Check Salary Hmrc

Payments may be withheld or need to be paid back if a claim is found to be fraudulent or based on incorrect information. Select how often you are paid - Monthly 4-Weekly 2-Weekly Daily.

What Your National Insurance Category Letter Means Class 1

If you have any income from a private pension then you can also see this.

Check salary hmrc. Select the tax year within which your payslip date is Remember a tax year runs from 6th April to 5th April. The latest budget information from April 2021 is used to show you exactly what you need to know. Hourly rates weekly pay and bonuses are also catered for.

Two or three years ago one of our clients received an HMRC letter stating that they had underpaid PAYE. Check how much Income Tax you paid last year Once your Income Tax has been calculated you can use this service to check how much you paid from 6 April 2020 to 5 April 2021. Check your online PAYE account to see if the submissions they show agree with the payroll figures submitted and check the payments you have made against the payments they have received.

How To Use. If you think youve been underpaid the minimum wage make a complaint to HMRC about your employer. HMRC will contact you for any further details as needed and if.

Calculate your net salary and find out exactly how much tax and national insurance you should pay to HMRC based on your income. If the contract is silent then the payment is not made by the employer. Check your Income Tax payments for the current year check how much you paid last year 6 April 2020 to 5 April 2021 estimate how much you should have paid.

The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. Check your payroll calculations manually. Use the following information to help you use the calculator.

Student loan pension contributions bonuses company car dividends Scottish tax and many more advanced features available in our tax calculator below. If you have any income from a. Select or Enter the payslip date - we will automatically calculate the pay period.

Why not find your dream salary too. Use these calculators and tax tables to check payroll tax National Insurance contributions and student. In the HMRC app you can see details about your job and salary and how your Income Tax tax-free amount and take-home pay are calculated.

When we spoke to HMRC. Posted 2 years ago by HMRC Admin 4. In the HMRC app you can see details about your job and salary and how your Income Tax tax-free amount and take-home pay are calculated.

If you would like to confirm what PAYE your employees are paying for a particular pay run in the year you can check this using the HMRC PAYE Calculator. In the HMRC app you can see details about your job and salary and how your Income Tax tax-free amount and take-home pay are calculated. Tell HM Revenue and Customs HMRC about changes that affect your tax code update your employer or pension provider details see an estimate of how much tax youll pay over the whole tax year check.

Check an employees PAYE calculation using HMRCs calculator. Calculate your take-home pay given income tax rates national insurance tax-free personal allowances pensions contributions and more. You need to check the employees contract to see what has been written in regarding the benefits and in particular to what it states re the salary sacrifice amount.

If you have any income from a private pension then you can also see this. As we manage their bookkeeping as well we could check if a payment had been missed - nothing was outstanding. HMRC will check claims.

Find out your take-home pay - MSE.

Compare Your Pay To The National Average In Your Job League Table Of Official Uk Salaries Across 400 Trades And Professions Call The Midwife Call The Midwife Seasons Midwife

Pin By Sokrat Noskov On Job Interview Good Luck Job Interview Quotes Job Interview Job Interview Tips

Hmrc Payroll Everything You Need To Know Free Payslip Download

Vat Returns Hmrc Vat Return Rules Rules Accounting Period Return

Check If The Vat Register Number Valid Or Not Company Accounting Services Accounting

