Total Annual Income On W2

Now subtract deductions from your annual income 100000 16000 the value 84000 will be your adjusted gross income. For example if you are self-employed.

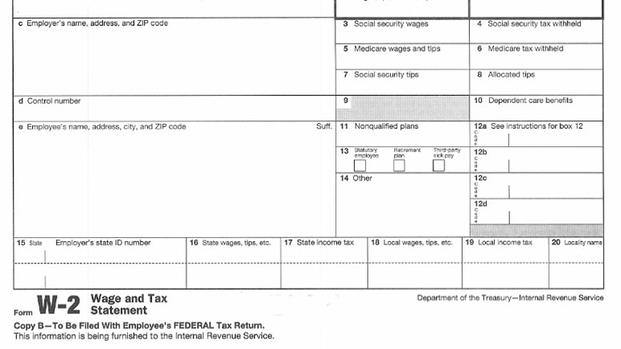

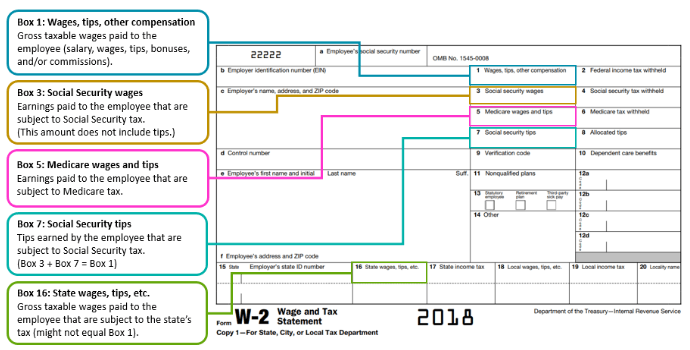

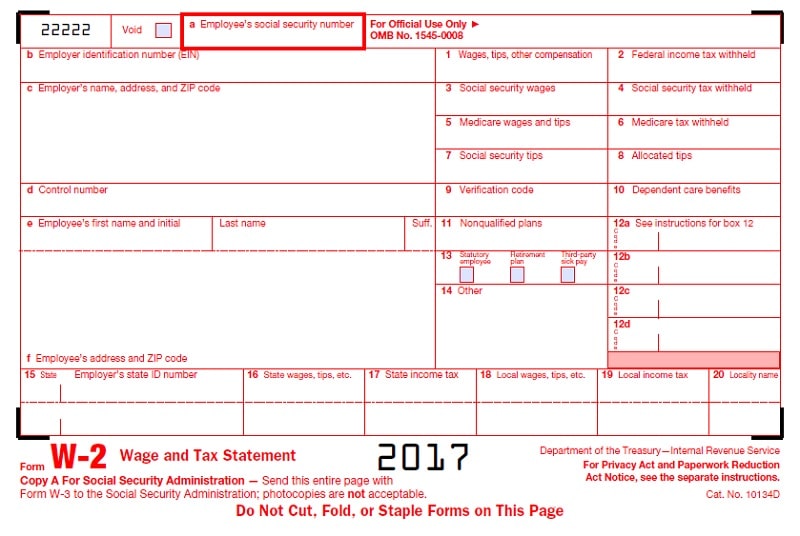

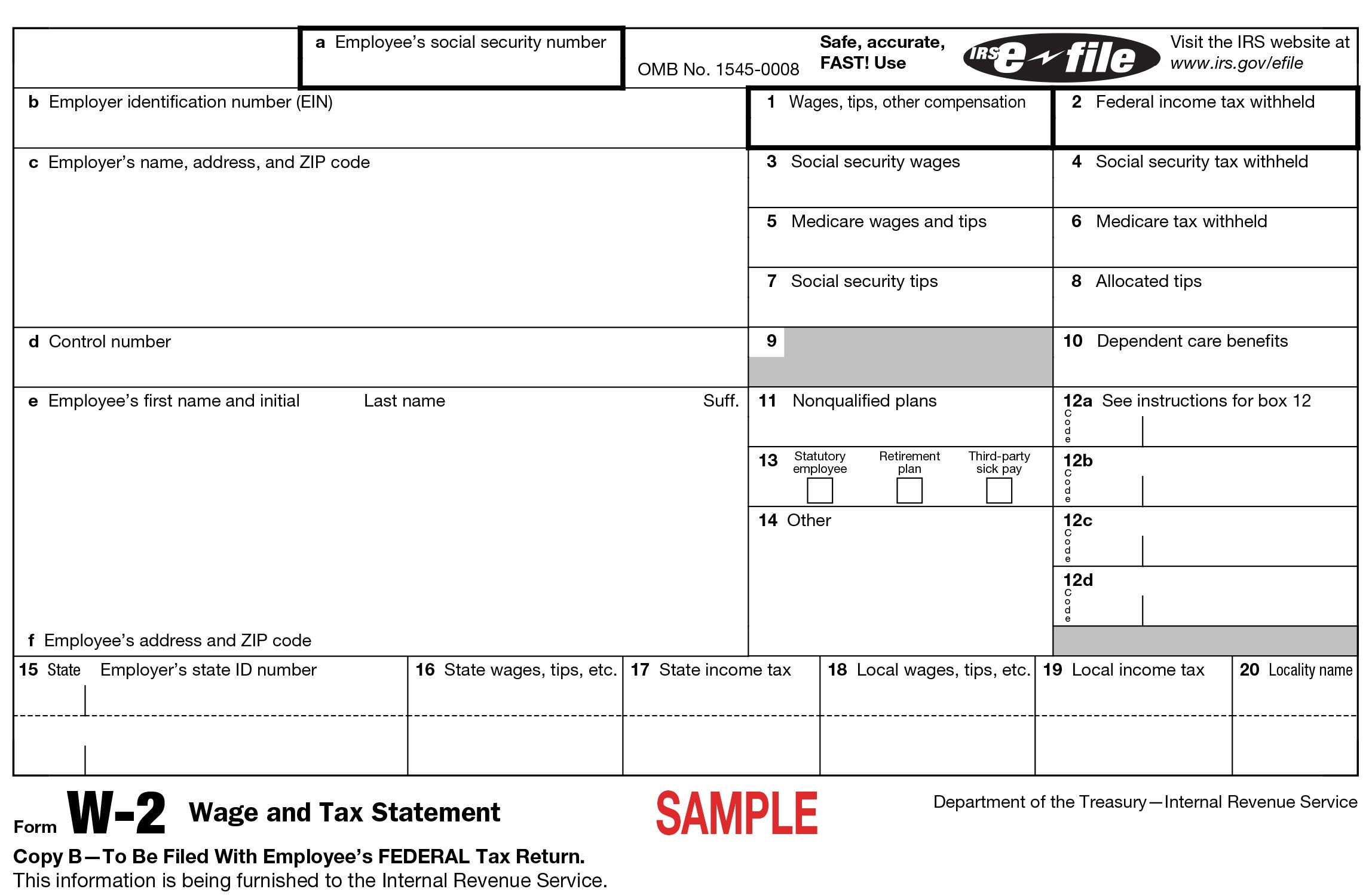

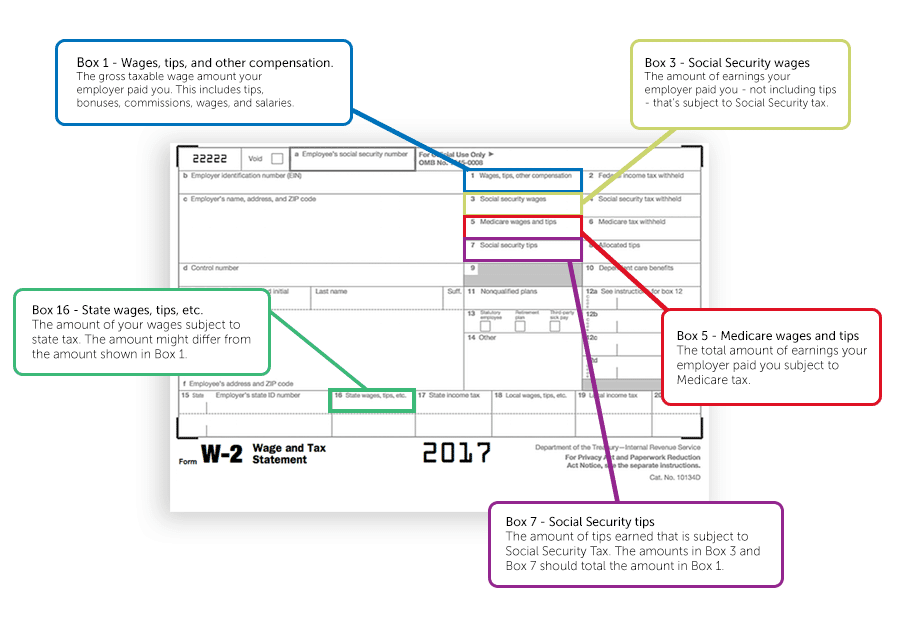

Form W 2 Explained William Mary

However you can easily figure out your annual salary from your W-2.

Total annual income on w2. How Much Annual Income Do You Need to Be Approved for a Credit Card. How to calculate adjusted gross income from w2. Every employer who pays at least 600 in cash or cash equivalent including taxable benefits to an employee must issue a form W-2.

Or if your employer withheld income Social Security or Medicare tax from your paycheck it is required to file a Form W-2 even if they paid you less than 600 during the tax year. If your take-home pay is 600 per week after taxes retirement contributions and premiums for health insurance are taken out for example your estimated annual net. For example if you earn 12 per hour and work 35 hours per week for 50 weeks each year your gross annual income would be 21000 12 x 35 x 50.

