Monthly Salary Calculator India

The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. Income Tax calculation 95000000 Salary.

How To Calculate Your Monthly Salary In India Excel Calculator

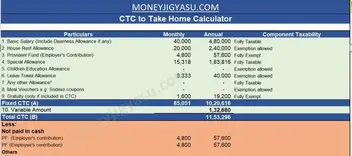

AM22Techs Indian salary calculator is easy to use if you know your salary package.

Monthly salary calculator india. Use 6figrs Salary Calculator for India Salary Hike Calculator to see how your salary compares with the market standards. Enter the Basic Salary HRA and other income as listed on your CTC. Please remember that these figures are Youtube Estimated Earnings as there are many.

The latest budget information from April 2021 is used to show you exactly what you need to know. Lets convert your Gross Monthly Salary to Net Monthly Salary. The formula for the calculation of Gratuity is mentioned below.

Usually it is 40 or 50 of the basic salary. 5400 Calculation of Minimum Gross Salary for. How does this work.

So the take home salary calculator shows you the take home salary. Income Tax calculation 105000000 Salary. It is calculated according to this formula.

Just follow the steps to find out 6figrs market estimate for your profile along with a complete breakdown of crucial CTC components like Gross Income Income Tax Provident Fund and Monthly Take Home salary from the. 177500 6th CPC Grade Pay Rs. Total Minimum Monthly Salary Calculation for 7th Pay Matrix Level 10 Rs.

This YouTube Money Calculator provides a glimpse into what a user could make with YouTube by estimating a commonly accepted CPM range based off of the average amount of views you insert down below. Income Tax calculation 115000000 Salary. Your CTC includes your variable pay as the name indicates variable pay amount differs based on various factors.

It now also provides option to calculate your take home salary choosing either Old or New Tax Slabs to calculate your estimated tax liability. Basic Salary is proportionate to the working days. We take it one step further to provide users with various settings allowing them to customize the experience.

The calculator will find the total yearly income tax and then show you the monthly deductions and monthly net income that should be credited to your bank account. TDS is calculated on Basic Allowances Deductions 12 IT Declarations Standard deduction Standard deduction 50000. The Salary Calculator.

You should know what this amount is while applying for the loan. Your Net Monthly Income is different. How to use Monthly Salary Calculator India application.

This is outlined on your job offer letter as well. FY 2019 2020 Income Tax formula for FY 2019 2020 Basic Allowances Deductions 12 IT Declarations Standard deduction Deductions are the sum of PF ESI and PT etc. Your variable pay is paid quarterly so you will not have the same take home each month in the months the variable.

Total deductions are Rs 2400Rs 21600Rs 21600 which equals Rs. Take home salary is equal to gross pay minus total deductions. Income Tax calculation 135000000 Salary.

Enter your total monthly household income My total monthly household income is. Last drawn salary basic salary plus dearness allowance X number of completed years of service X 1526. You are in the TOP of the richest households in India.

It uses the following formula to calculate the basic salary IF H40 ROUND J4E4H450 -1. Salary Calculator India 1. Monthly salary is the sum of Basic Pay HRA Conveyance Education LTA or other allowancesThis calculator best suits for IT professionals in India.

Take home salary is equal to Rs 500000 Rs 45600 Rs 424400. Why not find your dream salary too. Hourly rates weekly pay and bonuses are also catered for.

Our Take Home Salary Calculator India 2020-21 tool helps you quickly calculate your estimated monthly take home salary from your CTC. That is the amount you take home after taxes and deductions. Income Tax calculation 85000000 Salary.

Income Tax calculation 125000000 Salary. Next comes the allowances section. Your Gross Monthly Income is everything you can earn in one month before adding the taxes or deductions.

Gratuity Basic salary x Dearness Allowance x 1526 x Number of years of service The Gratuity that is subtracted on a yearly basis 1526 x Basic Salary per month Next you must calculate the taxable income.

