Net Salary Uk Meaning

Be on a salary of sth He must be on a salary. Net Pay Details Net Pay take-home pay.

Gross Vs Net Income Importance Differences And More Bookkeeping Business Accounting And Finance Finance Investing

This is your take-home salary which you will actually see come into your bank account.

Net salary uk meaning. The 20162017 net salary tax calculator page. Salary After Tax the money you take home after all taxes and contributions have been deducted. Net Salary Gross Salary less Income Tax less Public Provident Fund less Professional Tax.

872 if over 25 820 21-24 years old 645 18-20 years old 455 for under 18 years old and 415 for apprentice. Additional deductions might include retirement contributions. A persons salary after taxes insurance etc.

This is in contrast to the term Gross Salary which is the total. Also known as Net Income. Why not find your dream salary too.

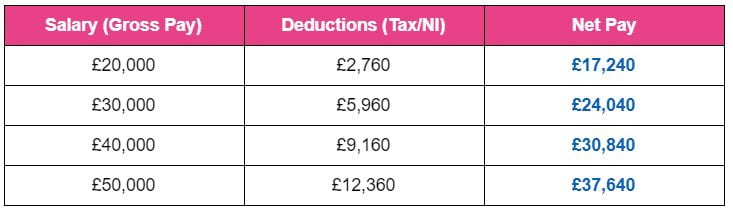

The total amount of money that an employee is paid every year to do their job or one of the payments they receive each month as part of this. The money left over is your net salary. For instance if you normally earn 1200 while 350 is taken as deductions then your gross pay will be 1200 and the net pay will be 850.

The gap between your gross pay and net pay is the deductions. The difference between gross and net salary is the money deducted in between - a proportion of your wage. Also known as Gross Income.

This is the difference between total Pay and Allowance minus total of Deductions. On the other hand your net salary is what you take home after all contributions and taxes are deducted from your gross salary. The residual amount is then paid to the employee in cash.

Net income is the amount left once relevant deductions have been made such as tax and health insurance. Wages are hourly or daily payments for work done during the working day. Tax you owe will be collected by your pension provider normally a pension scheme or annuity firm and forwarded to HMRC.

The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. In the UK these deductions include tax contributions and national insurance contributions. Net Salary is the actual take away home salary that an employee gets in its bank account.

The deductions that can be taken from gross pay to arrive at net salary include but are not limited to the following. The latest budget information from April 2021 is used to show you exactly what you need to know. Net salary is the amount of take-home pay remaining after all withholdings and deductions have been removed from a persons salary.

Net salary define as the amount that is paid by an employer to his workforce against the services they perform for him or her. Hourly rates weekly pay and bonuses are also catered for. Please note where a net salary has been agreed the employer will be covering the employees.

It can be. Gross Salary is the income that an employee gets in the form of CTC before considering retirement benefits eg 401 k benefits Income Tax deduction. The meaning of Net Salary is the amount that is left over from an employees salary once specific deductions have been made.

Net Salary is the amount of the employees salary after deducting tax provident fund and other such deductions from the gross salary which is generally known as Take home salary. Gross income is a strong indicator of the rewards offered for a certain role but the term only applies to financial benefits. Although net salary is lower than the gross salary.

Its equivalent to gross pay minus all mandatory deductions. Its a fixed amount payable at regular intervals it can be weekly or monthly payments straight to an employees bank account. The 20202021 UK minimum wage National Living Wage per hour is currently.

Read more here about Gross vs Net. Want to find out how your salary compares to the median income in London and in other parts of the UK. Your pension provider will also deduct any tax you owe on your state pension.

The money you receive is paid net meaning after tax has been deducted. The 20202021 UK Real Living Wage is currently 1075 in London and 930 elsewhere. Net salary or more commonly referred to as take-home salary is the income that an employee actually takes home after tax provident fund and other such deductions are subtracted from it.

Enter the gross wage per week or per month and you will see the net wage per week per month and per annum appear. An annuala monthly salary Her annual salary exceeds 100000. What is Net Salary.

The main difference between salary and hourly wage is that salaries are a fixed upon payment agreed to by both the employer and employee. Net Salary is usually lower than gross salary. Use the calculator to work out what your employee will take home from a gross wage agreement.

Salary Before Tax your total earnings before any taxes have been deducted.

How To Calculate Net Income 12 Steps With Pictures Wikihow

Clarion Technologies Is Hiring For Dot Net Mvc Developer Profound Edutech Edutech Software Testing Object Oriented Programming

The Difference Between Net Pay And Gross Pay A Simple Guide Hourly Inc

Tax Accountants In London Define Meaning Of Money Saving And Its Benefits Tax Accountant Tax Services Payroll

Gross Net Salary The Urssaf Converter

Net Household Savings Rate In Selected Countries 2019 Saving Rates Savings Household

Base Salary Explained A Guide To Understand Your Pay Packet N26

20 000 After Tax 2021 Income Tax Uk

Understanding The Difference Between P45 P60 Payslips Online Tax Forms Income Tax National Insurance Number

The Difference Between Gross And Net Pay Economics Help

How To Calculate Net Income 12 Steps With Pictures Wikihow

Base Salary Explained A Guide To Understand Your Pay Packet N26

What Is The Difference Between Gross And Net Salary Nannytax

Base Salary Explained A Guide To Understand Your Pay Packet N26

Happy Idioms English Vocabulary Learn English Vocabulary English Language Teaching

How To Calculate Net Income 12 Steps With Pictures Wikihow

How To Calculate Ebitda Finance Lessons Cost Of Goods Sold Finance

Post a Comment for "Net Salary Uk Meaning"