Monthly Salary Calculator Uk Gov

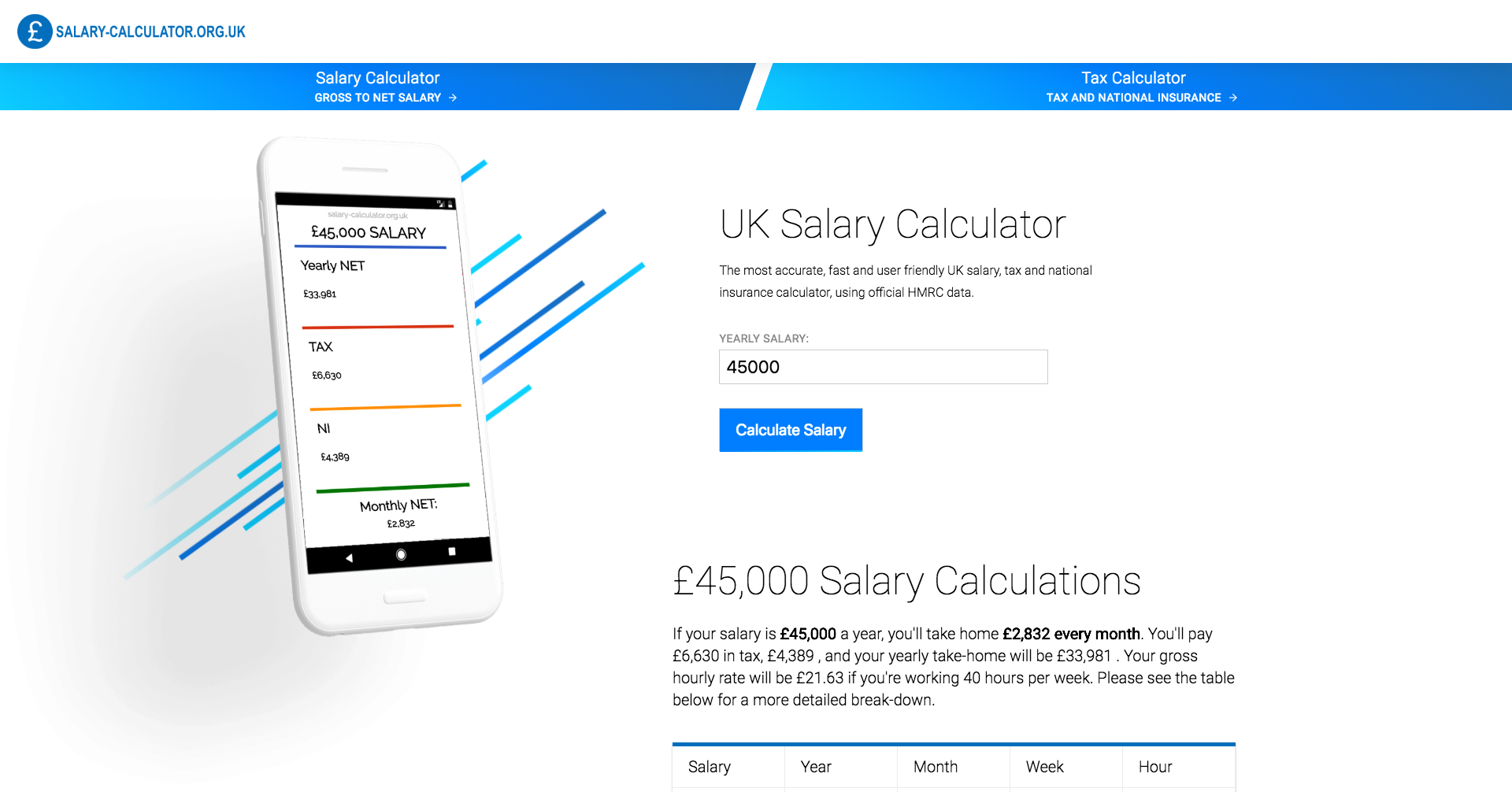

This salary calculator is based on the UK tax rates. In the UK your salary is subject to Income Tax and National Insurance contributions.

How To Calculate Salary After Tax Uk Tax Walls

We offer you the chance to provide a gross or net salary for your calculations.

Monthly salary calculator uk gov. You will see the costs to you as an employer including tax NI and pension contributions. This app takes into account National Insurance NI contributions student loan repayments pension contributions and age as National Insurance is no longer payable on your earnings once you are drawing state pension. Its based on age weekly pay and number of years in the job.

Youre paying a worker the National Living Wage. The latest budget information from April 2021 is used to show you exactly what you need to know. Enter the number of hours and the rate at which you will get.

