Monthly Salary Calculator Bc

Also known as Gross Income. The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and British Columbia Tax the Canadian Pension Plan the Employment Insurance.

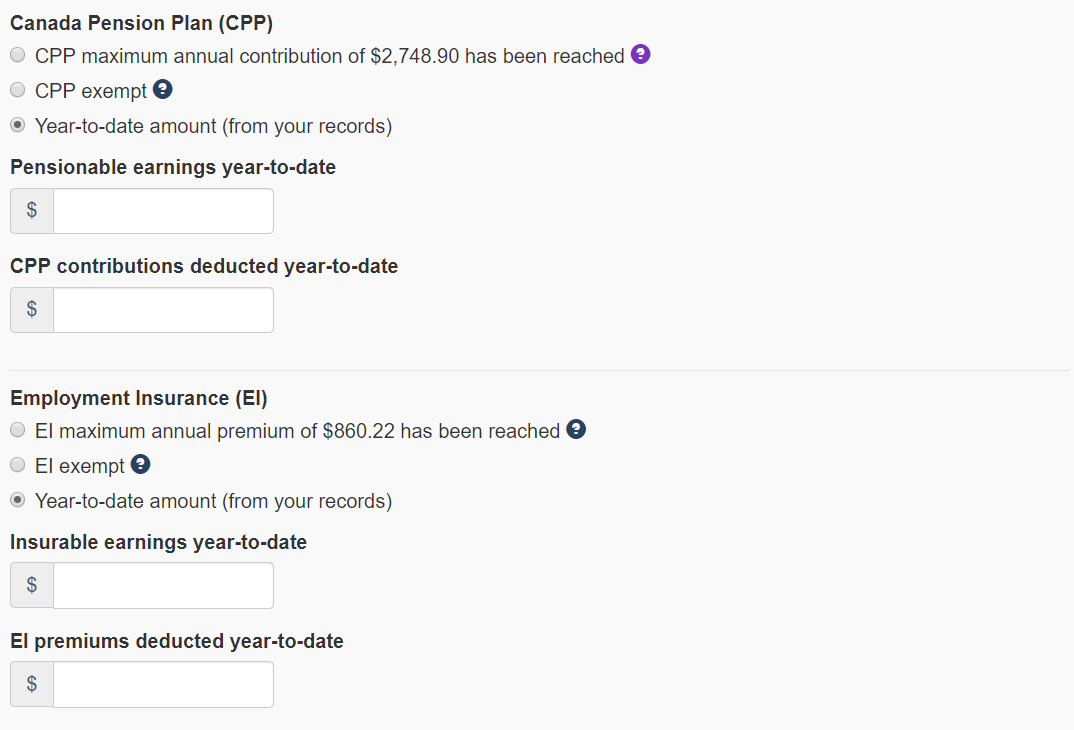

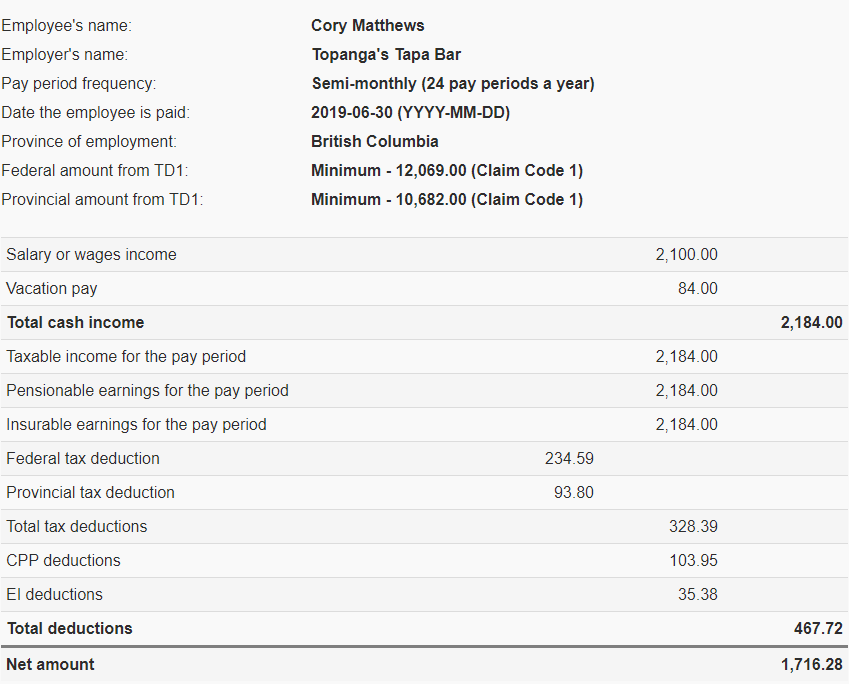

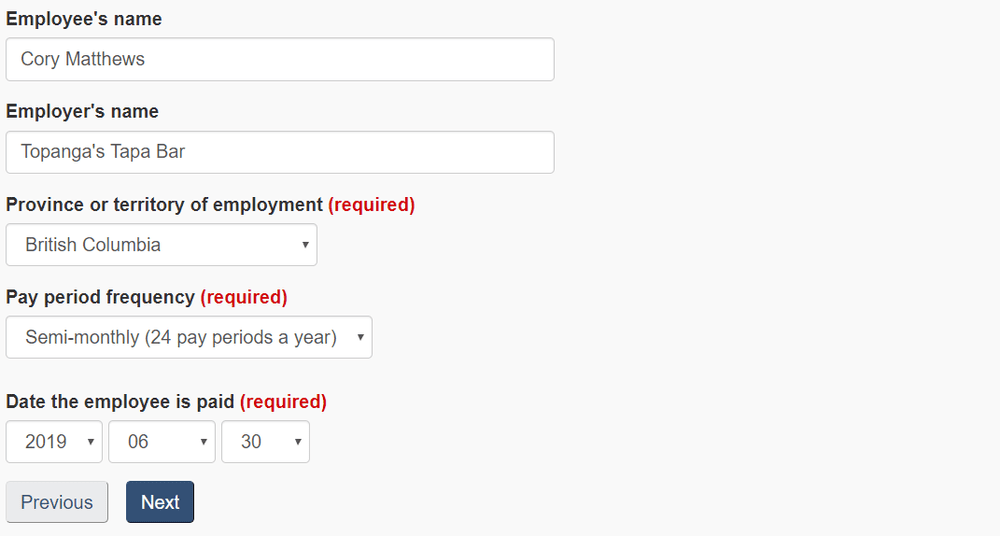

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

Salary calculations include gross annual income tax deductible elements such as Child Care Alimony and include family related tax allowances.

Monthly salary calculator bc. See how we can help improve your knowledge of Math Physics Tax Engineering and more. Calculate your income tax social security and pension deductions in seconds. Enter the number of hours worked a week.

You can calculate your Monthly take home pay based of your Monthly gross income and the tax allowances tax credits and tax brackets as defined in the 2021 Tax Tables. Select the province. Weekly base salary Unit per week Number of units x 52 weeks per year Holiday Statutory weeks Annual minimum Salary Residence over 60 suites Weekly base salary x 52 weeks per year Holiday Statutory weeks Annual minimum Salary.

365 days 12 months 7 days 434524 Based on 24 hoursday. Gross annual income - Taxes - CPP - EI Net annual salary. Youll pay 6500 in tax 4260 in National Insurance and your yearly take-home will be 34240.