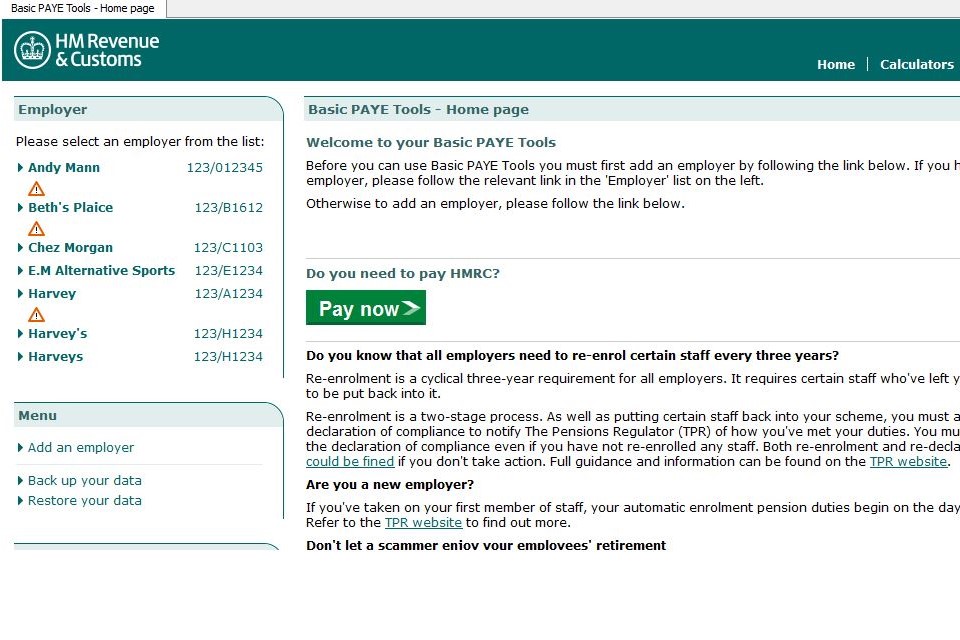

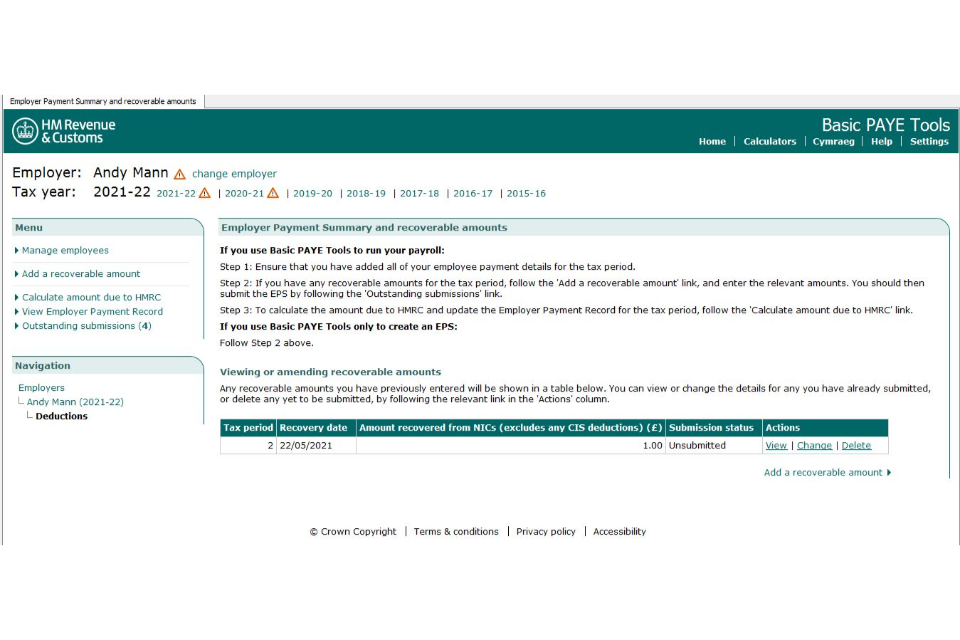

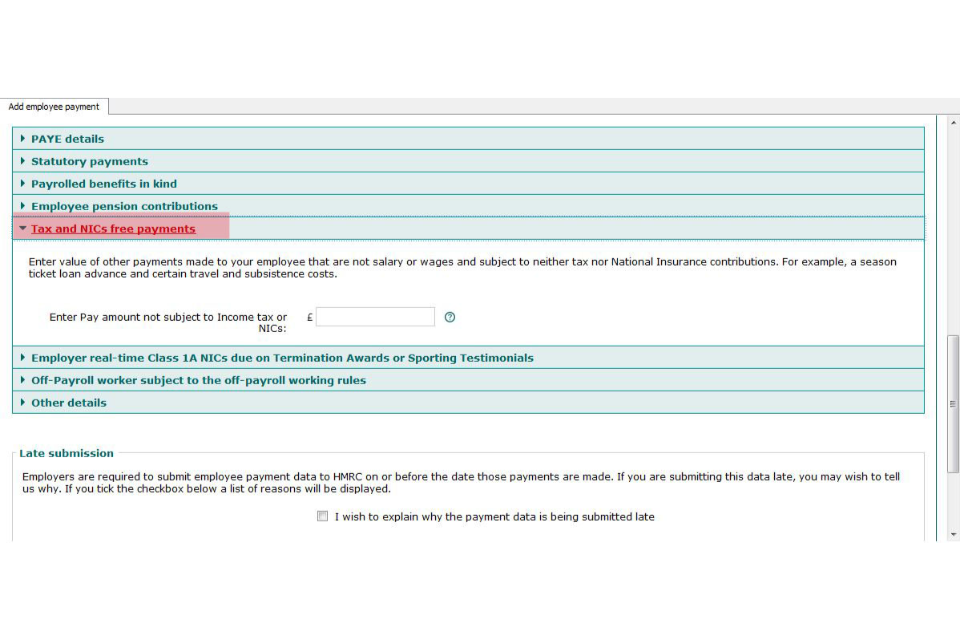

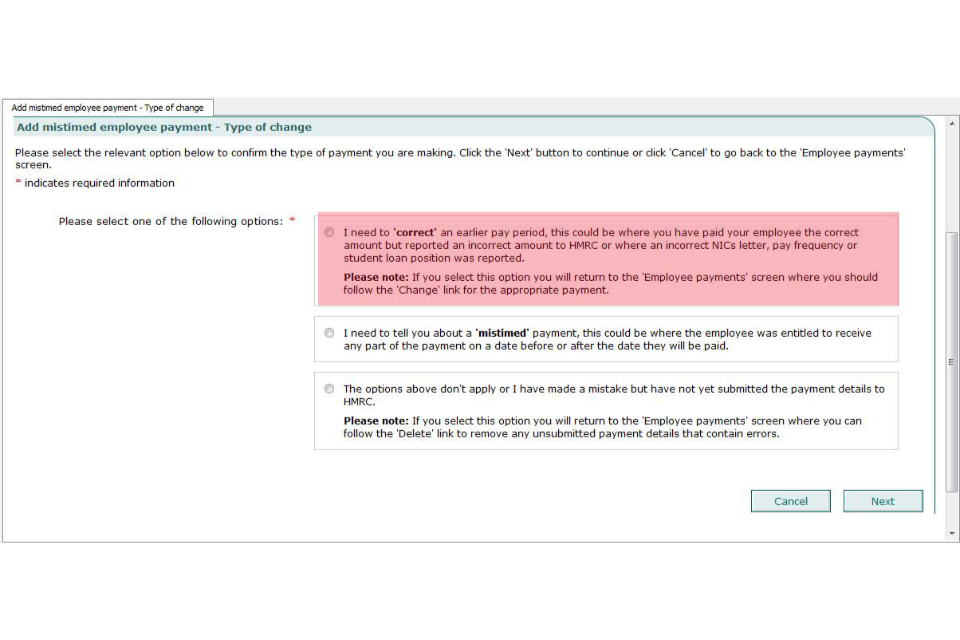

Basic Paye Tools User Guide Gov Uk

Understanding The Difference Between P45 P60 Payslips Online Tax Forms Income Tax National Insurance Number

Check A National Insurance Number Using Basic Paye Tools Gov Uk

Basic Paye Tools User Guide Gov Uk

Basic Paye Tools User Guide Gov Uk

