Monthly Salary Calculator Illinois

The Income Tax calculation for Illinois includes Standard deductions and Personal Income Tax Rates and Thresholds as detailed in the Illinois State Tax Tables in 2021. Illinois State Tax Calculation for 9000000 Salary.

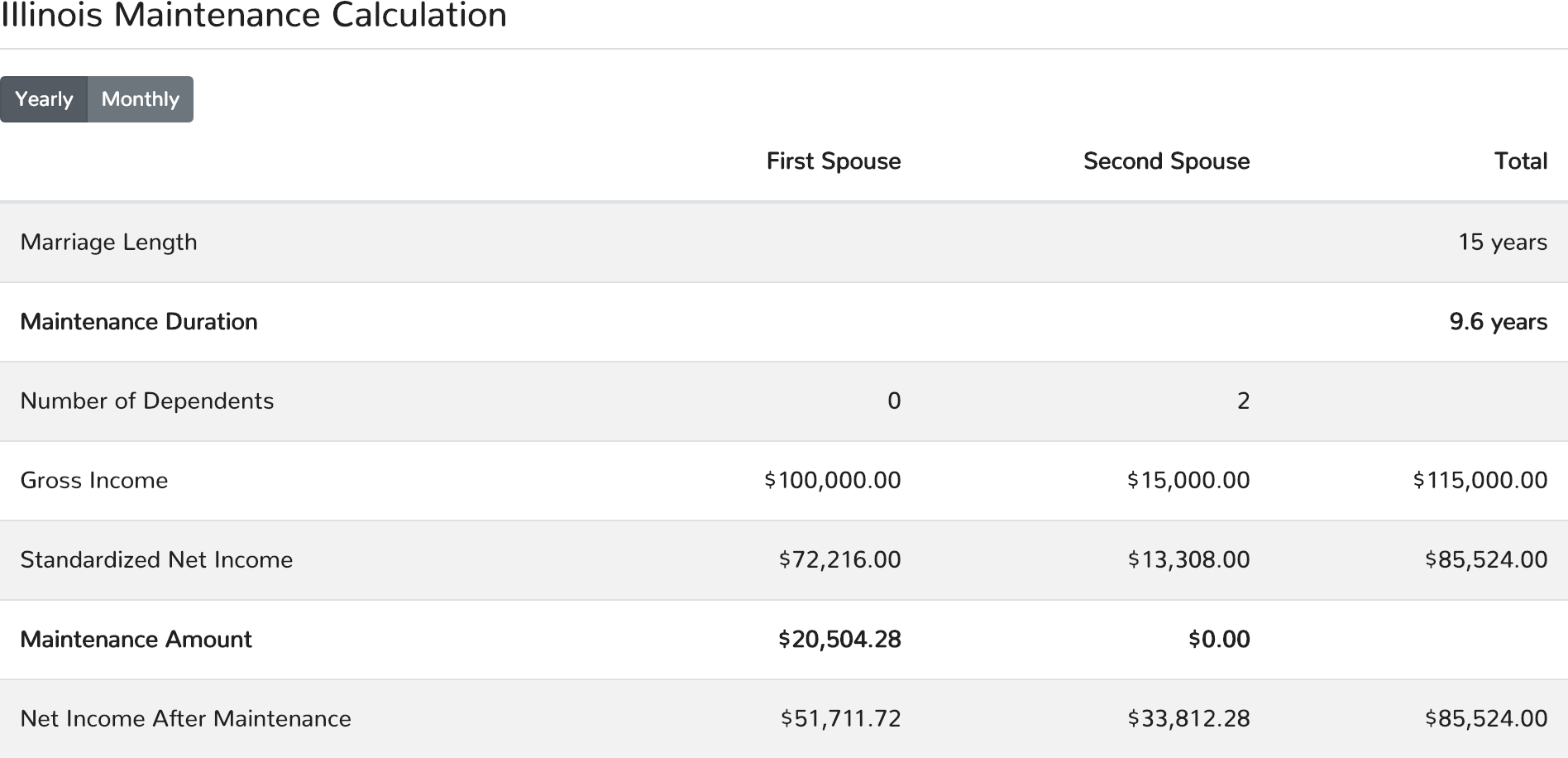

33 of the payers net income 25 of the payees net income the yearly maintenance paid.

