Monthly Salary Calculator Alberta

Youll then get a breakdown of your total tax liability and take-home pay. 55 billion GST rebates to help who lost income due to COVID-19.

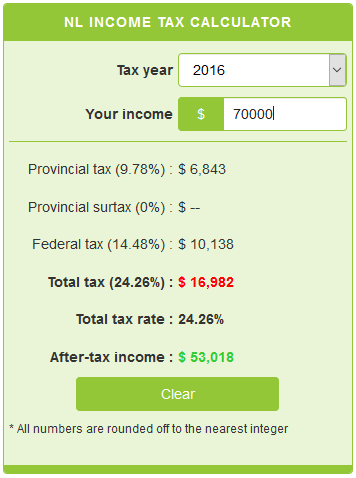

Newfoundland And Labrador Income Tax Calculator Calculatorscanada Ca

Your average tax rate is 222 and your marginal tax rate is 358.

Monthly salary calculator alberta. The Alberta salary comparison calculator is designed to be used online with mobile desktop and tablet devices. Hourly Pay Rate. Before taxes or any other deductions Gross Monthly Pay.

Your average tax rate is 221 and your marginal tax rate is 349. Usage of the Payroll Calculator. That means that your net pay will be 40512 per year or 3376 per month.

Each salary calculator provides detailed tax and payroll deductins to allow visability of how salaries are calculated in each province in Canada in 2021 based on the personal income tax rates and thresholds for 2021. All bi-weekly semi-monthly monthly and quarterly. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11488.

30 8 260 - 25 56400. Relief measures for individuals and businesses by Revenu Québec. The Alberta Income Tax Salary Calculator is updated 202122 tax year.

You can use the Alberta Monthly Salary Calculator to compare upto 5. Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of working days a year. Statutory holidays are included in the 261 as they are paid days for salaried employees.

To get the appropriate amount for your situation you can consult the minimum wage page of Alberta. Now you can go back to the Dues or Strike Calculator you were working on and enter the. Salary Before Tax your total earnings before any taxes have been deducted.

New Brunswick Salary Calculator. The Alberta Monthly Salary Calculator is updated with the latest Alberta personal income tax rates for 2021 and is a good calculator for working out your income tax and salary after tax in Alberta based on Monthly income. The Alberta Salary Calculator uses personal income tax rates from the following tax years 2021 is simply the default year for the Alberta salary calculator please note these income tax tables only include taxable elements allowances and thresholds used in the Canada Alberta Income Tax Calculator if you identify an error in the tax tables or a tax credit threshold that you would like us to add to the tax calculator.

The annual rate to three decimal places is calculated by multiplying the bi-weekly salary by 261. Income Tax calculations and RRSP factoring for 202122 with historical pay figures on average earnings in Canada for each market sector and location. If you make 52000 a year living in the region of Alberta Canada you will be taxed 11566.

Pay Frequency 52 - Weekly 26 - BiWeekly 12 - Monthly 04 - Quarterly 01 - Yearly 24 - Semi-Monthly 22 - 22 Pays a year 13 - 13 Pays a year 10 - Pays a year. Enter your pay rate. British Columbia Salary Calculator.

This marginal tax rate means that your immediate additional income will be taxed at this rate. Also known as Gross Income. Formula for calculating the minimum annual salary Hours per week x 52 weeks per year - Holiday Statutory weeks x hourly wages Annual Salary.

That means that your net pay will be 40434 per year or 3370 per month. Seed Cleaning and Conditioning Plant Manager. You can calculate your Monthly take home pay based of your Monthly gross income and the tax allowances tax credits and tax brackets as defined in the 2021 Tax Tables.

This marginal tax rate means that your immediate additional income will be taxed at this rate. The Canada Monthly Tax Calculator is updated for the 202122 tax year. You can use the calculator to compare your salaries between 2017 2018 2019 and 2020.

Use the simple monthly Canada tax calculator or switch to the advanced Canada monthly tax calculator to review NIS payments and. The calculator is updated with the tax rates of all Canadian provinces and territories. Annual salary without commas average weekly hours Take one of the two calculated amounts from the boxes on the right.

Annual Salary Paid Employees Only whether paid bi-weekly semi-monthly or other Enter annual salary. Simply enter your annual or monthly income into the tax calculator above to find out how taxes in Canada affect your income. Agricultural service contractors farm supervisors and specialized livestock workers.