How To Calculate Per Hour Salary In India How To Calculate Per Month Salary In India Central Government Employees News

Salary Calculator 2020 21 Take Home Salary Calculator India

Salary Calculator 2020 21 Take Home Salary Calculator India

How To Calculate My Monthly Salary In India If I Know My Ctc And The Split Ups Quora

How To Calculate In Hand Salary Quora

What Is The Take Home Monthly Salary For 12 5 Lpa Quora

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

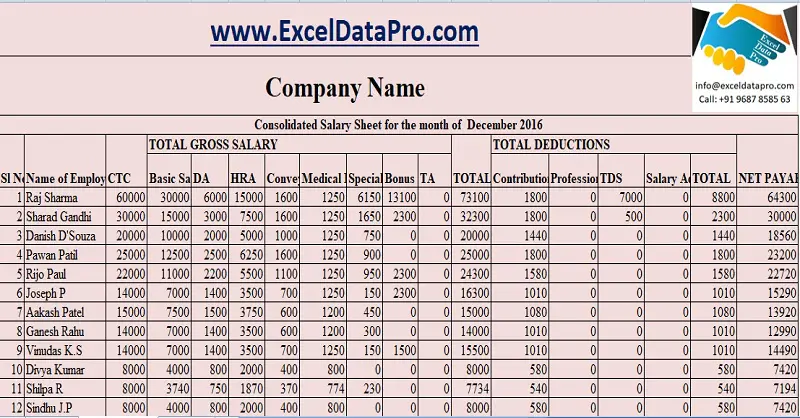

Salary Formula Calculate Salary Calculator Excel Template

Take Home Salary Calculator India Excel Updated For Fy 2020 21 With New Tax Slabs Option

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Salary Formula Calculate Salary Calculator Excel Template

Salary Formula Calculate Salary Calculator Excel Template

Download Salary Sheet Excel Template Exceldatapro

Salary Formula Calculate Salary Calculator Excel Template

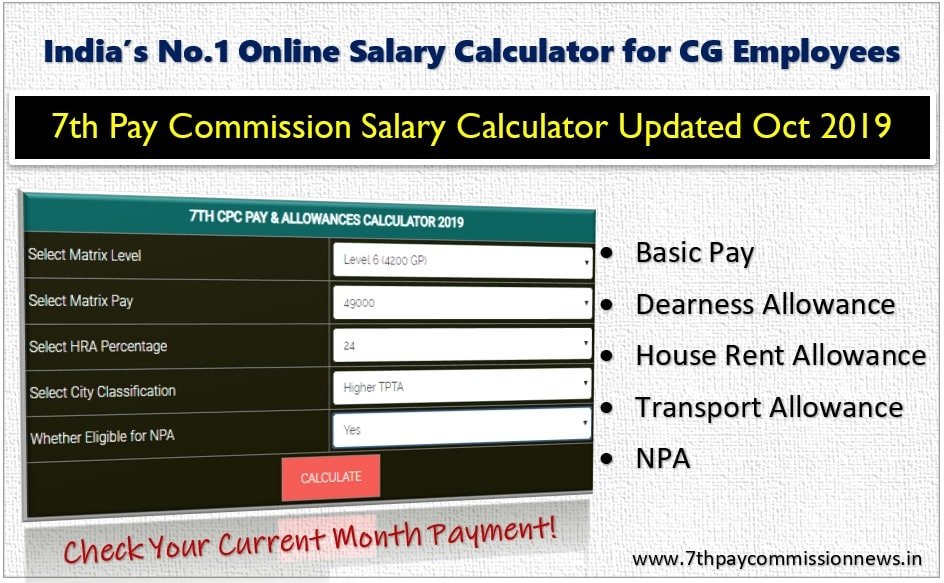

7th Pay Commission Salary Calculator 2021 7th Cpc Pay Scale Calculator 2021 Central Government Employees News

Take Home Salary Calculator India Excel Updated For Fy 2020 21 With New Tax Slabs Option

In Hand Salary Calculator 2021 Pay Slips Monthly Tax India

Monthly Salary To Hourly Calculator Convert Monthly Salary To Hourly Rate Chart Central Government Employees News

Post a Comment for "Monthly Salary Calculator India"