If your w 2 shows that your taxable wages earned are 61 000 and there is an additional 1 000 in investment income and 500 in taxable interest then your total taxable income is 61 000 plus 1 000 plus 500 which adds up to 61 500. This means your adjusted gross income is 43000. Your w 2 would show 56 500.

Your W-2 gives a lot of information but the most important is that it shows your total income and your salary as taxable wages. Income for Social Security purposes includes payroll deductions but Social Security taxes only apply to the first 128400 of gross earnings for tax year 2018. All income that cannot be entered directly on Form 1040 W2 income goes on Schedule 1.

A Form W-2 includes an employees wages and tax deductions for a specific calendar year--January 1 through December 31. If an employer pays you as an employee at least 600 in compensation cash or another type for the year it is required to file a Form W-2 on your behalf. Total taxes paid for the year were 10000.

Therefore for low wage earners. For instance say your gross income is 45000 but you have 2000 worth of deductions for the year. When you calculate this number take out any pretax deductions from an employees pay because they do not count as income for federal income taxes.

By contrast an employee who is paid 25 per hour is paid 2000 every two weeks only if they actually work 8 hours per day 5 days per week 25 x 8 x 5 x 2. You also file a Schedule C to fully report your business income. If you want to find out your adjusted gross income but you have not received the W-2 form do not worry.

Click to explore further. Sues gross annual income for the year was 60000. Your annual income as reported on your Form W-2 is called Taxable Gross Income Your income will be less than your salary if you have pre-tax deductions for a 403b or other deferred compensation plan or if you have pre-tax deductions for your elected benefits such as health and dental insurance.

Line 3 of Schedule 1 is where you enter your business income or loss. If you have pretax deductions or nontaxable wages. How do I find my adjusted gross income without a W-2.

Her federal taxes paid for the year were 6000 her state taxes were 1000 and Social Security Medicare and local taxes from her W-2 statement for the year totaled 3000. This includes any 1099 income as an independent contractor or your net income as a sole proprietor. It is easy to lose track of your total annual earnings if you have more than one job.

Why is my gross income less on my w2. If youre paid hourly multiply your wage by the number of hours you work each week and the number of weeks you work each year. Your adjusted gross income is your gross income on your W2 minus your major deductions for the year.

Sues actual net annual income. Similarly where do I find my annual income on my w2. Part I of Schedule 1 deals with Additional Income.

