Total Annual Gross Income For Credit Card

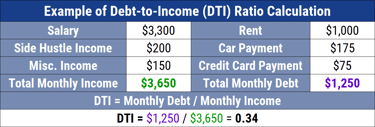

Often it comes down to your debt-to-income ratio or DTI. You Can Include Spouses Income When Applying for a Credit Card.

Say you earn 36000 per year or 3000 per month.

Total annual gross income for credit card. Note that sometimes a credit card issuer will phrase the income question differently. That rule dates back to the Credit CARD Act of 2009. Your gross income is total amount of salary or wages that you are paid by your employer before any deductions for benefits taxes or retirement savings.

Most banks allow you to include income beyond traditional salaries and wages. As long as you dont grossly exaggerate your income. Investment income from stocks and rental properties.

You can also count the amount of income you anticipate you will make from the job. The total income you report on your credit card application can be an important factor in receiving approval and the amount of your credit limit. And their instructions vary widely.

When you apply for the Chase Sapphire Reserve R for example the application asks for your total gross annual income but doesnt specify whether to include household income you can. Total annual gross income credit card application. The card issuer may also consider consumer reports credit scores A card issuer may consider any current or reasonably expected income.

On a credit application youll use the gross figure. If you apply for a Bank of America credit card for example they may ask for your total annual income. How Much Annual Income Do You Need to Be Approved for a Credit Card.

Depending on the issuer you might be asked to list your annual net income your gross income or simply your total. Your gross income is total amount of salary or wages that you are paid by your employer before any deductions for benefits taxes or retirement savings. For millions figuring out what counts as annual income for the sake of a credit card application can be surprisingly murky.

Featured secured credit card. They are trying to figure out how much credit they can give you and reasonably expect to have repaid. If youre at least 21 years old and you have access to the income of a partner or spouse you can list it in your credit card.

Citi applications ask for total annual income and the amount of your monthly rent or mortgage payment. That counts as gross income. Also pay attention to whether the issuer wants gross before taxes or net income.

Store cards in particular are likely to ask for this number. Credit card companies usually prefer to ask for net income because that is what you have available with which to pay your monthly payment. If your credit card application asks for your annual income and youre paid weekly multiply your weekly amount by 52.

Your DTI which is expressed as a percentage measures how. Sure he has some credit card debts and a couple of car loans but he never misses a If your annual income is 60000 the monthly total is 5000. Chase card applications ask for total gross annual income and whether any of it is non-taxable.

Another reason some people underreport their income on credit card applications is that they use their net income instead of their gross income. Heres a guide to the process. Once you do the bank will give you a credit card with a 300 limit.

If your annual salary is 48000 your gross monthly income would be 48000. They dont expect an exact answer down to the dollar or even down to the thousand dollar range. If it asks for monthly income multiply your weekly amount by 52 and then divide by 12.

You can include things like. You have monthly payments on your auto loan 200 student loan 250 and mortgage 800 for a total of 1250. Annual gross income is your income before anything is deducted.

Card issuers avoid using specific definitions of income in their questions to avoid confusion. So how exactly does a card issuer determine whether you earn enough income. Those are gross income as well.

Another reason some people underreport their income on credit card applications is that they use their net income instead of their gross income. An amendment to the CARD Act of 2009 broadened the definition of income for credit card applicants. But most credit card issuers including American Express Citi Discover and Chase instead ask for gross income.

Your gross annual income is the amount you earn before any deductions such as income tax withholding employee benefit costs or retirement plan contributions are deducted from your pay. Most ask for it to be expressed in annual terms so if your gross monthly pay is 2500 multiply that figure by 12 and youll have the annual.

15 Faqs Annual Income On Credit Card Applications 2021

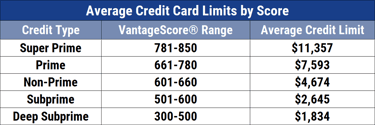

What Credit Limit Will I Get When I Apply For A Credit Card

Advantages Of A Credit Card Discover

Paycheck Tasks Print And Digital Consumer Math Paycheck Task Cards

Credit Card Statistics 2021 65 Facts For Europe Uk And Us

How To Report Income On Your Credit Card Application Nerdwallet

Download Mcc Home Centre App And Get Access To All Premium Tools To Help Plan Yo Mortgage Ca Mortgage Calculator Tools Mortgage Estimator Mortgage Calculator

Pin By Bobettecayeamburyd On Mortgage In 2020 Mortgage Process Home Buying Process Real Estate Tips