The Canada Monthly Tax Calculator is updated for the 202122 tax year. These hours are equivalent to working an 8-hour day. Youll then get a breakdown of your total tax liability and take-home pay.

The amount can be hourly daily weekly monthly or even annual earnings. To get the appropriate amount for your situation you can consult the minimum wage page of BC government. This view is better suited to those who are doing a quick salary comparison or quickly estimating their monthly.

The increase of the minimum wage in British Columbia BC has been fixed on june 1st since 2018. Salary Before Tax your total earnings before any taxes have been deducted. PaymentEvolution provides simple fast and free payroll calculator and payroll deductions online calculator for accountants and small businesses across Canada.

Annual Salary Paid Employees Only whether paid bi-weekly semi-monthly or other Enter annual salary. One of a suite of free online calculators provided by the team at iCalculator. Monthly tax deduction calculator bc.

Calculate you Monthly salary after tax using the online Gibraltar Tax Calculator updated with the 2021 income tax rates in Gibraltar. Formula for calculating net salary in BC. Your average tax rate is 208 and your marginal tax rate is 338.

Simply enter your annual or monthly income into the tax calculator above to find out how taxes in Canada affect your income. Canadian Payroll Calculator by PaymentEvolution. The amount can be hourly daily weekly monthly or even annual earnings.