Use the National Minimum Wage calculator to check if youre paying a worker the National Minimum Wage or if you owe them payments from past years. To accurately calculate your salary after tax enter your gross wage your salary before any tax or deductions are applied and select any conditions which may apply to yourself. Our Salary Calculator is a fast and simple tool to help you estimate your take-home pay based on your earnings.

If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side-by-side comparison of a normal month and a bonus month. Calculate how much statutory redundancy you can get. How to use the Take-Home Calculator.

Hourly rates weekly pay and bonuses are also catered for. Use SalaryBots salary calculator to work out tax deductions and allowances on your wage. If you do any overtime enter the number of hours you do each month and the rate you get paid at - for example if you did 10 extra hours each month at time-and-a-half you would enter 10 15.

What is the Average UK Income. Find out the benefit of that overtime. UK Tax Salary Calculator Calculate your net salary and find out exactly how much tax and national insurance you should pay to HMRC based on your income.

Use SalaryBots salary calculator to work out tax deductions and allowances on your wage. Calculate Salary or Advanced Calculator Advanced Calculator. Your weekly pay is the average you.

This equates to an annual salary of 29900 annually although it should be noted that this figure represents the income of a household not an individual. Why not find your dream salary too. Calculate your monthly net pay based on your yearly gross income with our salary calculator.

National Minimum Wage and Living Wage calculator for employers. Completed overhauled for 2019-19 tax year our new salary and tax calculator is built to support all your salary and payroll audit needs. It allows you to select from the 2020-19 and 2019-20 tax years.

Calculate your statutory redundancy pay. The median monthly household income in the United Kingdom is 2491 before deductions such as income tax and National Insurance payments have been made. Our salary calculator will provide you with an illustration of the costs associated with each employee.

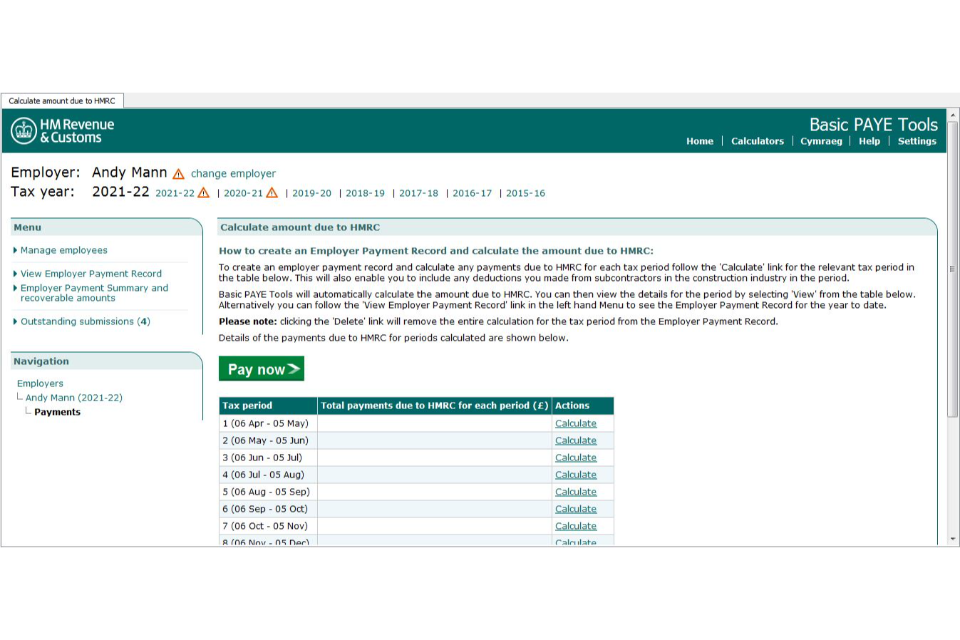

Use these calculators and tax tables to check payroll tax National Insurance contributions and student loan deductions if youre an employer. You owe your. The 202021 tax calculator provides a full payroll salary and tax calculations for the 202021 tax year including employers NIC payments P60 analysis Salary Sacrifice Pension calculations and more.

The results are broken down into yearly monthly weekly daily and hourly wages. We strongly recommend you agree to a gross salary. Youre paying a worker the National Minimum Wage.

Use this service to estimate how much Income Tax and National Insurance you should pay for the current tax year 6. The tool estimates your net income based on the Income Tax you will be deducted and the NI contributions you will be required to pay. Check your payroll calculations manually - GOVUK.

Student loan pension contributions bonuses company car dividends Scottish tax and many more advanced features available in our tax calculator. Our salary calculator builds upon our comprehensive calculation system to provide you with an accurate breakdown of your salary by factoring income taxes national insurance and other deductions such as student loans and pensions. Accurate fast and user friendly UK salary calculator using official HMRC data.

