Net Income Margin Meaning

The net profit margin is equal to net profit also known as net income Net Income Net Income is a key line item not only in the income statement but in all three core financial statements. The measurement reveals the amount of profit that a business can extract from its total sales.

Gross Profit Margin Vs Net Profit Margin Formula

In the context of profit margin calculations.

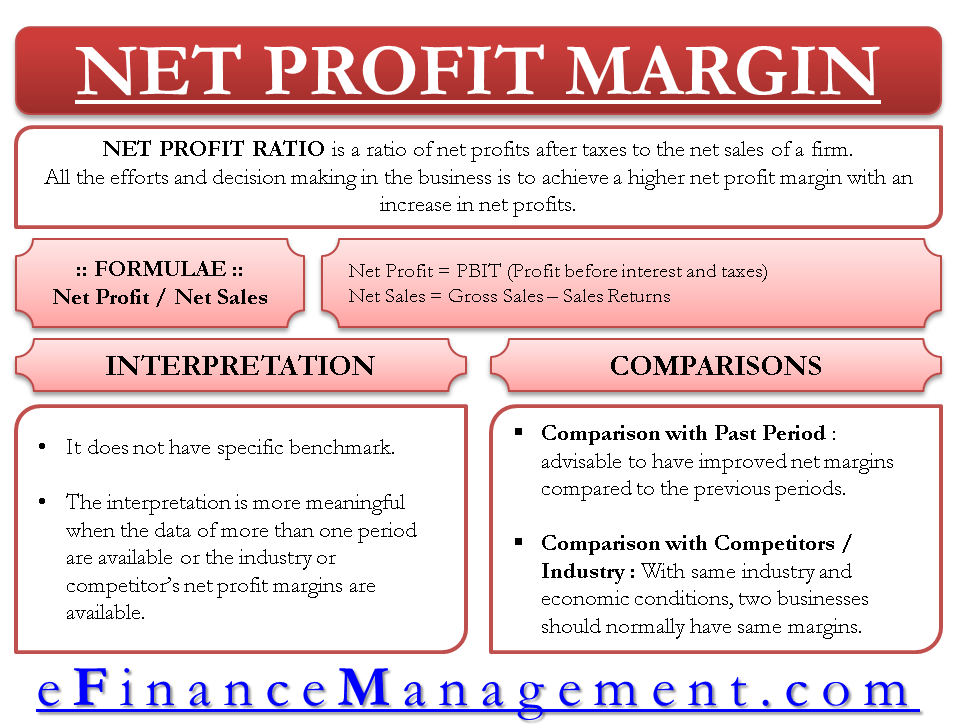

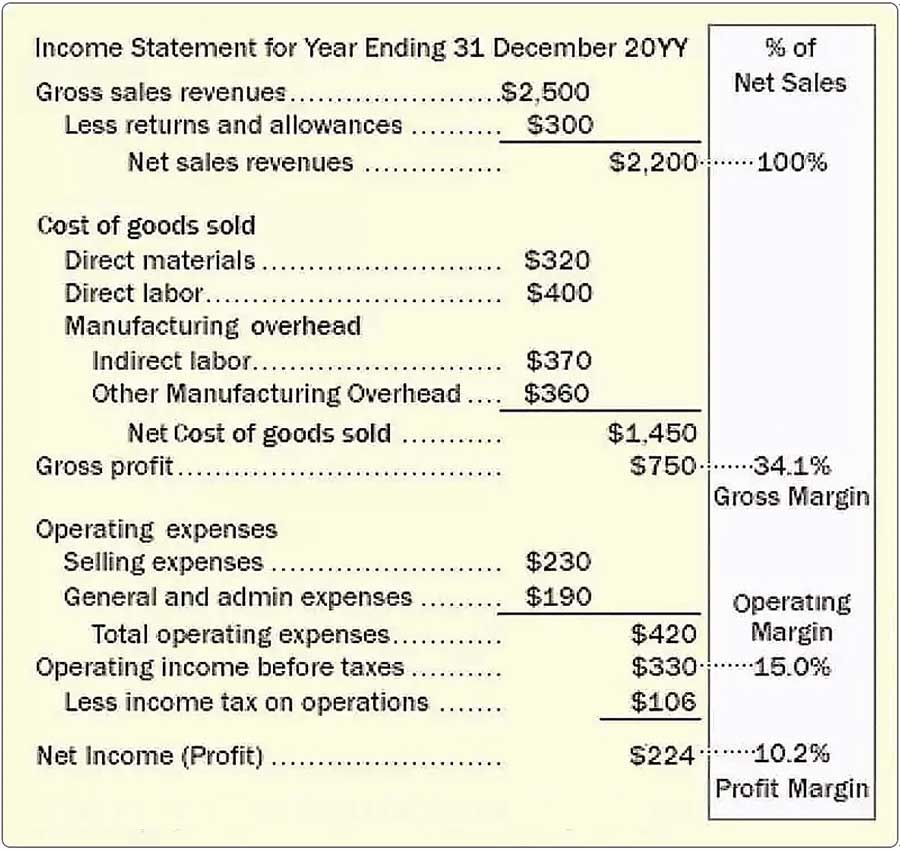

Net income margin meaning. Net interest margin is the difference between the interest income generated and the amount of interest paid out to lenders. In other words this ratio. Net profit margin analysis is not the same as gross profit margin.

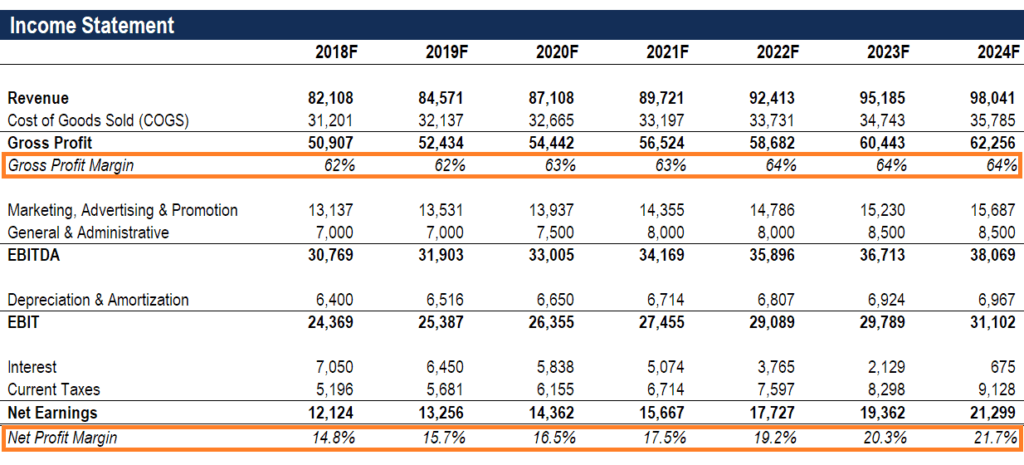

Your net income is your income after all eligible business expenses. The net margin by contrast is only 148 the sum of 12124 of net income divided by 82108 in revenue. Like gross profit gross profit margin your net income also called net profit and your net profit margin show you how much is left after you subtract your expenses from your revenue.

Net income can also be called net profit the bottom line and net earnings. It is an industry-specific profitability ratio for banks and other financial institutions that lend out interest-earning assets. Net profit margin dashboard showing profit as a percentage of revenue.

A higher net profit margin means that a company is more efficient at converting sales into actual profit. 1 It measures how effectively a company operates. The net profit margin is a ratio that compares a companys profits to the total amount of money it brings in.

It is used in ratio analysis to determine the proportional profitability of a business. Net margin considers the net profits generated from all segments of a business accounting for all costs and accounting items incurred including taxes and depreciation. Net interest margin NIM is a measurement comparing the net interest income a financial firm generates from credit products like loans and mortgages with the outgoing interest it pays holders of.

What Does It Mean. It is especially useful when tracked on a trend line to see if there are any spikes or dips in. The formula for net income is simply total revenue minus total expenses.

