Gross Pay Of Definition

Salaries Fixed compensation for services paid to a person on a regular basis. Gross pay is the employees income before any pension or salary sacrifice deduction.

What Are Gross Wages Definition And Overview

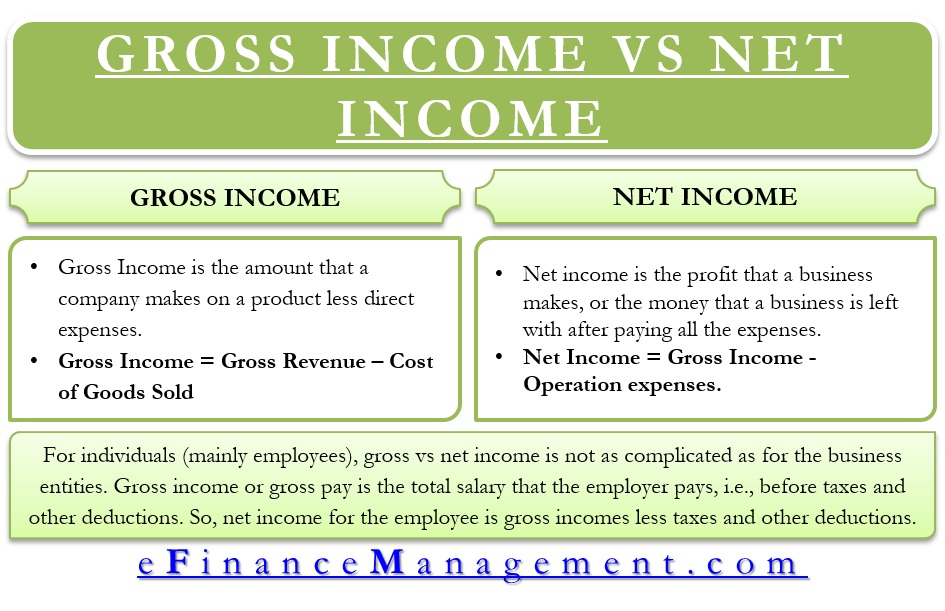

Gross profit is the profit a company makes after deducting the costs associated with making and selling its products or the costs associated with providing its services.

Gross pay of definition. Gross pay Noun An amount of pay wages salary or other compensation before deductions such as for taxes insurance. Current Budget Bonus Budget Bonus Paycheck Paycheck Gross pay. Think of net pay as tossing a.

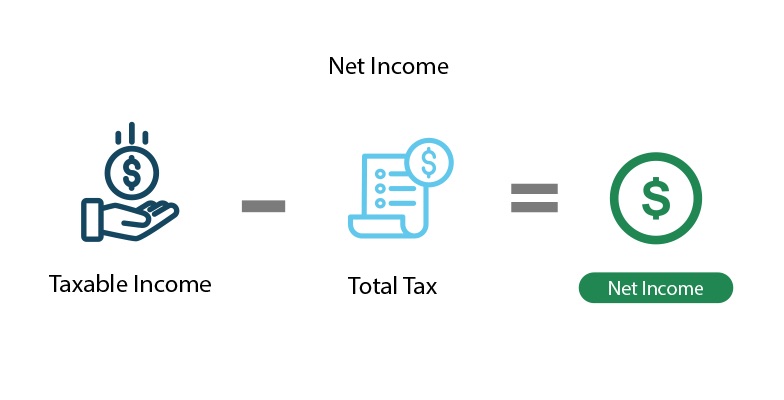

Taxable pay is your gross pay less any contributions you make to a. Calculating Gross Pay for Hourly Employees. Meanwhile net income is the amount left over taxes and health insurance.

Base pay and gross pay may seem to describe the same or similar things. The employees pay before any pension contributions or salary sacrifice deductions are made. Chapter 3 of the Employers Guide to PAYE details the different types of pay that would be included.

It may include salary annual rate wages hourly rate bonuses or reimbursements if any vacation pay holiday pay or commissions. American Heritage Dictionary of the English. What is Gross Pay.

Wiktionary 000 0 votesRate this definition. Gross pay often called gross wages is the total compensation earned by each employee. Gross pay is the employees pay of any kind including.

Some employees gross pay is in the form of a salary. Gross pay Noun A payment for the entire years income. The amount earned depends on the employment status and wage rate set by the employer.

Notice I didnt say it was the total amount paid to each employee. An amount of pay wages salary or other compensation before deductions such as for taxes insurance and retirement. Définitions de gross pay synonymes antonymes dérivés de gross pay dictionnaire analogique de gross pay anglais.

