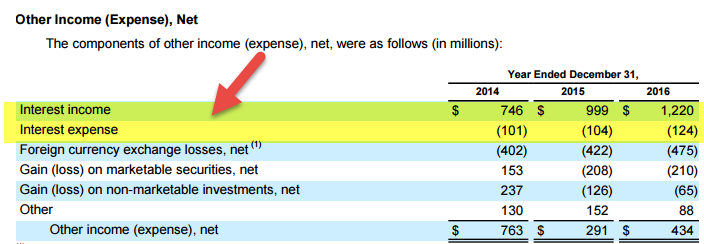

Adjusted savings income Annual Gap-filled total Adjusted net national. Net banking income se traduit par revenu net bancaire et constitue le bénéfice net des opérations effectuées par les établissements financiers. Net interest income is a financial performance measure that reflects the difference between the revenue generated from a banks interest-bearing assets and the expenses associated with paying on.

The same ratio can be written for banks as Operating costs Financial margin. Dictionary of Banking Terms for. The net interest income is the difference in euro between financial income and financial costs.

Commission payée par un actionnaire pour lexécution dun ordre variable selon les tarifs de lintermédiaire et le montant de l a transaction. Le revenu net bancaire exclut les intérêts et le capital des dettes irrécouvrables mais inclut les. Net interest income Interest earned - interest paid Assuming ABC Bank earned an interest income of Rs 15000 crore on its assets comprising all kinds of loans mortgages and securities for the year ended March 31 2015 and paid Rs 13750.

Revenue refers to the sum of money which the company generates from doing the business in the normal course of operations from its customers whereas net income refers to the income earned by the company or the income left over in the company after deducting all the expenses of the period from the net revenue. Net interest income NII is the difference between the interest income a bank earns from its lending activities and the interest it pays to depositors. Adjusted net national income current US Adjusted net national income is GNI minus consumption of fixed capital and natural resources depletion.

Banks use this ratio to track the movement of costs vis-à-vis its income. Ratio showing how much of the NBI Net Banking Income is used to cover the companys operating expenses. Net income is the amount of money thats left after taxes and certain deductions are made from gross income.

World Bank staff estimates based on sources and methods described in the World Banks The Changing Wealth of Nations. There exists an inverse relationship exists between the Cost Income ratio and bank profitability. For example a well-known financial indicator for banks net banking income includes property income and capital gains and losses induced by own-account financial transactions.

Net interest income Interest earned -. Revenue and net income are related. Il représente la différence entre le revenu dexploitation dune banque et ses coûts de fonctionnement.

Net interest income NII is the difference between the interest income a bank earns from its lending activities and the interest it pays to depositors. Revenue does NOT necessarily mean a receipt of cash and expenses does not always mean a cash payment. More specifically operating revenues are composed of interest and commissions excluding interest on doubtful debts but including provisions and recovery of provisions for depreciation of investment securities as weel as gains or losses on securities.

It is useful in analyzing banking stocks.

Net Interest Income Overview And How To Calculate It

Income Statement Definition Structure How To Interpret

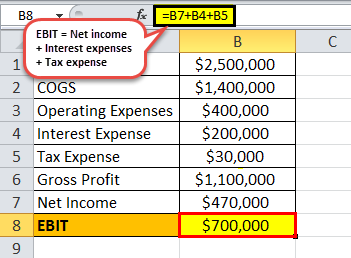

Ebit Vs Operating Income What S The Difference

Net Income The Profit Of A Business After Deducting Expenses

Net Income The Profit Of A Business After Deducting Expenses

Net Income Example Formula Meaning Investinganswers

Is It Possible To Have Positive Cash Flow And Negative Net Income

Net Profit Formula Definition Investinganswers

/IncomeStatementFinalJPEG-5c8ff20446e0fb000146adb1.jpg)

Income Statement Definition Uses Examples

Ebit Earnings Before Interest Taxes Meaning Examples

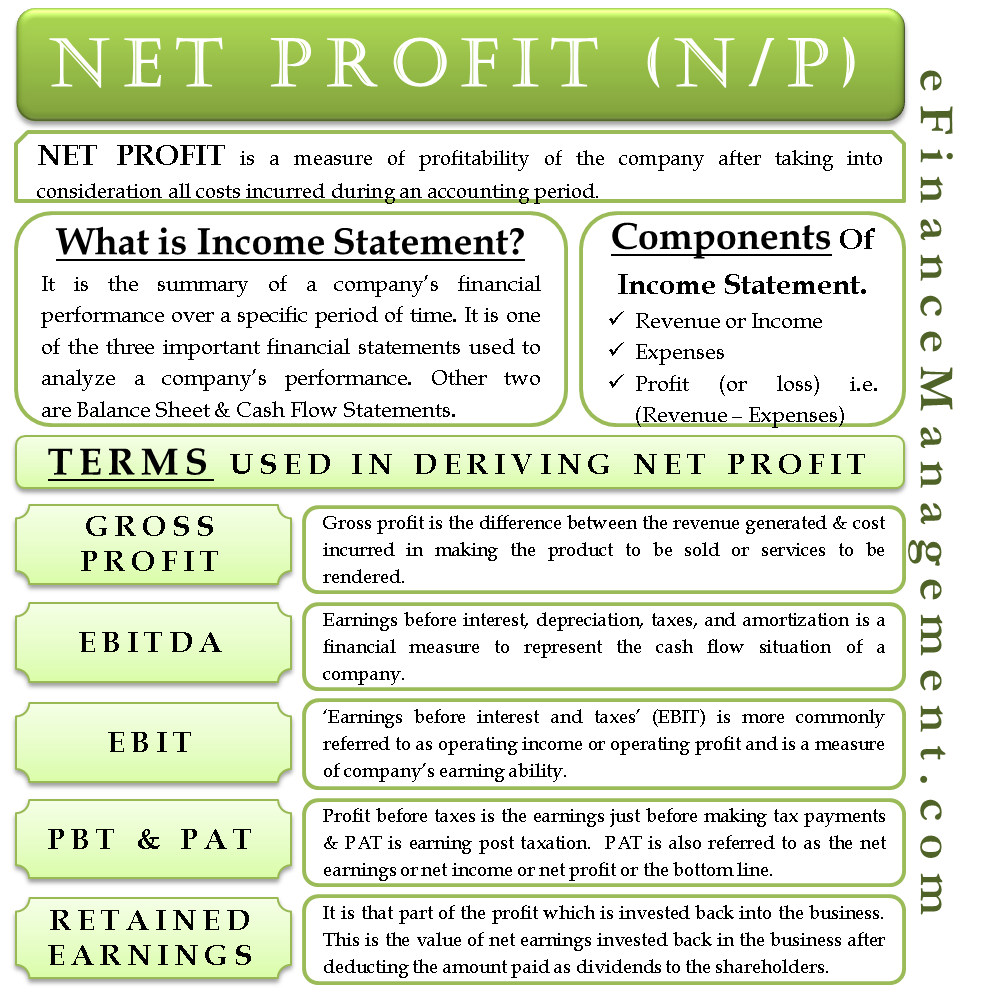

Net Profit Income Statement Terms Ebit Pbt Retained Earnings Etc

Financial Statements For Banks Assets Leverage Interest Income

Interest Income Definition Example How To Account

Analyzing A Bank S Financial Statements

Net Income After Tax Niat Overview How To Calculate Analysis

How Do Net Income And Operating Cash Flow Differ

Analyzing A Bank S Financial Statements

How Do Operating Income And Revenue Differ

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Post a Comment for "Net Income Meaning Bank"