Basic Salary Gratuity Calculation In Excel

Can any send me a format in excel for gratuity calculation as per UAE with IF conditions. 1 Year Gratuity amount equal to 15 days monthly Basic Salary means.

Take Home Salary Calculator India Excel Updated For Fy 2020 21 With New Tax Slabs Option

Of years of service 30.

Basic salary gratuity calculation in excel. If some one worked 6 years and his last Basic is 5000 at the time of his exit you simple calculate like this 500026 you will get per day amount. Gratuity calculation formulanumber of completed years of service. BASIC WAGE x 1 x NUMBER OF YEARS WORKED The basic wage used for the calculation shall be the basic wage the employee last received.

Gratuity Formula in Excel. Gratuity calculation formula for those who are covered. Download Form 16 in Excel format for Ay 2021-22.

Notification Center-COMPLETE INDIA PAYROLL MANAGEMENT GUIDE Part 1 httpsyoutubeNJfPOuEkMIADownload Excel Salary Template - httpsdrivegooglec. Second is for people who are not covered under payment of gratuity act. Of years of service 30.

After 5 years 30 days basic salary x number of years served. Thus the gratuity formula to calculate the gratuity amount is. Through the gratuity calculator uae you can calculate your end service benefit wether you are although our end of service calculator uae will calculate an exact amount for your gratuity here is the gratuity calculation formula for limited contract.

Of years of service 30. Usually it is 40 or 50 of the basic salary. How to calculate PF if basic wage is more than 15000 Rs.

So what is the gratuity calculation formula it is a simple formula so it is 15 by 26 multiplied by the total amount of your basic DA and commission into multiply by a total number of years of service plus excess of six months to be considered as a completed year for example. Rules is if the employee has completed between 1 - 2 years of service he is entitled to 7 days of Basic salary If the employee has completed between 2 - 4 years of service he is entitled to 14 days of Basic salary If. Basic Gross Pay X Percentage.

The deduction will be Income tax and provident fund under which the net salary comes around 552400. 1st year 7 days salary of basic. 1526 x Last Drawn Wages x Number of completed years of service or in part thereof exceeding 6 months.

In 3. Gratuity Rule is Last Basic26Days X 15 Days X Number of working years. If the employee basic salary is 4000 and Dearness Allowance is 3000 then complete formula for gratuity will be 7000 1526 5 Hope its clear to all 21st March 2013 From India Buldana.

Then the gratuity formula is as follows. 3rd year 21 days basic salary. 3rd to 5 years 21 days basic salary x number of years upto 5.

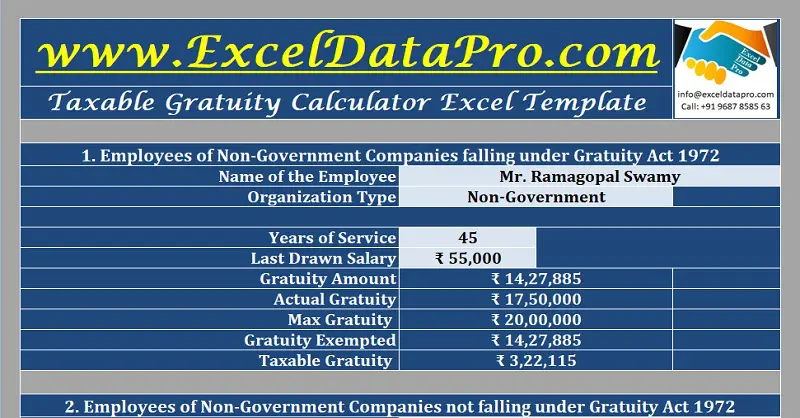

Basic Gross Pay DA HRA Conveyance Medical Other. First is for people who are covered under payment of gratuity act. Every employer needs to pay 13 of the employees basic salary towards the EPF account of the employee and 325 of the employees gross salary as ESIC contribution if applicable.

The amount is also dependent upon the number of years served in the company and the last drawn salary. Otherwise if your contract mentions the percentage you can do that directly using the following formula. I want to write small code in excel vb editor to calculate gratuity amount.

The Rule is as follows. We used this formula in the example of Manoj. Dear Expert Can you assist me in creating a formula for our gratuity.

In 1. Salary Calculation in Excel in Tamil How to Calculate Basic Salary Details Tax Related AllTax Related All. In year5- Basic Salary x 21 days x No.

Article 39 also says that a Gratuity shall not be paid if the duration of continuous employment is less than 1 year. It uses the following formula to calculate the basic salary IF H40 ROUND J4E4H450 -1. To calculate the take-home amount you can use the Salary Sheet Excel Template.