Half of the population earns less than this figure and. To use the tax calculator enter your annual salary or the one you would like in the salary box above. The latest budget information from April 2021 is used to show you exactly what you need to know.

Estimate your Income Tax for the current year. 5 hours double time would be 5 2. If you know your tax code you can enter it or else leave it blank.

The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. If you are looking for a feature which isnt available. The results are broken down into yearly monthly weekly daily and hourly wages.

Enter your hourly wage and hours worked per week to see your monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. To accurately calculate your salary after tax enter your gross wage your salary before any tax or deductions are applied and select any conditions which may apply to yourself.

Tax Calculator 2017 2018 Tax Calculator 2017 2018 S

How To Calculate Your Take Home Salary A Uk Guide

![]()

Multiple Income Tax Calculator Uk Tax Calculators

How To Calculate Your Take Home Salary A Uk Guide

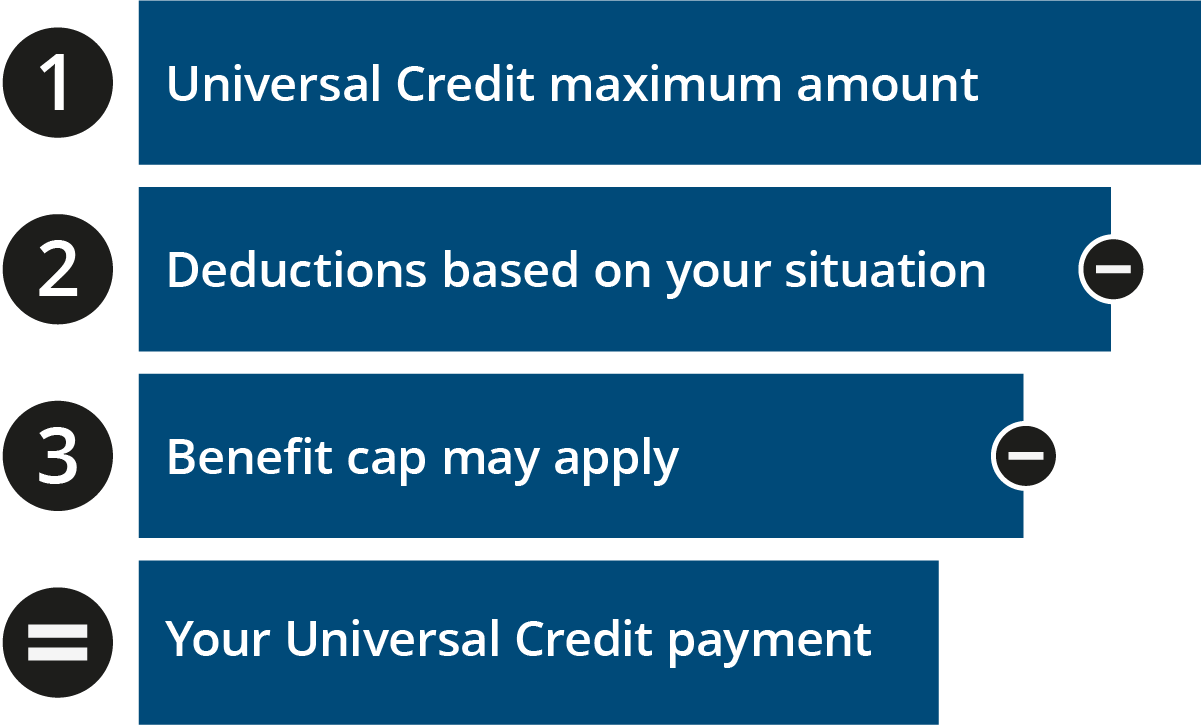

Understanding Universal Credit How Earnings Affect Universal Credit

Career Lesson Wage Conversion Chart Hourly Pay Is Converted To Monthly And Yearly Pay To Help Kids Calculate Their I Career Lessons Conversion Chart Lesson

Monthly Paye Payments Or Quarterly Payments Alterledger

Employees Daily And Monthly Salary Calculation With Overtime In Excel By Learning Centers Excel Tutorials Salary

Understanding Universal Credit How Much Universal Credit Can I Get

Boosting Your Maternity Pay Maternity Money Uk

Uk Salary Calculator Template Spreadsheet Eexcel Ltd

Calculate Your Maternity Pay Or Benefits On Gov Uk Youtube

Basic Paye Tools User Guide Gov Uk

Furlough Grant Calculator Job Retention Scheme

26 000 After Tax Salary Calculator Uk

Income Tax Co Uk Uk Tax Calculator Posts Facebook

80 000 After Tax 2021 Income Tax Uk

Calculators Low Incomes Tax Reform Group

Post a Comment for "Monthly Salary Calculator Uk Gov"