Gross Income Meaning Ato

Your gross income can be from a salary hourly wages tips freelancing and many other sources. Under Section 32 A Except when otherwise provided in this Title gross income means all income derived from WHATEVER SOURCE including but not limited to the following items.

Chapter 3 Exempt Income And Non Assessable Non

Copyright 2007 by The McGraw-Hill Companies Inc.

Gross income meaning ato. The total revenue of a business or individual before deduction for expenses allowancesdepreciationor other adjustments. Gross business income is the total income a business receives before any taxes expenses adjustments exemptions or deductions are taken out. Gross means the total or whole amount of something whereas net means what remains from the whole after certain deductions are made.

A pay period can be weekly fortnightly or monthly. Gross income is an individuals total earnings before taxes and other deductions. It does not include any allowances overtime or any extra compensation.

When we say turnover we mean aggregated turnover. Your aggregated turnover is your annual turnover all ordinary income you earned in the ordinary course of running a business for the income year plus the annual turnover of any entities you are connected with or that are your affiliates. Gross income n noun.

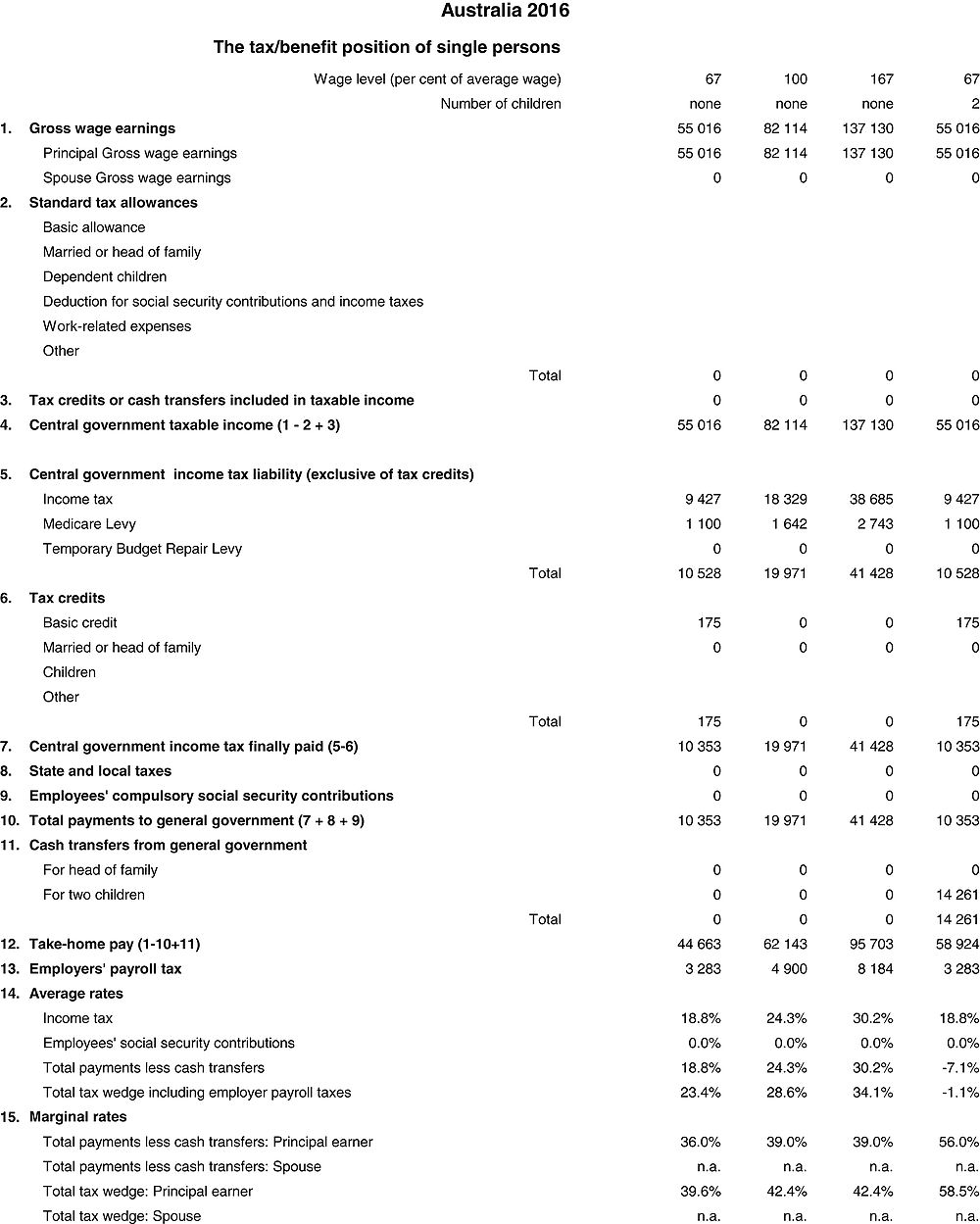

In your case if your car is salary sacrificed this income in removed from your salary prior to tax and is not considered part of your assessable income. Taxable income is your assessable income which is made up in part of the gross income from your employer minus any allowable deductions you can claim. Earnings before tax revenu brut nm nom masculin.

You can receive income as a result of working or from an investment. Amounts you receive as a gift or win as a prize are not usually income. Australias taxation system relies heavily on personal income tax so it is important to understand what we mean by income.

Refers to person place thing quality etc. Gross income is essentially the total amount you or a business earns over the course of certain period of time. It impacts how much someone can borrow for a home and its also used to determine your federal and state income taxes.

The Complete Real Estate Encyclopedia by Denise L. 1 Compensation for services in whatever form paid including but not limited to fees salaries wages commissions and similar items. Amounts you paid for unused long service leave that accrued before 16.

