Monthly Salary Calculation Rules

Salary After Tax the money you take home after all taxes and contributions have been. 12 of monthly salary subject to a maximum of Rs 1800 Employee Pension Scheme EPS 0.

Salary Formula Calculate Salary Calculator Excel Template

Monthly Salary Total days in Month Leave without Pay total days in month.

Monthly salary calculation rules. 12000 367 Rs 44040. Employee Starts work on 1212016 his salary is RM 1000. For example there are 2 possibilities here.

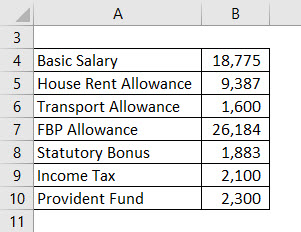

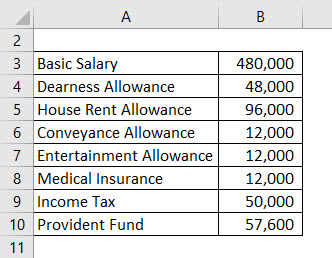

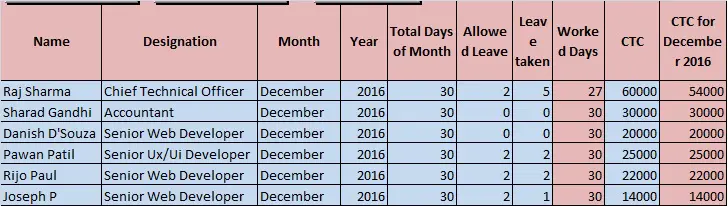

CTC includes both monetary and non-monetary items. Based on the above there are two main calculation methods. In-Hand Salary Monthly Gross Income Income tax Employee PF Other deductions if any.

Illustrative calculation Comments. You may receive a monthly or daily salary. Rules for calculating payroll taxes FY 2019 2020 Income Tax formula for FY 2019 2020 Basic Allowances Deductions 12 IT Declarations Standard deduction.

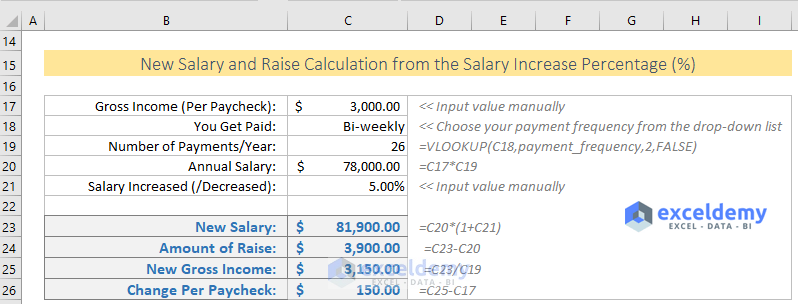

Why not find your dream salary too. Salary Calculator for Minimum Wage in year 2020 A government has decided to raise the minimum monthly wage from RM1 100 to RM1200 and will take effect from 1 st January 2020 in major. Is this the right way what does the labour law says how to calulate eg 7000 is monthly salary x 12 84000 84000 divide by 365 Rs 230 Day Feb.

Salary per month Gross 30 days in a month x No. 12000 12 Rs 1440. This will calculate the combined tax for both salary and bonus in the payslip after that you may deduct the tax of the monthly salary component to get the bonus-only tax.

What items to include in itemised pay slips when to give them and in what format. Monthly salary 5000 2536 4166 same as above Please check the below link for more information on the same. Monthly and daily salary.

12000 833 Rs 99960. This new minimum wage follows the tabling of Budget 2020 and. Salary Before Tax your total earnings before any taxes have been deducted.

Gross salary Basic salary HRA House rent allowance DA dearness allowance MA medical allowance. Simply enter your annual or monthly income into the salary calculator above to find out how taxes in Ireland affect your income. In-hand is a word used in daily life to mean the final amount received after the deduction of taxes.

Hourly rates weekly pay and bonuses are also catered for. 500030 25 4166. Depends on what basis you calculate salary.

If the employer pays you an Monthly salary Multiply it by 12 to get your annual salary and divide 365 days to get salary per day and than deduct salaryday As per absent. Formula can vary based on the calculation basis. 367 of the 12 Example Monthly Salary.