The 261 factor is based on 261 working days in a calendar year 365 days minus weekends equals 261 working days. The adjusted annual salary can be calculated as. The amount can be hourly daily weekly monthly or even annual earnings.

Current tax rates in Alberta and federal tax rates are listed below and check. Pay Unit Hourly Rate Daily Rate Weekly Rate Monthly Rate Yearly Rate. If you are paid an even sum for each month to convert annual salary into monthly salary divide the annual salary by 24.

Salary calculations include gross annual income tax deductible elements such as Child Care Alimony and include family related tax allowances. This is income tax calculator for Alberta province residents for year 2012-2020. If you are paid in part based on how many days are in each month then divide your annual salary by 365 or 366 on leap years then multiply that number by the number of days in the month to calculate monthly salary.

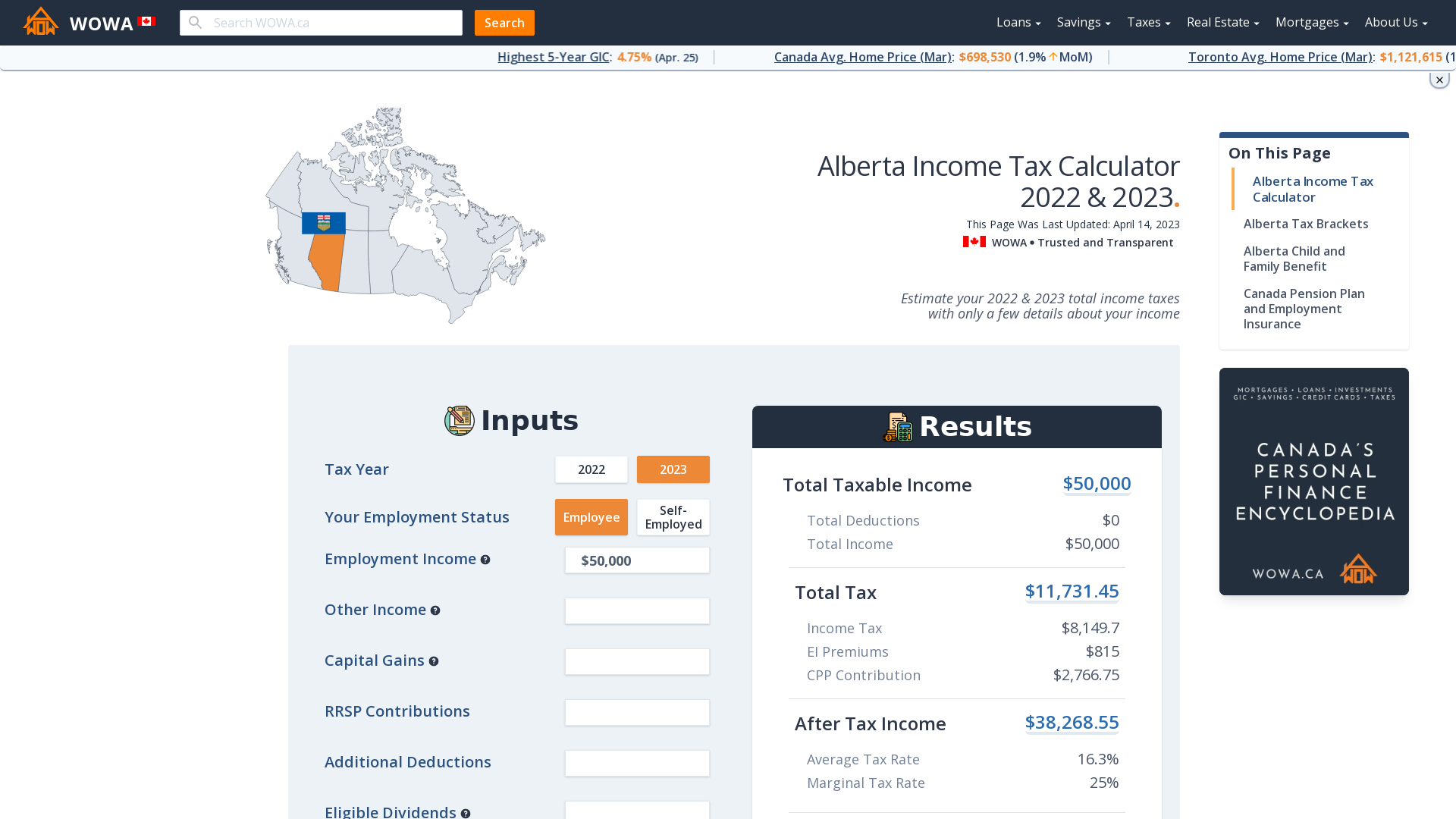

Payroll Calculator Free Employee Payroll Template For Excel

Quebec Income Calculator 2020 2021