If you make 52000 a year living in the region of British Columbia Canada you will be taxed 10804. Based on 434524 weeks per month. Formula for calculating net salary in BC.

Use the simple monthly Canada tax calculator or switch to the advanced Canada monthly tax calculator to review NIS payments and income tax deductions for. 52 pay periods a year Weekly PDF 26 pay. Net annual salary Weeks of work year Net weekly income.

Why not find your dream salary too. All bi-weekly semi-monthly monthly and quarterly. The calculator is updated with the tax rates of all Canadian provinces and territories.

This is required information only if you selected the hourly salary option. Net weekly income Hours of work week Net hourly wage. One of a suite of free online calculators provided by the team at iCalculator.

Calculate you Monthly salary after tax using the online France Tax Calculator updated with the 2021 income tax rates in France. Your gross hourly rate will be 2163 if youre working 40 hours per week. That means that your net pay will be 41196 per year or 3433 per month.

Gross annual income Taxes CPP EI Net annual salary. If your salary is 45000 a year youll take home 2853 every month. Hourly Pay Rate.

Annual salary without commas average weekly hours Take one of the two calculated amounts from the boxes on the right. Enter your pay rate. The British Columbia Income Tax Salary Calculator is updated 202122 tax year.

Before taxes or any other deductions Gross Monthly Pay. 30 8 260 - 25 56400 Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of working days a year. The latest budget information from April 2021 is used to show you exactly what you need to know.

Please see the table below for a more detailed break-down. Hourly rates weekly pay and bonuses are also catered for. Income Tax calculations and RRSP factoring for 202122 with historical pay figures on average earnings in Canada for each market sector and location.

The following table shows the equivalent pre-tax hourly income associated with various monthly salaries for a person who worked 8 hours a day for either 200 or 250 days for a total of 1600 to 2000 hours per year. Calculate your income tax social security and pension deductions in seconds. The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and British Columbia Tax the Canadian Pension Plan the Employment Insurance.

Gross annual income - Taxes - CPP - EI Net annual salary. Net annual salary Weeks of work year Net weekly income. The Normal view allows you to use the Canada Salary Calculator within the normal content this means you see the standard menus text and information around the calculator.

The adjusted annual salary can be calculated as. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. See how we can help improve your knowledge of Math Physics Tax Engineering and more.

Now you can go back to the Dues or Strike Calculator you were working on and enter the. Enter the number of pay periods.

Canada Province Salary Calculators 2021

Annual Income Learn How To Calculate Total Annual Income

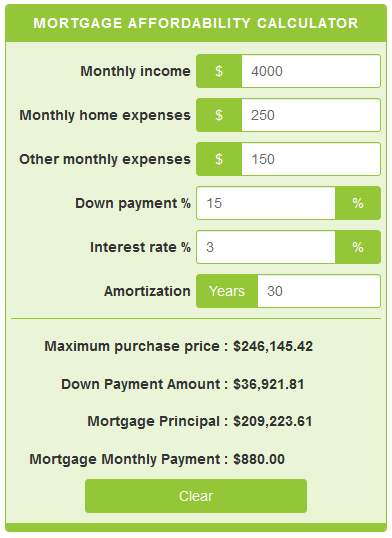

Mortgage Affordability Calculator Calculatorscanada Ca

How To Calculate Income Tax In Excel

Avanti Gross Salary Calculator

If You Earned Cad 2000 Month In Canada What Would Your Salary Be After Taxation Quora

The Salary Calculator Tells Your Yearly Net Income In Vancouver After Income Tax And National Insurance Contributions Have Salary Calculator Salary Net Income