Sue wants to know what her actual net annual income was for 2009. The individuals gross income every two weeks would be 1923 or 50000 divided by 26 pay periods. The magic number is 600.

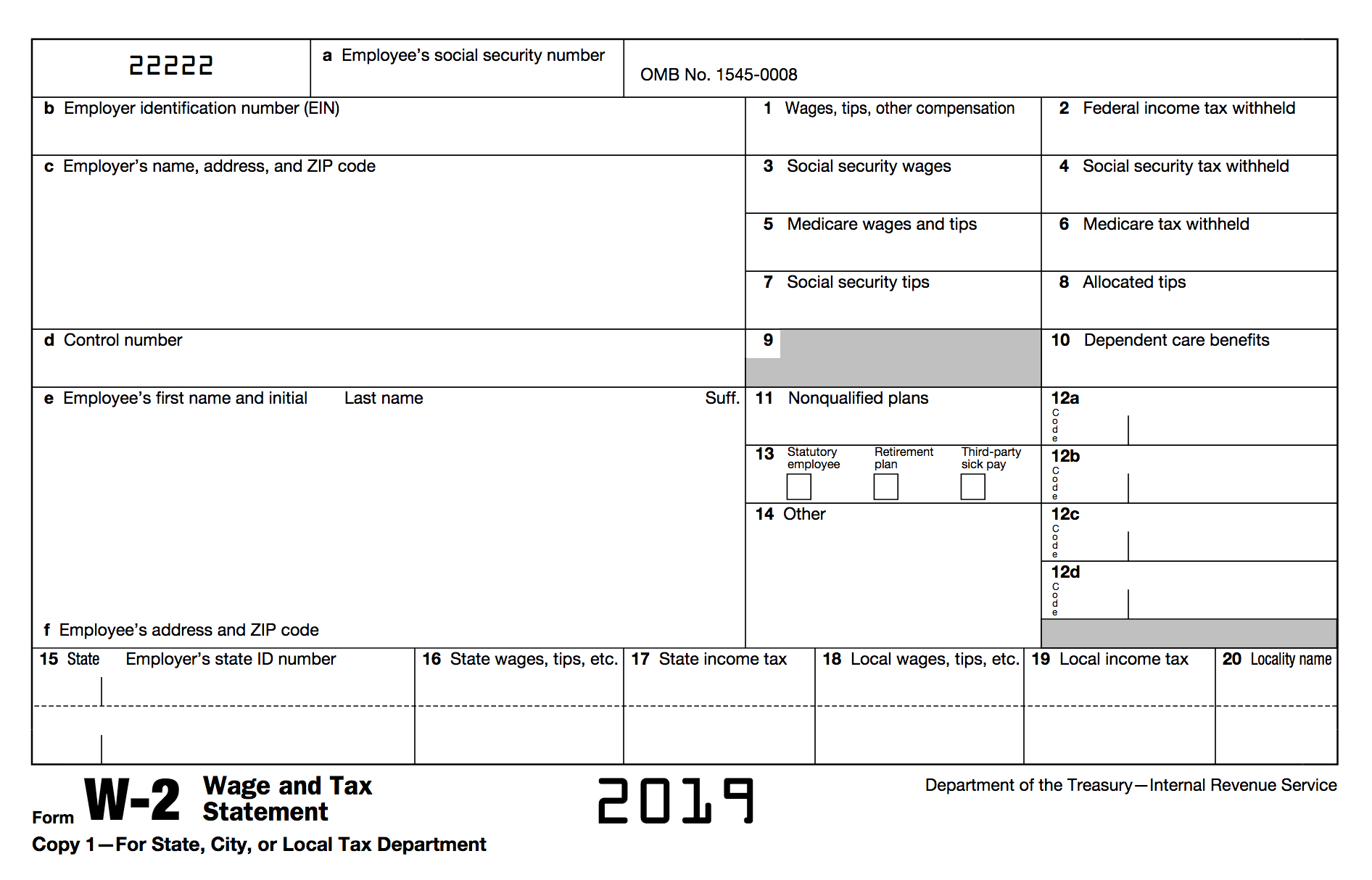

This decreases your taxable income which can have an impact on your tax bracket. W-2 Wages for Income Taxes In box 1 of the Form W-2 your company reports the total taxable wages of the employee for IRS record keeping. Because Sue completed her own tax return she has the information readily available.