Basic Paye Tools User Guide Gov Uk

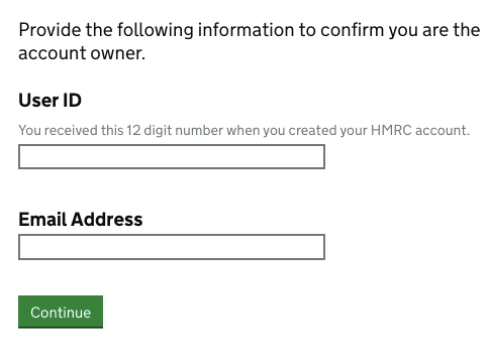

How To Recover Your Hmrc Login Password Taxscouts

Hmrc Derby Community Accountancy Service

Basic Paye Tools User Guide Gov Uk

How To File Your Uk Taxes When You Live Abroad Expatica

Calculators Calculators National Insurance Tax

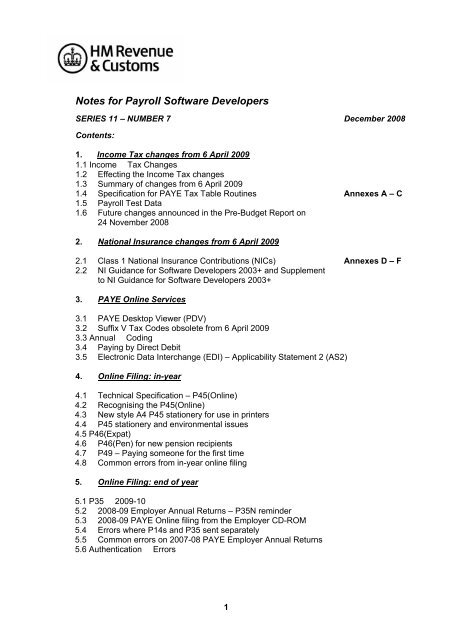

Hmrc Notes For Payroll Software Developers Hm Revenue

Post a Comment for "Check Salary Hmrc"