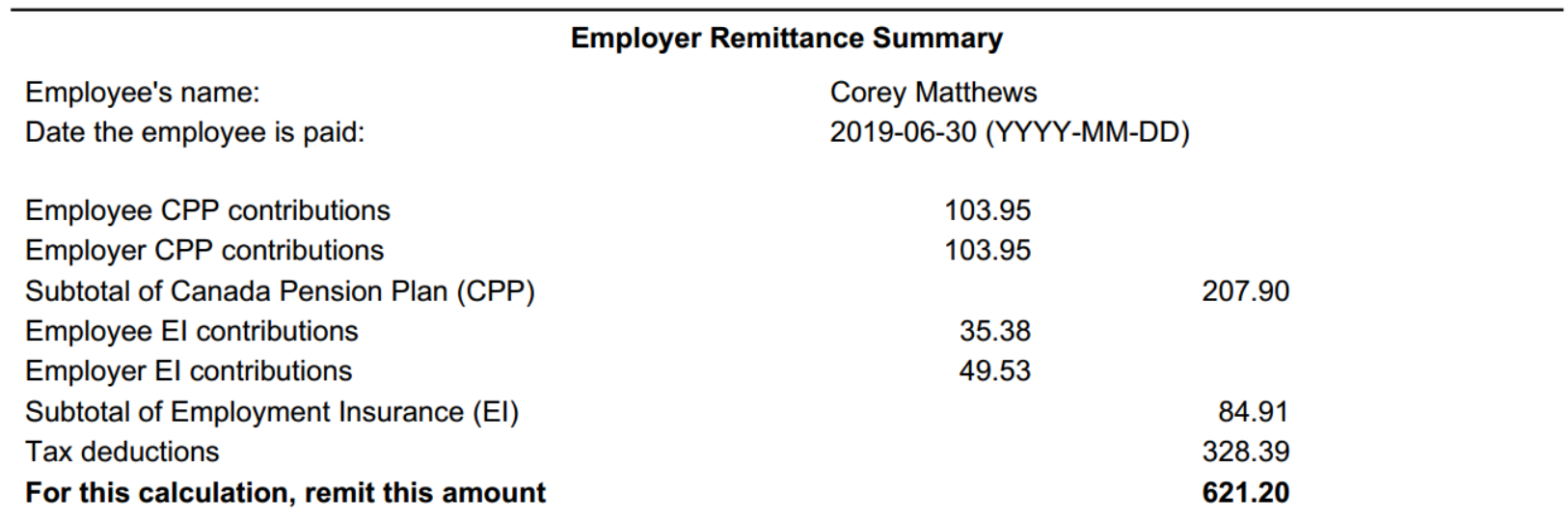

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

Temporary Wage Subsidy For Employers How To Calc

How To Calculate Net Income 12 Steps With Pictures Wikihow

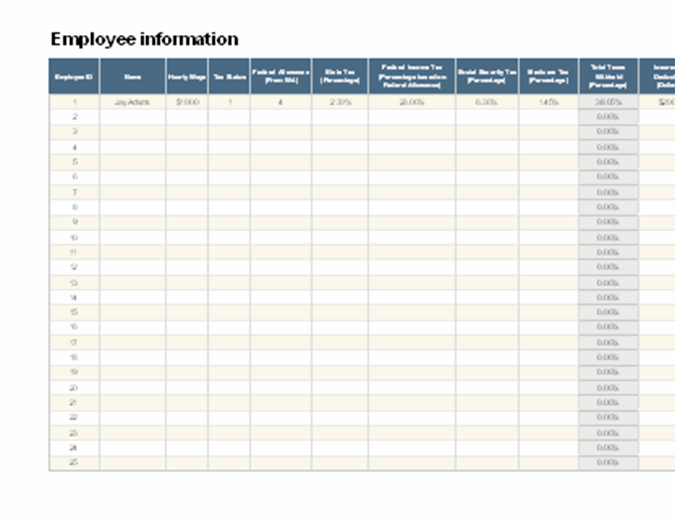

Everything You Need To Know About Running Payroll In Canada

How We Calculate Your Pension College College

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

Canada Federal And Provincial Income Tax Calculator Wowa Ca

Income Tax Formula Excel University

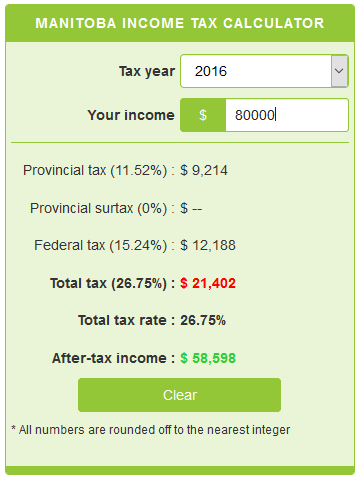

Manitoba Income Tax Calculator Calculatorscanada Ca

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

How To Calculate Payroll Tax Deductions Monster Ca

Post a Comment for "Monthly Salary Calculator Bc"