15 Faqs Annual Income On Credit Card Applications 2021

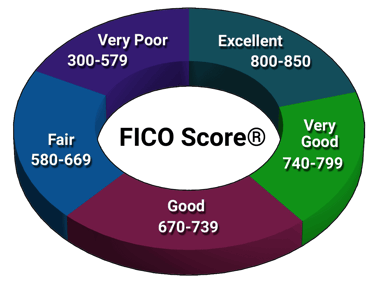

How Your Credit Limit Is Determined

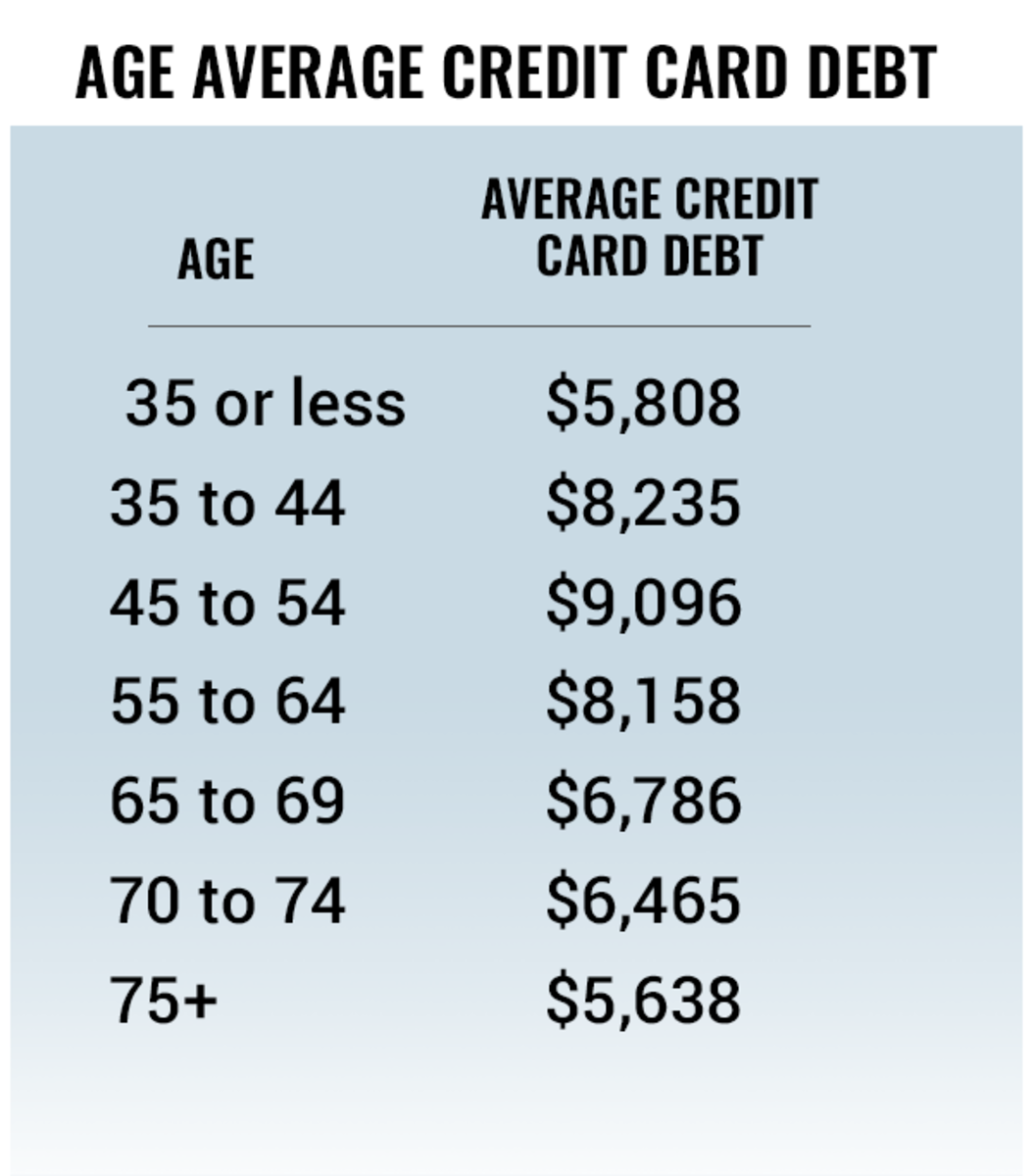

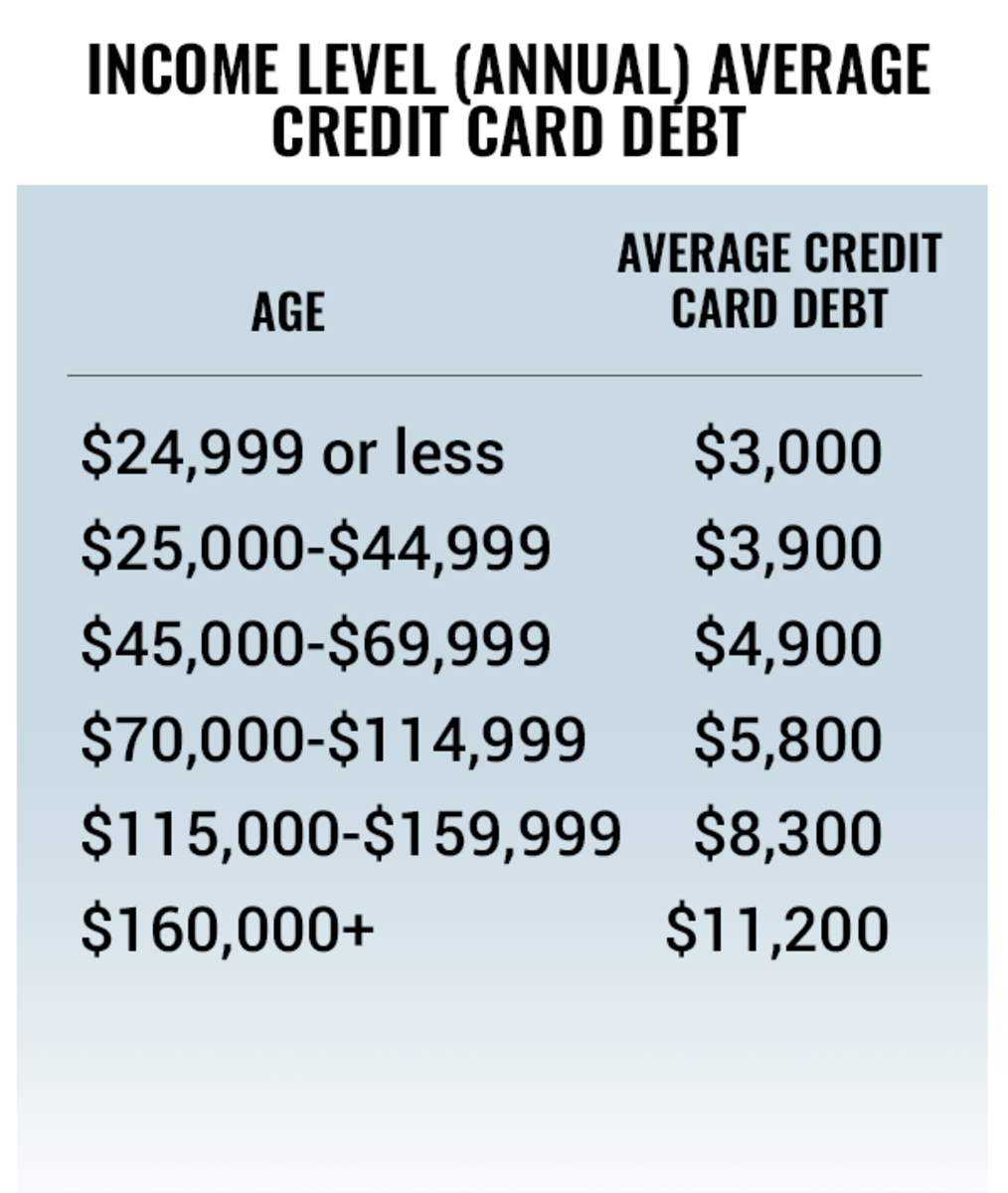

What Is The Average U S Credit Card Debt By Income And Age Thestreet

Credit Card Statistics 2021 65 Facts For Europe Uk And Us

15 Faqs Annual Income On Credit Card Applications 2021

Heraldeecreates Home Making Life Colorful One Page At A Time Credit Card Hacks Good Credit Rewards Credit Cards

What Is The Average U S Credit Card Debt By Income And Age Thestreet

This Credit Card Calculator Will Calculate Your Minimum Monthly Payment Given A Credit Card Balance An Paying Off Credit Cards Credit Card Balance Credit Card

Credit Card Statistics 2021 65 Facts For Europe Uk And Us

Post a Comment for "Total Annual Gross Income For Credit Card"