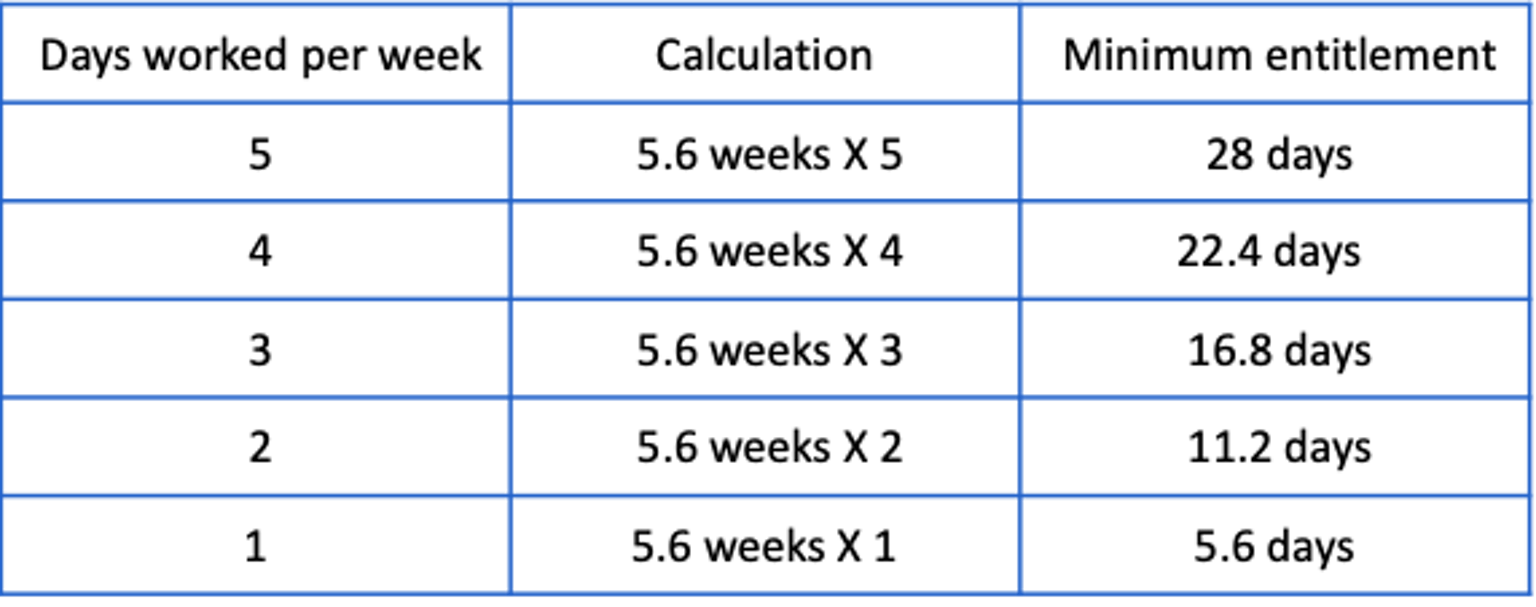

Some calculate salary for a fixed number of days such as 30 each month. Monthly Salary x Number of Days employed in the month Number of days in the respective month Example. The employees monthly salary calculating 26 days or 31 days because the working days only 26 in a month but one month is a 30 days what is the format to.

In-Hand salary means Take home pay in India. Requirements for paying salary including frequency timing and payments in other situations. One is deduction for absence which means the portion of days absent is to be deducted from the monthly basic salary ie.

Types of salary deductions allowed in accordance with the Employment Act. If monthly salary is RM 5000 with a yearly bonus of RM 5000 then for an employee who is not married the combined tax for both salary and bonus is RM 650. Youll then get a breakdown of your total tax liability and take-home pay.

Eligible Monthly Salary. 12 of monthly salary. Salary of a.

You could calculate salary on the basis of the total number of days between 21 and 20 similar to the calendar day logic. Salary for January 2016 RM 1000 x 20 31 RM 64516. This tutorial will teach you how to make a query for salary calculation.

The latest budget information from April 2021 is used to show you exactly what you need to know. Calculation of Basic Salary from Gross Salary. You need to enter basic salary only and entire detail will calculated automatically.

We can have hours worked a piece rate overtime or fixed amount to identify the Eligible Monthly Salary. 833 of the 12 Employee Provident Fund EPF Full amount. All allowances and cash reimbursements are part of.

