Total Annual Income Non-taxable

Employer contributions to an unqualified retirement plan. Non Taxable 82 00000 max as per law Total Taxable Income 243 82440 Less.

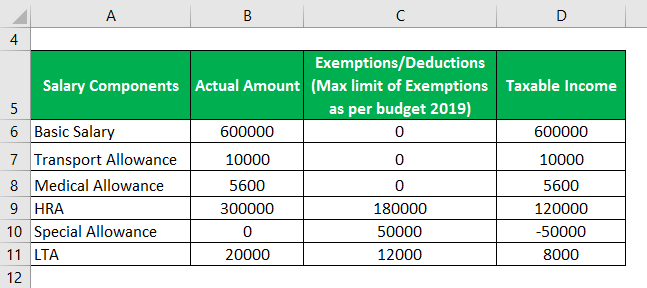

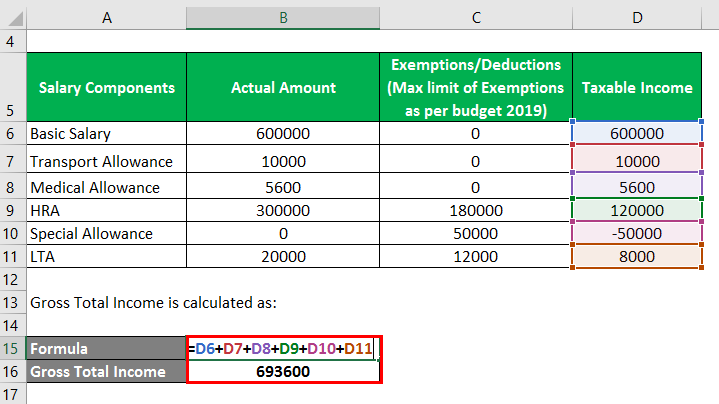

Taxable Income Formula Calculator Examples With Excel Template

The following calculator can be used to calculate your hourly to salary rate.

Total annual income non-taxable. Citi applications ask for total annual income and the amount of your monthly rent or mortgage payment. Other than that your base pay is taxable. 10 of the total income that is more than Rs5 lakh 4 cess From Rs750001 to Rs1000000 15 of the total income that is more than Rs75 lakh 4 cess From Rs1000001 to Rs1250000 20 of the total income that is more than Rs10 lakh 4 cess.

Where BO is bonuses or overtime. So your total income is the sum of your salary rental income and capital gains. Taxable income includes wages salaries bonuses and tips as well as investment income and various types of unearned income.

Obviously any wage earned in one of the states that does not have a state income tax is considered a non-taxable wage as far as state taxes are concerned. Taxation of income has significant benefits on the American economy. However there are certain benefits that are considered non-taxable income.

Card users may wonder whether to give last years income per tax filings or an estimate of this years income or whether to include one-time income sources such as a bonus thats unlikely to recur. Disability retirement payments from an employer-paid plan. This comes under income from capital gains.

Other income is non-taxable not taxable exempt or tax-free. Chase card applications ask for total gross annual income and whether any of it is non-taxable. States without income tax.

You should also check your salary for taxable and non-taxable components. Please keep in mind this is not an all-inclusive list and it is subject to change. Always check with an accountant or your base finance office for further details.

How Much Annual Income Do You Need to Be Approved for a Credit Card. However it is essential to note that not all income is taxable. Non-taxable income may be used to meet the required financial support amount such as the following scenarios.

H is the number of hours worked per day. The fair-market value of property received for your services. W is the number of weeks worked per year.

Some income is called taxable which means it forms part of the total income that you have to pay tax on though sometimes no tax may be due if the income falls within your allowances or is taxed at 0. 30 of excess over 14000000 16 14732 Total Tax Due 38 64732. After that you can add your.

Annual income does not exceed 15000 including non-taxable income such as Social Security benefits. These would be for example gains from equity shares if held for more than a year. Income can be in.

For joint tax filers you pay no tax on Social Security if your combined income does not exceed 32000. Net Taxable Income 193 82440. First 14000000 tax is.

By non-taxable we mean not included in gross income. However this income is still taxed by the federal government. This includes both earned income from wages salary tips and self-employment and unearned income such as dividends and interest earned on investments royalties and gambling winnings.

If youre paid hourly multiply your wage by the number of hours you work each week and the number of weeks you work each year. As of this date of publication if you file taxes as an individual and your annual income amounts to less than 25000 then you do not pay income tax on your Social Security income. Be careful to provide documentation of these benefits since by definition they will not be accounted for in your reported total income on tax returns.

You do not have to pay tax on all of your income. States where all wages are non-taxable by the state include Alaska Nevada Florida Texas Tennessee South Dakota New Hampshire. Unearned income considered to be taxable income includes canceled.

Where P is your hourly pay rate. Income that may not be readily identified as taxable but generally must be included on your tax return includes. Personal Exemption 50 00000.

Annual Salary PDHWBO. Non-Taxable Income Taxable income includes all types of compensation whether they are in the form of cash or services as well as property. Next subtract the tax-free earnings from the total income.

Unless a particular income is expressly exempted by law from tax liability every income is taxable and should be reported in the income tax return. The recent Tax Cuts and Jobs Act saw the corporate income tax rate declining from 35 to 21. D is the number of days worked per week.

For example if you earn 12 per hour and work 35 hours per week for 50 weeks each year your gross annual income would be 21000 12 x 35 x 50. Total Income and Considerations After adding up all of your sources of nontaxable income for the entire year divide that amount by 12 to get a monthly amount.

Taxable Income Formula Examples How To Calculate Taxable Income

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

What You Need To Know About Income Tax Calculation In Malaysia

Taxable Income Formula Examples How To Calculate Taxable Income

Taxable Income Formula Examples How To Calculate Taxable Income

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

What Is Income Tax The Financial Express

Https Www Impots Gouv Fr Portail Files Media 1 Metier 5 International French Tax System Pdf

Taxable Income Formula Calculator Examples With Excel Template

How Much Money Do You Have To Make To Not Pay Taxes

Taxable Income Formula Calculator Examples With Excel Template

Taxes In France A Complete Guide For Expats Expatica

Taxable Income Formula Examples How To Calculate Taxable Income

Income That Is Non Taxable Is Called As Exempt Income Section 10 Of The Income Tax Act 1961 Includes Those Incomes Which Do Not Form In 2021 Taxact Income Income Tax

Understanding Your Pay Statement Office Of Human Resources

Taxable Income Formula Calculator Examples With Excel Template

Taxable Income Formula Calculator Examples With Excel Template

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Post a Comment for "Total Annual Income Non-taxable"