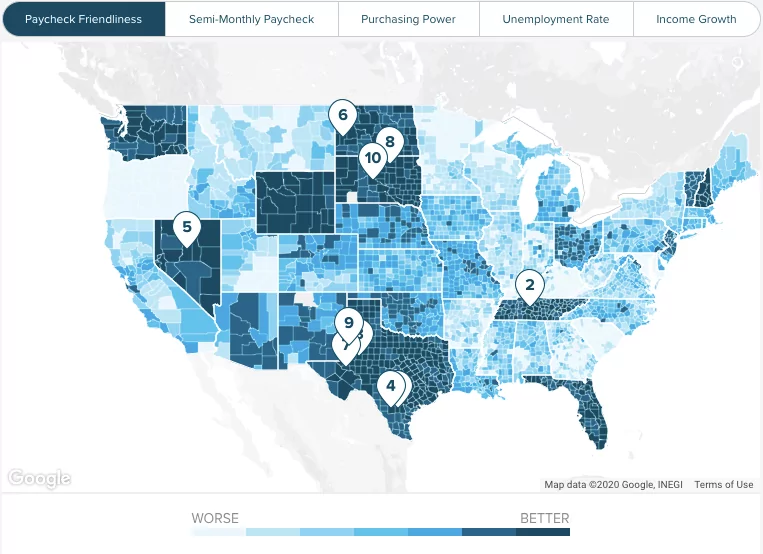

Monthly salary calculator illinois. How is Alimony Calculated in Illinois. The following table shows the equivalent pre-tax hourly income associated with various monthly salaries for a person who worked 8 hours a day for either 200 or 250 days for a total of 1600 to 2000 hours per year. Overview of Illinois Taxes Illinois has a flat income tax of 495 which means everyones income in Illinois is.

3000000 salary example for employee and employer paying Illinois State tincome taxes. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On. However that spousal support cannot cause one spouse to earn more than 40 of the couples combined income.

The latest budget information from April 2021 is used to show you exactly what you need to know. Illinois Hourly Paycheck Calculator. The adjusted annual salary can be calculated as.

These hours are equivalent to working an 8-hour day. One of a suite of free online calculators provided by the team at iCalculator. Median Salary The median salary is 117000 USD per year which means that half 50 of the population are earning less than 117000 USD while the other half are earning more than 117000 USD.

One of a suite of free online calculators provided by the team at iCalculator. Salaries in Illinois range from 28000 USD per year minimum salary to 494000 USD per year maximum average salary actual maximum is higher. While a person on a bi-weekly payment schedule will receive two paychecks for ten months out of the year they will receive three paychecks.

Detailed salary after tax calculation including Illinois State Tax Federal State Tax Medicare Deductions Social Security Capital Gains and other income tax and salary deductions complete with supporting Illinois state tax tables. This places Ireland on the 8th place in the International Labour Organisation statistics for 2012 after United Kingdom but before France. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Illinois.

If you live in one location but work in another the. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. See how we can help.

Hourly rates weekly pay and bonuses are also catered for. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. The table below details how Illinois State Income Tax is calculated in 2021.

Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. For the purposes of this calculator bi-weekly payments occur every other week though in some cases it can be used to mean twice a week.

Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Illinois. The results are broken up into three sections. 30 8 260 - 25 56400 Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of working days a year.

The average monthly net salary in the Republic of Ireland is around 3000 EUR with a minimum income of 1600 EUR per month. One of a suite of free online calculators provided by the team at iCalculator. The Illinois Salary Comparison Calculator allows you to quickly calculate and compare upto 6 salaries in Illinois or compare with other states for the 2021 tax year and historical tax years.

Also a bi-weekly payment frequency generates two more paychecks a year 26 compared to 24 for semi-monthly. See how we can help improve your knowledge of Math Physics Tax Engineering and more. Illinois Salary Paycheck Calculator.

In 2019 this formula is used to calculate alimony in Illinois. Why not find your dream salary too. Calculate your Illinois net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Illinois paycheck calculator.

This Illinois hourly paycheck calculator is perfect for those who. The Illinois Salary Calculator allows you to quickly calculate your salary after tax including Illinois State Tax Federal State Tax Medicare Deductions Social Security Capital Gains and other income tax and salary deductions complete with supporting Illinois state tax tables. You can see how your job and your salary will be impacted by a change of location.