Its often hard to remember which term applies to which pay calculation. It is different from Taxable pay. Gross wages are the full amount an employee earns before taxes and other deductions are withheld from the paycheck.

The earnings base is currently net-gross pay ie. For example if you earn 15 per hour and work eight hours a day. Définitions de gross salary synonymes antonymes dérivés de gross salary dictionnaire analogique de gross salary anglais.

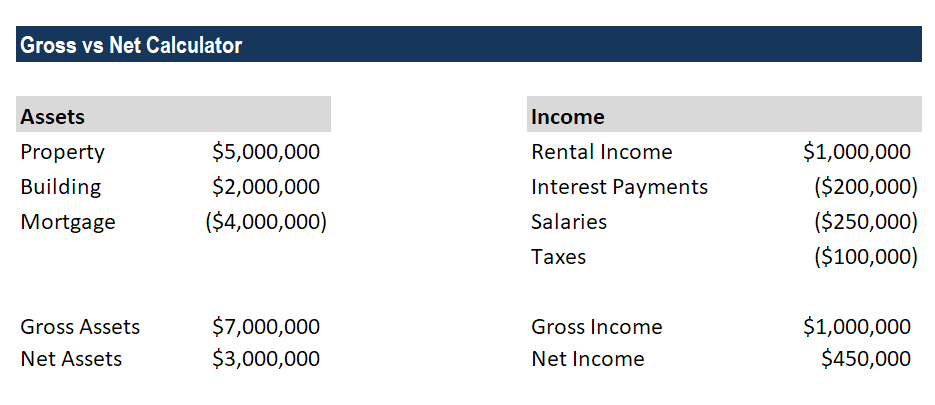

Gross Pay Gross vs. If you are a salaried employee your annual salary is your gross wage. Often salaried employees are paid semimonthly or biweekly.

3 OPTIONS CHART 1 Current Single Bonus Single Bonus Paycheck Paycheck Gross pay 8000 9000 Tax withholdings -2800 -3150 Withholding to cover premium -1000 Net pay 5200 4850 CHART 2. Gross pay is the total amount you earn. Current Double Bonus Double Bonus Paycheck Paycheck Gross pay 8000 9538 Tax withholdings -2800 -3338 Withholding to cover premium -1000 Net pay 5200 5200 CHART 3.

Gross profit will appear. Good-old-europe-networkeu Le salaire de référence qui est actuellement la rémunération brute-nette cest-à-dire la rémunération brute diminuée des cotisations salariales de toutes les années depuis 1988 se rapproche de la durée de. Gross rate of pay means the total amount of money including allowances to which an employee is entitled under his contract of service either for working for a period of time that is for one hour one day one week one month or for such other period as may be stated or implied in his contract of service or for each completed piece or task of work but does not include.

Gross wage less employees contribution in all years since 1988 moving towards the full lifetime. The amount of salary or wages earned by an employee before any deductions or contributions are subtracted from the total earnings. But theres a significant difference between the two.

To get the gross pay at an hourly rate multiply the number of hours worked. Whether its an hourly rate or annual rate the computation depends on the amount that is. Gross pay typically consists wages salaries commissions bonuses and any other type of earnings before taxes.

Gross pay synonyms Gross pay pronunciation Gross pay translation English dictionary definition of Gross pay. Gross income represents wages received which includes the employees base salary and additional earnings and financial bonuses. Definition of Net Pay vs.

Components of Gross Pay. Also known as gross wages or gross income gross pay is an individuals total earnings before subtracting federal income tax Medicare and Social Security. For example if an administrative assistant has an annual gross salary of 48000 per year the persons semimonthly gross pay will be 2000 4800024 pay periods.

Gross Vs Net Income Importance Differences And More Bookkeeping Business Accounting And Finance Finance Investing

Gross Or Net Vocabulary Englishclub

Difference Between Gross Income Vs Net Income Definitions Importance

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Net Income Example Formula Meaning Investinganswers

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Gross Vs Net Learn The Difference Between Gross Vs Net

Gross Salary Vs Net Salary Top 6 Differences With Infographics

The Difference Between Net Pay And Gross Pay A Simple Guide Hourly Inc

The Difference Between Gross And Net Pay Economics Help

Gross Vs Net Learn The Difference Between Gross Vs Net

What Is Payroll Definition And Examples Market Business News

What Is Base Salary Definition And Ways To Determine It Snov Io

What Is Gross Income For A Business

Gross Income Definition Formula Examples

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Salary Net Salary Gross Salary Cost To Company What Is The Difference

:max_bytes(150000):strip_icc()/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Post a Comment for "Gross Pay Of Definition"