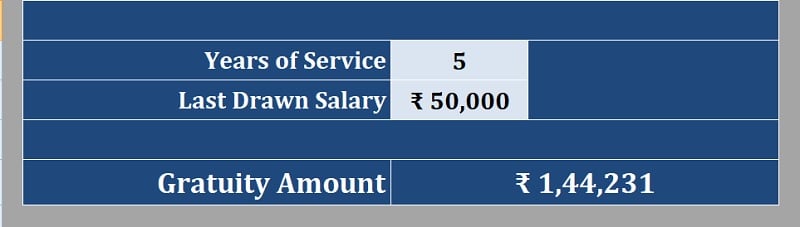

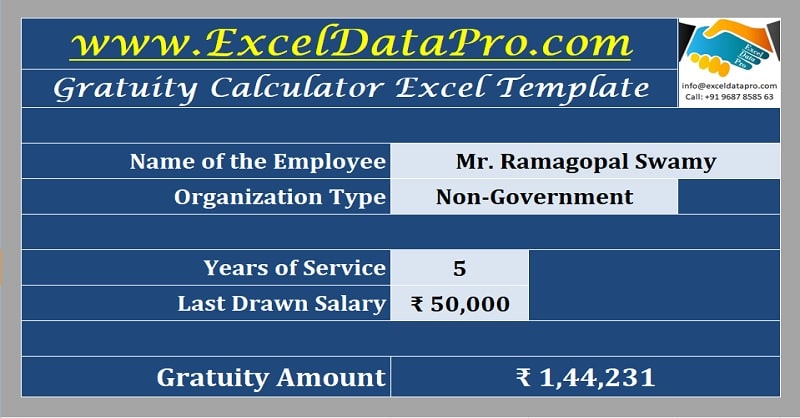

Gratuity Calculation Formulas Last Drawn Monthly Salary 26 x 15 x Number of years of service completed. There are two gratuity calculation formula. Basic Salary is proportionate to the working days.

Net Salary 552400 Here the basic salary will be calculated as per follows Basic Salary Dearness Allowance HRA Allowance conveyance allowance entertainment allowance medical insurance here the gross salary 660000. 2nd year 14 days basic salary. Next comes the allowances section.

Download salary slip format in Excel and PDF. Total Gratuity Last Drawn Monthly Salary 1526 Number of years served in a company For instance if you started to work in a company in 2013 and resigned your job in 2018.

Download Gratuity Calculator India Excel Template Exceldatapro

How To Calculate Pf On Salary In Excel

Download Gratuity Calculator India Excel Template Exceldatapro

Gratuity Calculator How To Calculate Gratuity India

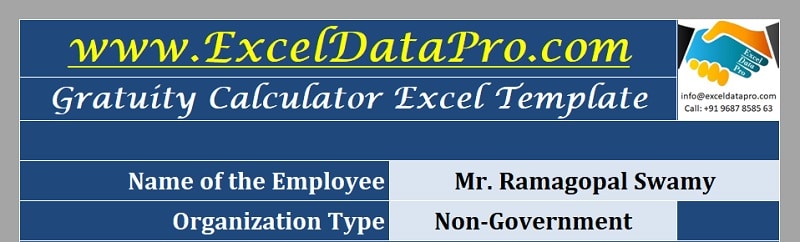

Download Taxable Gratuity Calculator Excel Template Exceldatapro

Gratuity Settlement Calculation Youtube

Excel Formula Calculate Retirement Date Exceljet

Download Salary Sheet Excel Template Exceldatapro

Calculate Taxable Gratuity By Using New Excel Formulas Youtube

Pf Esi Calculation Excel Format 2021 Download

Download Gratuity Calculator India Excel Template Exceldatapro

Arrears Relief Calculator U S 89 1 Tdstaxindia Net

Download Employee Turnover Cost Calculator Excel Template Exceldatapro Employee Turnover Payroll Template Turnovers

307 How To Calculate Gratuity On Ms Excel Advance Sheet Hindi Youtube

Online Or Excel Gratuity Calculator 2021 Formula Purpose In India

Full And Final Settlement Format In Excel With Calculations

Download Automated Income Tax Preparation Excel Based Software All In One For Govt Non Govt Employees For F Y 2019 20 With Gratuity Calculator Exemption Limit And Calculation Ay 20120 21 Simpletax

Gratuity Calculator In Excel Income Tax Software

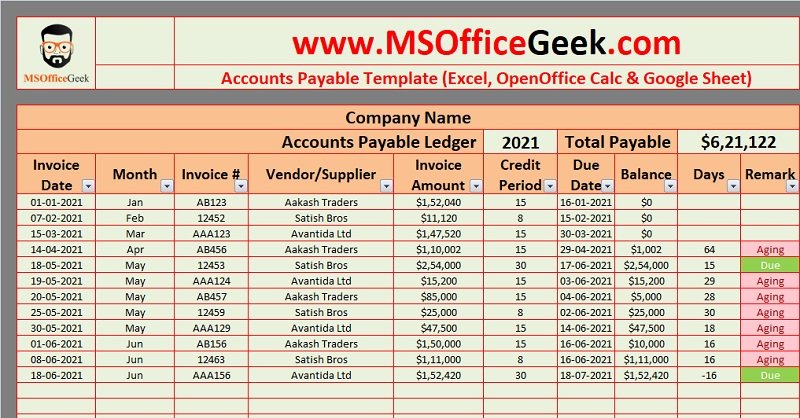

Ready To Use Accounts Payable Excel Template Msofficegeek

Post a Comment for "Basic Salary Gratuity Calculation In Excel"