The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. 230 x 28 6440. For the same employee monthly PCB for salary alone will be.

Monthly and daily salary. Daily wages are calculated using either the gross rate for paid public holidays paid leave salary in lieu and salary deductions or the basic rate for work on rest days or public holidays. So we calculate as follows.

12000 12 Rs 1440. Also known as Gross Income. On an excel sheet the formula is SUMD2G2 Below is a table showing different components of a salary including CTC break-up.

Basic Salary Calculation Formula In Excel Download Excel Sheet

Salary Net Salary Gross Salary Cost To Company What Is The Difference

Salary Formula Calculate Salary Calculator Excel Template

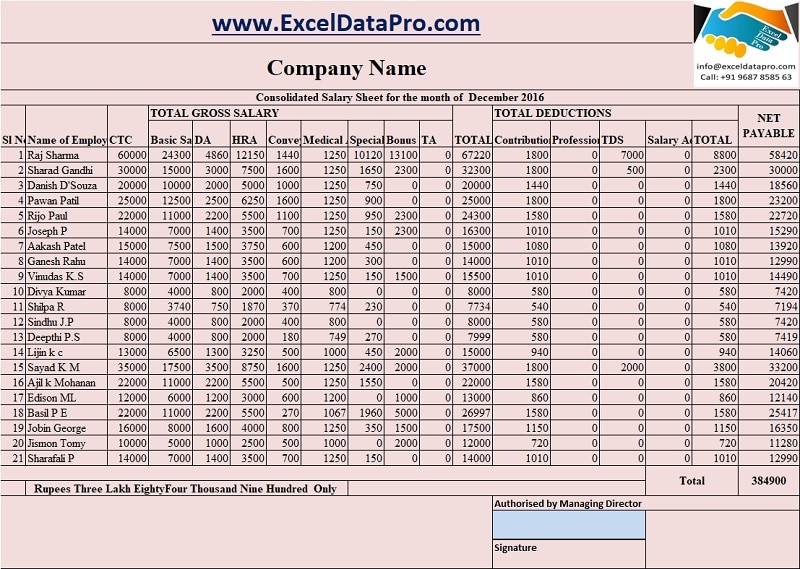

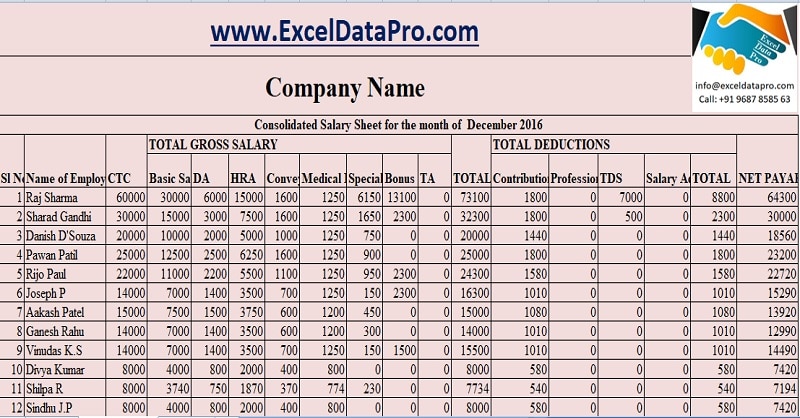

Download Salary Sheet Excel Template Exceldatapro

Basic Salary Calculation Formula In Excel Download Excel Sheet

Salary Formula Calculate Salary Calculator Excel Template

Salary Formula Calculate Salary Calculator Excel Template

Download Salary Sheet Excel Template Exceldatapro

Salary Formula Calculate Salary Calculator Excel Template

Payroll Formula Step By Step Calculation With Examples

Download Salary Sheet Excel Template Exceldatapro

Salary Calculation Dna Hr Capital Sdn Bhd

Salary Formula Calculate Salary Calculator Excel Template

What Is Payroll And How Are Payroll Calculations Done

How To Calculate Salary Increase Percentage In Excel Free Template

What Is Basic Salary Definition Formula Income Tax Exceldatapro

Your Step By Step Correct Guide To Calculating Overtime Pay

Salary Calculation Sheet Template Payroll Template Spreadsheet Design Excel Budget

Post a Comment for "Monthly Salary Calculation Rules"