Your total deductions will be 300700100005000 16000.

How To Read Your Military W 2 Military Com

Why Is My Final Pay Stub Different From My W 2

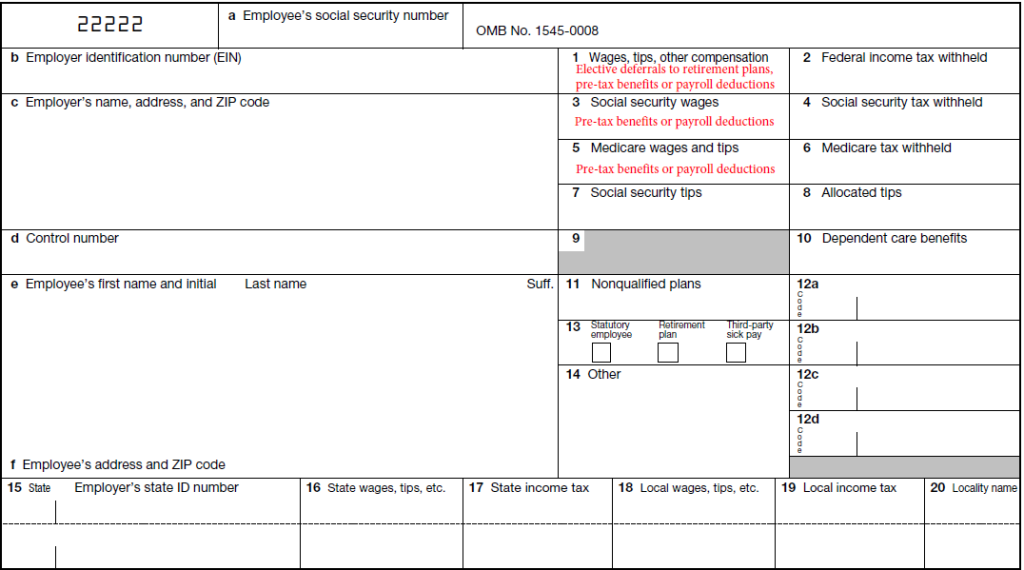

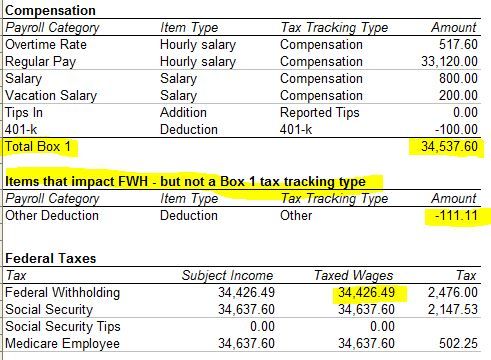

W 2 Box 1 Wages Vs Final Pay Stub Asap Help Center

Get Educated Learn How To Read Your W 2

How To Report And Tax Google Adsense Income

So You Have Stock Compensation And Your Form W 2 Just Arrived Now What The Mystockoptions Blog

How To Calculate Agi Adjusted Gross Income Using W 2 Exceldatapro

So You Have Stock Compensation And Your Form W 2 Just Arrived Now What The Mystockoptions Blog

W 2 Box 1 Wages Vs Final Pay Stub Asap Help Center

How To Read Your W 2 University Of Colorado

What Is Form W 2 An Employer S Guide To The W 2 Tax Form Gusto

What Is Form W 2 An Employer S Guide To The W 2 Tax Form Gusto

Understanding Your W 2 Controller S Office

W 2 Box 1 Wages Vs Final Pay Stub Asap Help Center

Gross Wage Calculation Defined Contribution Plan Auditor

Solved W2 Box 1 Not Calculating Correctly

W 2 And W 4 A Simple Breakdown Bench Accounting

W 2 Vs Last Pay Stub What S The Difference Aps Payroll

Post a Comment for "Total Annual Income On W2"