So if you earn 10440 per hour your annual salary is 19000000 based on 1820 working hours per year which may seem a lot but thats only 1517 hours per month or 35 hours per week and your monthly salary is 1583333. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits. All bi-weekly semi-monthly monthly and quarterly figures.

Illinois Salary Paycheck Calculator Results Below are your Illinois salary paycheck results.

Paycheck Calculator Take Home Pay Calculator

Oregon Paycheck Calculator Smartasset

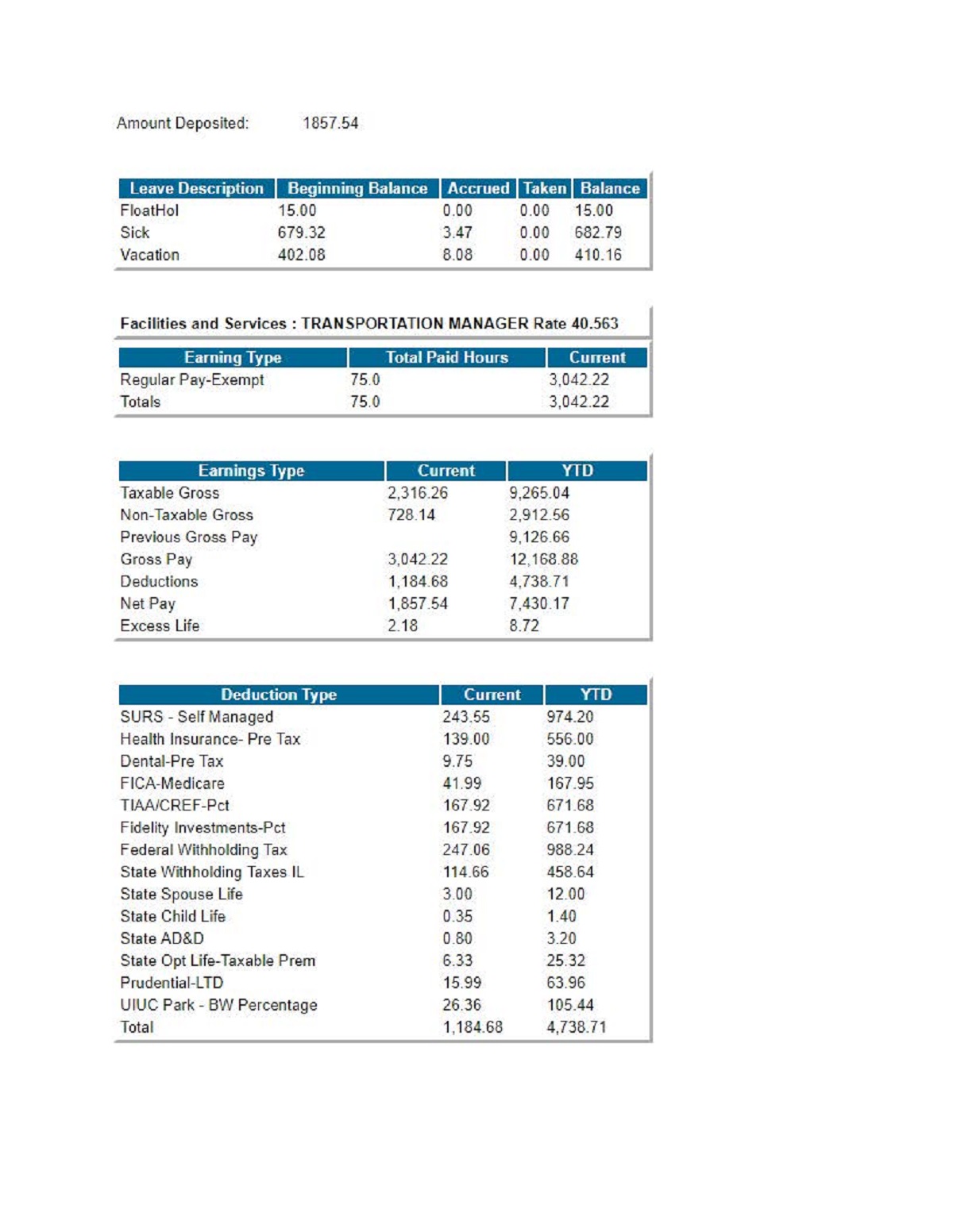