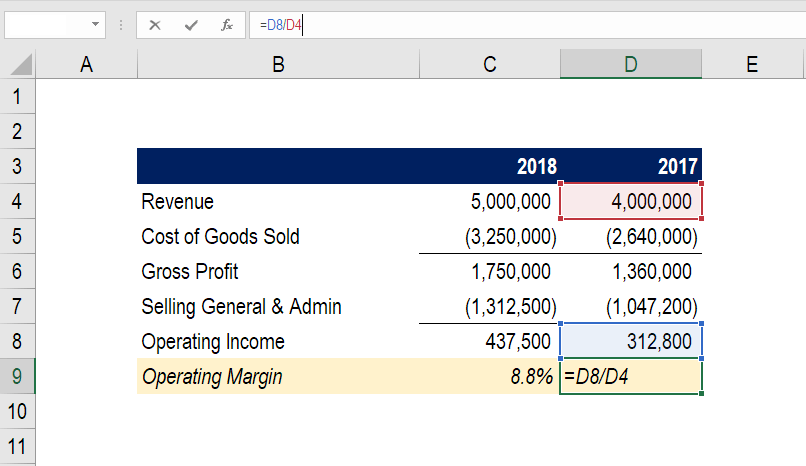

In 2018 the gross margin is 62 the sum of 50907 divided by 82108. Net income goes even further than net gross margin because you deduct all other expenses including overhead and taxes. While it is arrived at through divided by total revenue Sales Revenue Sales revenue is the income received by a company from its sales of goods or the provision of services.

Continued increases in profit margin Net Profit Margin Net Profit Margin also known as Profit Margin or Net Profit Margin Ratio is a financial ratio used to calculate the percentage of profit a company produces from its total revenue. If a company has a 20 net profit margin for example that means that it keeps 020 for every 1 in sales revenue. Net income margin is the net after-tax income of a business expressed as a percentage of sales.

