Ca Salary Basis Test

The salary of a Chartered Accountant in India depends on hisher skills capabilities and experience. Exemption employees generally must meet certain tests regarding their job duties and be paid on a salary basis at not less than 684 per week.

Salary Of A Chartered Accountant In India Updated 2021

The Safay Basis Test The salary basis test is set forth in Labor Code 515a and the applicable wage order.

Ca salary basis test. This salary basis will increase with each increase in the California state minimum wage. Salary basis test. The employee must be paid a predetermined and fixed salary that is not subject to reduction because of variations in the quality or quantity of work performed.

The average salary of Chartered Accountants in India ranges from 6-7 lakhs to 30 lakhs. This forms the two-part test the employees must meet to be exempt. Duties Test In California the duties test is interpreted to mean that the employee must be performing exempt level work more than 50 of the.

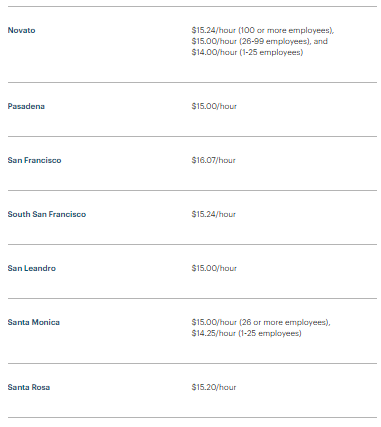

These salary rates will increase beginning January 1 2020. The minimum wage and overtime pay requirements under the FLSA may not apply to salaried employees. To qualify for exemption employees generally must meet certain tests regarding their job duties and be paid on a salary basis at not less than 684 per week.

The salary basis test consists of stipulations that may exempt an employee from being eligible for overtime pay. However salaried employees can still have their pay expressed in hourly terms which is helpful for an employer trying to keep track of hours. Job titles do not determine exempt status.

In other words an employee is paid a guaranteed amount of money to perform designated work by an employer. These exemptions relieve employers from paying overtime to certain employees based on regularly. To qualify as an exempt employee California requires that an employee must be primarily engaged in the duties that meet the test of the exemption and earns a monthly salary equivalent to no less than two times the state minimum wage for full-time employment Labor Code section 515.

Professionals that get paid on an hourly basis and not with a minimum salary typically are not exempt employees. Chartered accountant salary - In India CA salary ranges from 6 lakh - 75 lakh annum. Violating the salary basis by making an improper deduction from an exempt employees pay could potentially invalidate the exemption.

Therefore on July 1 2014 in order to qualify for a white collar exemption the employee must receive an annual salary of at least 37440 and as of January 1 2016 the threshold annual salary increases to at least 41600. The first of the salary exempt tests is the salary basis test which considers exactly how an employee is paid. Department of Labor provides the guidelines in determining exemption from the FLSA based on salary.

What are white collar exemptions. If an employee has a guaranteed minimum amount of money received every workweek they are salaried. In the campus placement conducted by ICAI.

This means their salary cannot go up or down based on the quality or quantity of their work. To qualify for the exemption one must be paid a salary. With very limited exceptions the employer must pay employees their full salary in any week they perform work regardless of the quality or quantity of the work.

Exemptions from the overtime laws. In order for an exemption to apply an employees specific job duties and salary must meet all the requirements of the Departments regulations. If this threshold has been passed the next step is to assess the duties of the position in order to see if they qualify as a white collar exemption.

To meet the salary test an employee must be paid a monthly salary that is at least twice the state minimum wage for full-time employment12 Full-time employment for these purposes is defined as 40 hours per week. Administrative professional and executive exemptions require workers. In order for an exemption to apply an employees specific job duties and salary must meet all the requirements of the Departments regulations.

DOL proposal to increase the salary for required to meet the salary basis test. International packages are even higher ranging up to 75 lakhs. To qualify for exemption employees generally must be paid at least 455 per week on a salary basis.

Salary-based pay cannot be reduced based on the. If an employee is not paid correctly according to the salary basis they cannot be considered an exempt employee. California law has a minimum salary test that employees must meet before they can be classified as exempt from wage and hour laws overtime breaks lunches along with a duties test.

Makes one at a specific salary level. Sections 3 through 12 of the Orders 3 through 11 for Order 16-2001 do not apply. 1 the salary basis test and 2 the duties test.

Exempt from Orders under Professional employee classification Employees directly employed by the State or any political subdivision thereof including any city county or special district. Effective January 1 2020 employers must pay employees a salary of at least 684 per week. This baseline salary isnt necessarily the only form of compensation they may receive but it does indicate the minimum total.

Check the starting salary of CA based on skills experience profile. The FLSAs minimum salary requirement is set to remain the same in 2021. These salary requirements do not apply to outside sales.

In particular Wage Order 4 Section lAlf provides that in order for an employee to meet the salary basis test portion of the exemption. The salary test means that a worker is only a professional if heshe. The salary basis test is a series of stipulations that may exempt an employee from being eligible for overtime pay.

Last years stats show that the average salary of CAs in India was offered around 736 lakhs pa. The salary basis test says the employee must be paid a predetermined fixed salary. Here is some information on the new rates so you can prepare for 2020.

The FLSA salary basis test is applicable only to reductions in monetary amounts. For purposes of this statute a salary is a fixed amount of money that. Job titles do not determine exempt status.

Makes a salary and.

Exempt Vs Non Exempt In California 2021 Perspectives Employers Group

The Us Department Of Labor Sets Forth New Guidance Regarding The Classification Of Independent Contractors Under The Fair Labor Standards Act California Public Agency Labor Employment Blog

Chartered Accountant Or Ca Salary In India Monthly Salaries In 2020

Average Ca Salary In India 2021 How Much A Ca Earns

Https Www Dir Ca Gov Dlse Opinions 2002 05 06 Pdf

What S The Average Package For Ca Quora

California S 2021 Minimum Wage Increase To Impact Exempt And Nonexempt Employees Lexology

California Salary Laws And When Must A Company Pay You By The Hour

Chartered Accountant Or Ca Salary In India Ca Annual Salary In 2021

Ca Salary 2021 Freshers Professionals Toppers Placement Stats

What S The Average Package For Ca Quora

Salary Of A Chartered Accountant In India Updated 2021

Updated 2020 21 Ca Salary In India Monthly Yearly And Per Annum

Average Ca Salary In India 2021 How Much A Ca Earns

Salary Of A Chartered Accountant In India Updated 2021

Exempt And Nonexempt Employees California Chamber Of Commerce

California S 2021 Minimum Wage Increase To Impact Exempt And Nonexempt Employees Lexology

Chartered Accountant Or Ca Salary In India Monthly Salaries In 2020

California Salary Laws And When Must A Company Pay You By The Hour

Post a Comment for "Ca Salary Basis Test"