Monthly Salary Calculator Scotland

To calculate what your net salary would be if you reduced your hours from full-time to part-time please refer to the net salary calculations spreadsheet. Use our income tax calculator for 2021-22.

Payment is therefore calculated on a 19540235 day basis with holiday pay being accrued at 4019502051 per day worked.

Monthly salary calculator scotland. Use SalaryBots salary calculator to work out tax deductions and allowances on your wage. This is because should a tax code change for any reason it will. Student loan pension contributions bonuses company car dividends Scottish tax and many more advanced features available in our tax calculator.

ICalculator Scottish Income Tax Calculator is updated for the 202122 tax year. 24944 - 14549 is equal to 10395Your taxable income is 10395. Why not find your dream salary too.

Now lets break down your salary income. Find out how much income tax youll pay in Scotland using our calculator. Find out the benefit of that overtime.

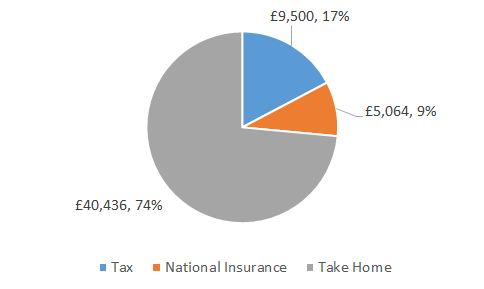

Calculate your net salary and find out exactly how much tax and national insurance you should pay to HMRC based on your income. Please see the table below for a more detailed break-down. Simply enter your annual or monthly income into the salary calculator above to find out how UK taxes affect your income.

Your gross hourly rate will be 2163 if youre working 40 hours per week. Hourly rates weekly pay and bonuses are also catered for. Please enter your gross salary ie.

SCOTTISH INCOME TAX CALCULATOR. This is up to a maximum day rate of 8065 in July and August 31-day months and 8334 in September a 30-day month. Simply enter your annual salary and click calculate or switch to the advanced tax calculator to review employers national insurance payments income tax deductions and PAYE tax commitments for Scotland.

We offer you the chance to provide a gross or net salary for your calculations. If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side-by-side comparison of a normal month and a bonus month. You can calculate your take home pay based on your gross income PAYE NI and tax for 202122.

You can calculate your Monthly take home pay based of your Monthly gross income salary sacrifice adjustment PAYE NI and tax for 202122. 19 percent of tax on the same is 38931. For claims for pay periods starting on or after 1st July 2021 the claim amount for the base wage is calculated at 70 of an employees usual monthly wage for July and 60 for August and September.

Our salary calculator will provide you with an illustration of the costs associated with each employee. Youll be able to earn the same amount before any tax as in the rest of the UK where the personal allowance is 12570 but those earning more than 25296 will pay 1 more tax in Scotland. The chart below reflects the average mean wage as reported by various data providers.

Simply flip the tab to Scotland and select the tax year youd like to calculate. 14549 - 12500 is equal to 2049 Your taxable income is 2049. If your salary is 45000 a year youll take home 2853 every month.

You will see the costs to you as an employer including tax NI and pension contributions. The employer must then top up the amount paid to the employee covering at least. Also known as Gross Income.

To accurately calculate your salary after tax enter your gross wage your salary before any tax or deductions are applied and select any conditions which may apply to yourself. Youll then get a breakdown of your total tax liability and take-home pay. We strongly recommend you agree to a gross salary rather than a net salary.

Salary Before Tax your total earnings before any taxes have been deducted. Based on a 40 hours work-week your hourly rate will be 1588 with your 33000 salary. This tool allows you to calculate income tax for various salary points under the new Scottish tax regime for 2019-20.

The results are broken down into yearly monthly weekly daily and hourly wages. Find out your take-home pay - MSE. To use the tax calculator enter your annual salary or the one you would like in the salary box above.

A comparison is given for residents in the other parts of the UK. ICalculator Monthly salary sacrifice calculator is updated for the 202122 tax year. Calculations for tax are based on a tax code of S1250L.

Calculate your take-home pay given income tax rates national insurance tax-free personal allowances pensions contributions and more. 20 percent of tax on the same is 2079. Enter the number of hours and the rate at which you will get paid.

Use the simple monthly salary sacrifice calculator or switch to the advanced monthly salary sacrifice calculator to review employers national insurance. Scottish Income Tax Calculations 2020-21. For example for 5 hours.

UK Tax Salary Calculator. Youll pay 6500 in tax 4260 in National Insurance and your yearly take-home will be 34240. Therefore for a partial year the first thing to do is count the number of days of the 195 you will actually work.

The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. This is the map and list of European countries by monthly average wage annual divided by 12 months gross and net income after taxes average wages for full-time employees in their local currency and in euros. The salary distribution is.

If you earn 33000 a year then after your taxes and national insurance you will take home 26080 a year or 2173 per month as a net salary. Net Salary Calculator 2020 10855 KB Excel Please note. The latest budget information from April 2021 is used to show you exactly what you need to know.

29 500 After Tax 2021 Income Tax Uk

Smartphones All The Popular Brands In One Place Unlocked Unlocked Student Loan Debt Student Loans Health Savings Account

21 No Objection Certificate Templates Free Word Pdf Lettering Letter Sample Business Format

Website Technical Proposal Template Technical Proposal Proposal Templates Proposal

19 Salary Certificate Formats Word Excel Pdf Templates Business Letter Template Certificate Format Word Template

The Salary Calculator Irish Take Home Tax Calculator Salary Calculator Weekly Pay Salary

24 250 After Tax After Tax Calculator 2019

6 Net Worth Certificate Formats Free Word Pdf Certificate Format Net Worth Certificate

Remittance Advice Template Templates Word Template Advice

Facebook Posters Ephemera Facebook Poster Portfolio Design Hacks

Remittance Advice Template Templates Word Template Advice

The Salary Calculator Income Tax Calculator Salary Calculator Income Tax Federal Income Tax

A Recruitment Poster For The Black Watch Ww1 Propaganda Posters Propaganda Posters Ww1 Posters

Here Are The Benefits Of Shared Container Shipping Sharing A Shipping Container Implies Sharing The Cost International Move Move Abroad San Francisco Skyline

20 Salary Certificate Formats Free Word Pdf Certificate Format Business Format Free Certificate Templates

Post a Comment for "Monthly Salary Calculator Scotland"