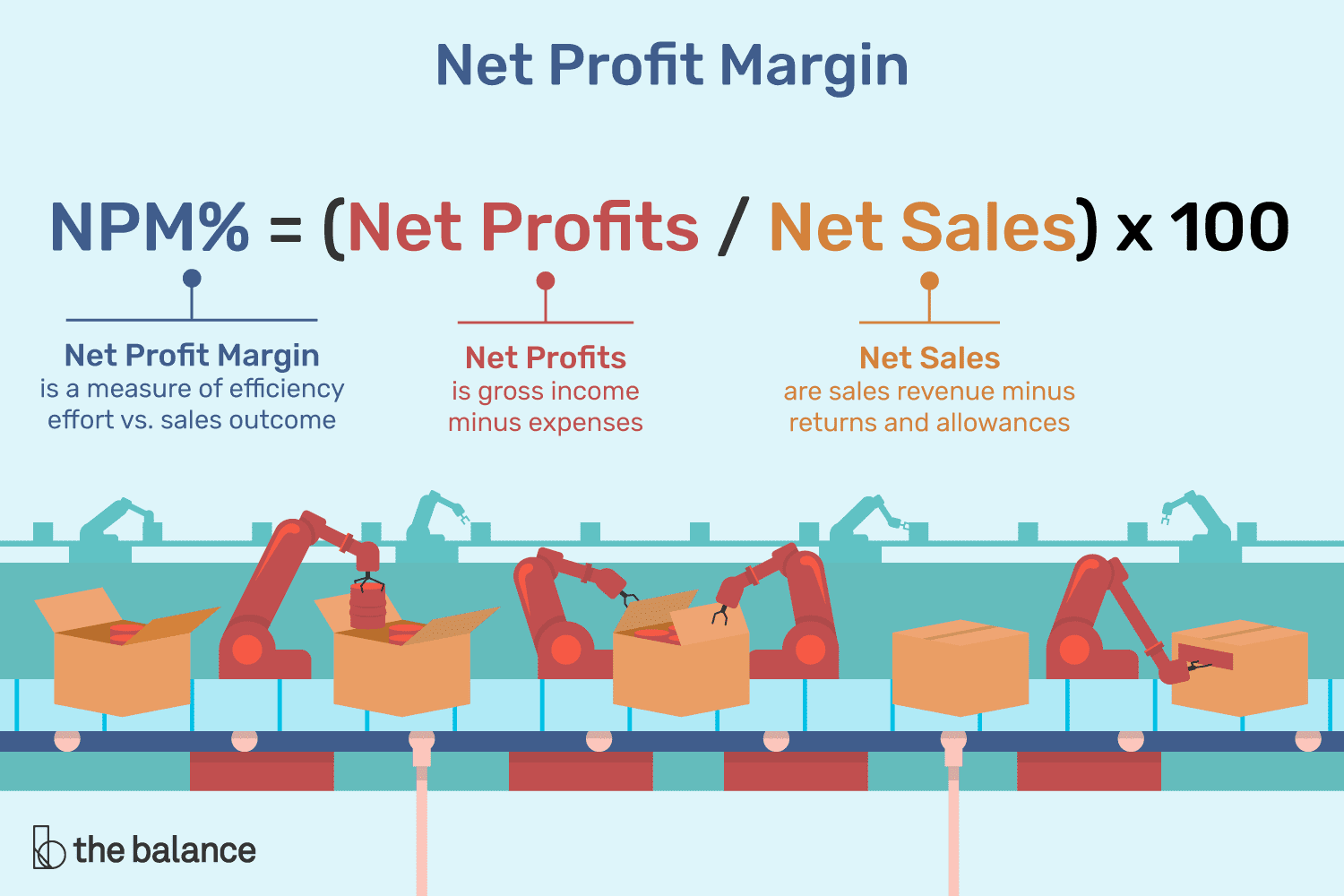

Net Profit Margin Net Income Revenue x 100 As you can see in the above example the difference between gross vs net is quite large. Operating income from continuing operations before amortization operating margin net income excluding the impairment loss the tax adjustments and the loss from discontinued. The net sales part of the equation is gross sales.

Net margin also called net profit margin measures how much profit or net income is earned as a percentage of overall revenue. Net profit margin is the percentage of revenue left after all expenses have been deducted from sales. The net profit margin also known as net margin indicates how much net income a company makes with total sales achieved.

Net profit margin is calculated by dividing the net profits by net sales or by dividing the net income by revenue realized over a given time period. Net margin is a ratio that is typically expressed as a percentage though it may also be listed in decimal form. Net income is the amount of money thats left after taxes and certain deductions are made from gross income.

Net Income for Businesses Net income for a business represents the income remaining after subtracting the following from a companys total revenue.

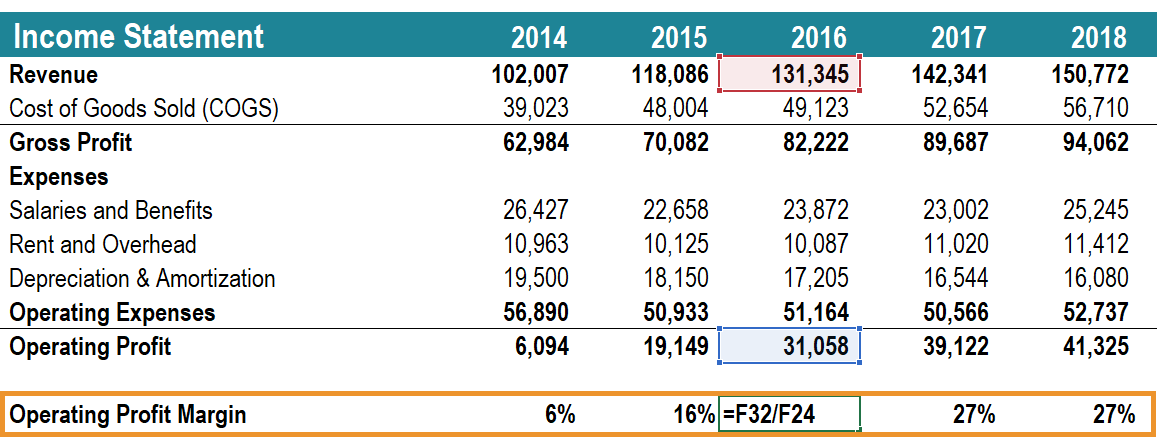

Margin Definition Gross Profit Margin Profit Margin Formula Operating Profit Margin Infographic Economics Lessons Finance Investing Accounting And Finance

Profit Margin Guide Examples How To Calculate Profit Margins

Operating Profit Margin Or Ebit Margin Profit Meant To Be Trend Analysis

Gross Profit Margin Vs Net Profit Margin Formula

Gross Profit Margin Vs Net Profit Margin Formula

Net Profit Margin Ratio Define Formula Calculate Interpret Compare

/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

Gross Profit Margin Vs Net Profit Margin Formula

Profit Margin Guide Examples How To Calculate Profit Margins

Operating Profit Margin Learn To Calculate Operating Profit Margin

What Is Net Sales A Complete Guide With Formula Examples

Operating Margin An Important Measure Of Profitability For A Business

How Does Gross Margin And Net Margin Differ

What Is Profit Margin Definition And Meaning Market Business News

Net Profit Margin Definition How To Calculate It Tide Business

Profit Margins Explained In One Minute From Definition Meaning To Formulas And Examples Youtube

Margins Measure Business Profitability And Reveal Leverage

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

Post a Comment for "Net Income Margin Meaning"