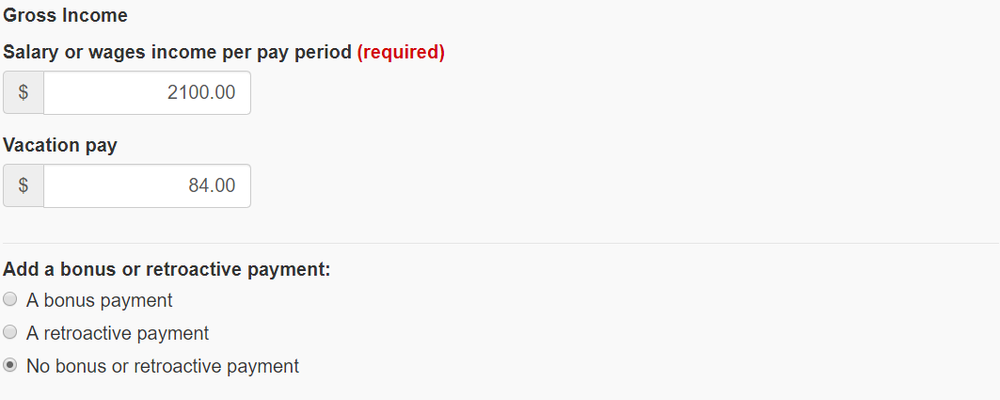

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

Payroll Calculator Free Employee Payroll Template For Excel

How To Calculate Income Tax In Excel

Wedding Photography Pricing Made Simple Package Calculator Wedding Photography Pricing Photography Pricing Photography Marketing

How To Save Money In India Getmoneyrich Com Home Loans Loan Business Loans

What Motor Vehicle Expenses Can You Claim On Income Tax In Canada Income Tax Tax Motor Car

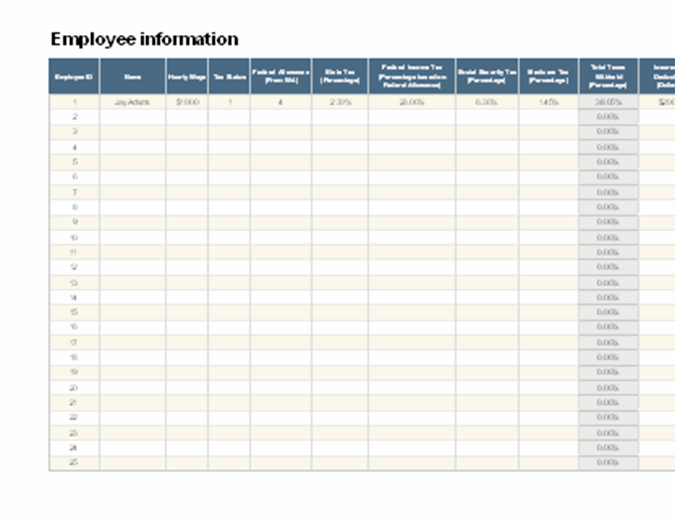

2021 Alberta Province Tax Calculator Canada

Alberta Income Tax Calculator Wowa Ca

Avanti Gross Salary Calculator

Canadian Payroll Tax Deduction Calculator

Extra Payment Mortgage Calculator Making Additional Home Loan Payments Mortgage Payment Calculator Mortgage Mortgag Mortgage Loan Calculator Mortgage Loan Originator Mortgage Amortization Calculator

Payroll Calculator Free Employee Payroll Template For Excel

How To Create An Income Tax Calculator In Excel Youtube

Post a Comment for "Monthly Salary Calculator Alberta"