13th Month Pay Guidelines For Government Employees

The minimum 13th month pay required by law shall not be less than one-twelfth of the total basic salary earned by an employee within a calendar year. Computation of the 13th month pay primarily consists of the total basic monthly salary of an employee for the whole year divided by twelve 12 months.

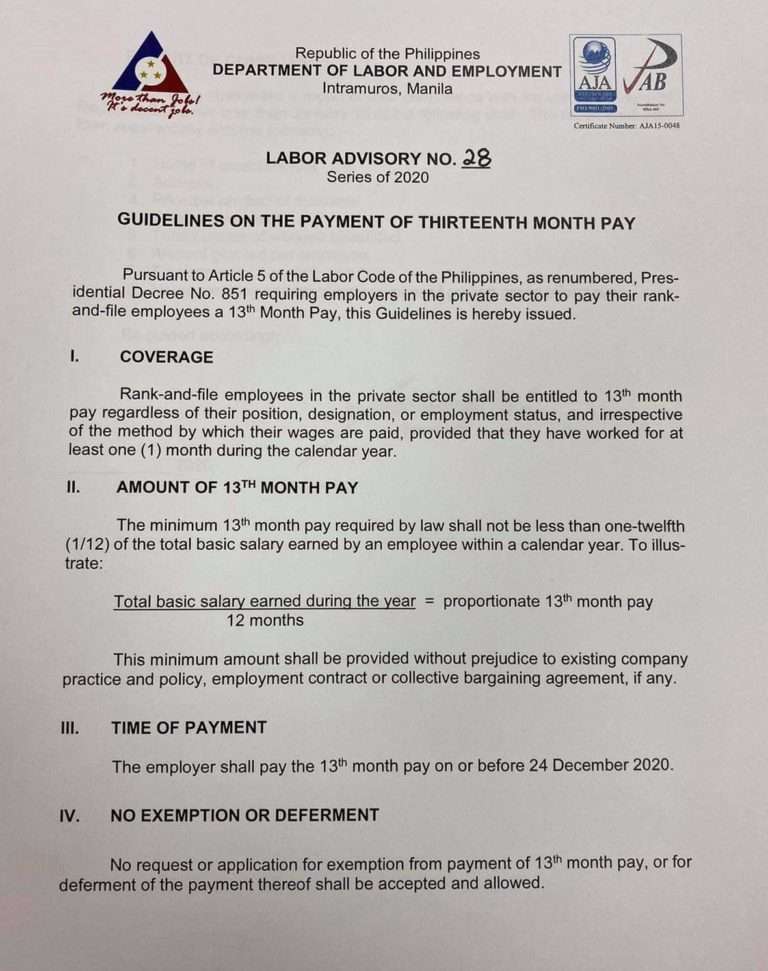

13th Month Pay Computation Dole Labor Advisory

However under Sec8 of Republic Act No.

13th month pay guidelines for government employees. 13TH MONTH PAY Here are some of the things you might want to know about the 13th month pay for government employees and release date. For people of the working sector the 13th month benefit is something that they are looking forward every December. It is a single annual payment on top of an employees total annual wage.

Definition of Rank-and-File Employees. When should the 13 th month pay be paid. Payment depends on what is in your employment contract or collective agreement.

Diokno said the 13th-month pay for government employees was already given in full last May. All employers are required to pay their rank and file employees thirteenth-month pay regardless of the. An employee who has resigned or whose services were terminated at any time before the time for payment.

4 months of service from July 1 of the immediately preceding year to May 15 of the current year. For the year 1987 the computation of the 13th month pay shall include the cost of living allowances COLA integrated into the basic salary of a covered employee pursuant to Executive Order 178. The 13th month pay was divided into two chunks throughout the year.

Previously government workers received a yearend bonus or 13th-month pay in two tranchesthe first in May ahead of the opening of classes and the second in November before Christmas. In previous years the government only granted a yearend bonus. 512 Personnel remains to be in the government service as of May 15 of the current year.