Understanding Your Pay Statement Office Of Human Resources

Paycheck Calculator Salaried Employees Primepay

Free Online Paycheck Calculator Calculate Take Home Pay 2021

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

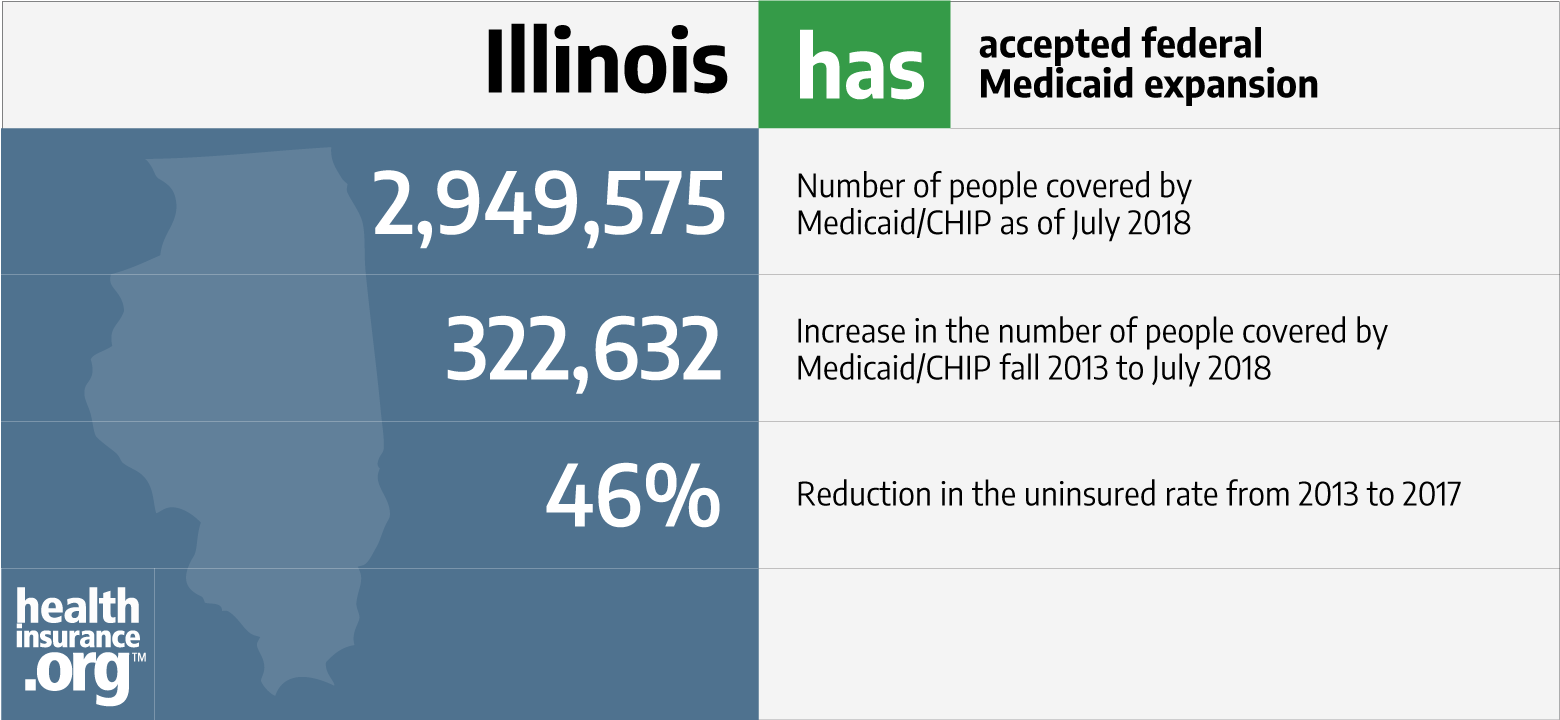

Illinois And The Aca S Medicaid Expansion Healthinsurance Org

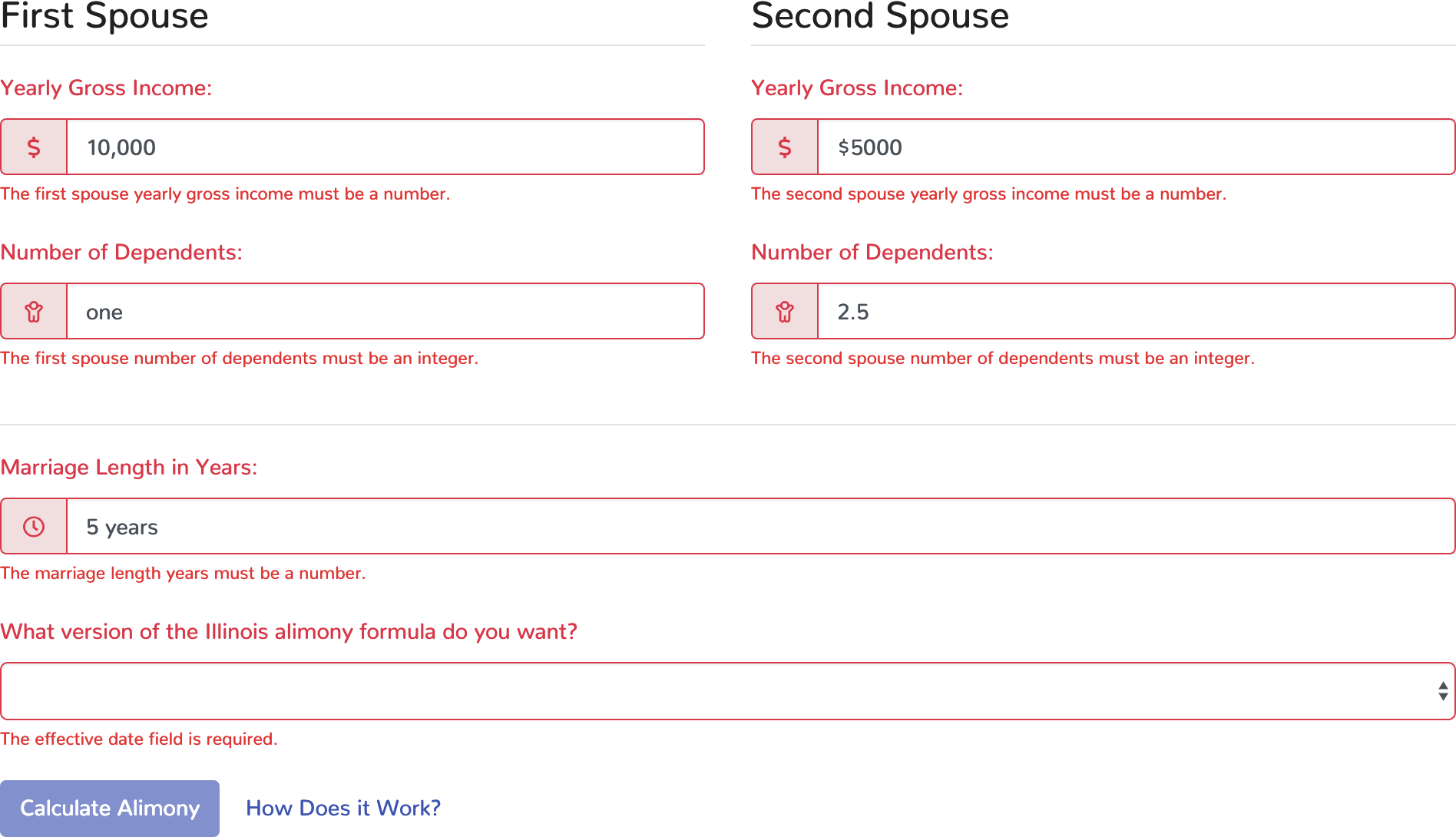

Calculating Illinois Maintenance Legal Calculators

Employees Daily And Monthly Salary Calculation With Overtime In Excel By Learning Centers Excel Tutorials Salary

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Payroll Taxes

Illinois Salary Paycheck Calculator Paycheckcity

5 Free Salary Calculator Websites With State Tax Calculations

Calculating Illinois Maintenance Legal Calculators

Paycheck Calculator Take Home Pay Calculator

Illinois Paycheck Calculator Smartasset

Top 6 Best Annual Salary Income Calculators 2017 Ranking Yearly Income Calculator To Calculate Annual Salary Advisoryhq

New Tax Law Take Home Pay Calculator For 75 000 Salary

Post a Comment for "Monthly Salary Calculator Illinois"