The minimum 13th month pay required by law shall not be less than one-twelfth of the total basic salary earned by an employee within a calendar year. For the year 1987 the computation of the 13th month pay shall include the cost of living allowances COLA integrated into the basic salary of a covered employee pursuant to Executive Order 178. The minimum 13th month pay required by the law shall not be less than one-twelfth 112 of the total basic salary earned by an employee within a calendar year.

851 Section 1 states that. AWS is not compulsory. Government employees are not entitled to the 13th-month pay contemplated under PD.

The 13th month pay and other benefits including productivity incentives and Christmas bonuses are exempted from tax if they do not exceed P90000 according to Republic Act 10963 or the Tax Reform for Acceleration and Inclusion TRAIN law. One half in May. DOLE Guidelines for 13th Month Pay in Private Sectors 1.

An employer however may give to his employees one-half of the 13 th month pay before the opening of the regular school year and the other half on or before the 24 th day of December of every year. Those who have worked for less than a year however are only entitled to receive the amount due to them on the number of. The law dictates that you should get a monetary benefit in a form of 13th month pay not later later than December 24.

The AWS is also called the 13th month payment. 3 b specifically excludes government employees. As set by the Department of Labor and Employment DOLE you should receive your 13th month not later than December 24 of every year.

Why should I receive a 13th month pay. And 513 Personnel has obtained at least a satisfactory performance rating. It should be paid not later than December 24 of each year.

When will I receive my 13th month pay. - All employers covered by Presidential Decree No. The Labor Code as amended distinguishes a rank-and-file employee.

851 hereinafter referred to as the Decree shall pay to all their employees receiving a basic salary of not more than P1000 a month a thirteenth-month pay not later than December 24 of every year. Payment of 13th-month Pay. For the year 1987 the computation of the 13th month pay shall include the cost of living allowances COLA integrated into the basic salary of a covered employee pursuant to Executive Order 178.

11466 or the Salary Standardization Law of 2019 1 government employees are entitled to the following. Are resigned or separatedterminated employees entitled to 13 th month pay. The minimum 13th month pay required by law shall not be less than one-twelfth of the total basic salary earned by an employee within a calendar year.

13th Month Pay For Government Employees Release Date

13th Month Pay Computation Dole Labor Advisory

How To Compute Your 13th Month Pay 2020 Jobs360

How To Compute 13th Month Pay In The Philippines An Ultimate Guide

13th Month Pay 2020 Guidelines To Resigned Or Terminated Employees

Dole Directs Private Companies To Give 13th Month Pay By December 24 Life Of Maharlika

Everything You Need To Know About 13th Month Pay Sunstar

Dole Advisory Guidelines On The Payment Of 13th Month Pay 2020

Q A On 13th Month Pay Official Gazette Of The Republic Of The Philippines

13th Month Pay An Employer S Guide To Monetary Benefits

13th Month Pay An Employer S Guide To Monetary Benefits

Here S What You Need To Know About 13th Month Pay In The Philippines Jobstreet Philippines

Dole Guidelines For 13th Month Pay In Private Sectors

How To Compute Your 13th Month Pay 2020 Jobs360

Dole Guidelines For 13th Month Pay In Private Sectors

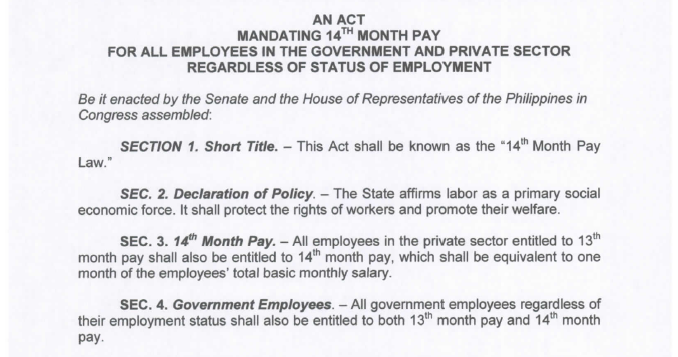

Release Of 14th Month Pay From Nov 15 To Dec 31 Pushed Deped Tambayan

13th And 14th Month Pay Bonuses Of 2018 Deped Teachers Club

Post a Comment for "13th Month Pay Guidelines For Government Employees"