Gross income is the amount of money you earn before any taxes or other deductions are taken out. Gross Salary is the amount of salary after adding all benefits and allowances but before deducting any tax. The gross pay estimator will give you an estimate of your gross pay based on your net pay for a particular pay period.

Gross income in business Gross income in business is gross revenue minus direct costs. If there is no amount included at Lump sum A do not complete the Type box. Basic salary is the amount paid to an employee before any extras are added or taken off.

It is calculated on a business tax return as the total business sales less cost of goods sold COGS and appears on the income profit and loss statement as a starting figure. Sutilise avec les articles le l devant une voyelle ou un h muet un. Gross income for an individualalso known as gross pay when its on a paycheckis the individuals total pay from his or her employer before taxes.

Its usually measured over a. T if the payment was made for any other reason. R if the payment was made for a genuine redundancy invalidity or under an early retirement scheme.

Evans JD O. It can be used for the 201314 to 202021 income years. For example a company with revenues of 10 million and expenses of 8 million reports a gross income of 10 million the whole and net income of 2 million the part that remains after deductions.

For individuals gross income is the total of their paycheck or wages from any and all sources including pension and interest pre-tax. Income in some situations may be in the form of goods and services.

4 1 Gross Earnings Off To Work You Go Mathematics Libretexts

Jobkeeper Or Jobseeker Australians Can Now Get Both

Chapter 3 Exempt Income And Non Assessable Non

Guide To Taxable Income For Individuals How To Calculate Your Taxable Income Amount Estimated Tax Payments Federal Income Tax Income

Margin Definition Gross Profit Margin Profit Margin Formula Operating Profit Margin Infographic Economics Lessons Finance Investing Accounting And Finance

What My Gross Income Of 60000 Year Is Actually Used On In Europe Austria Oc Dataisbeautiful Accident Insurance Income Retirement Planning

Chapter 3 Exempt Income And Non Assessable Non

Gross Vs Net Income Importance Differences And More Bookkeeping Business Accounting And Finance Finance Investing

Lesson 8 Tax In Australia Li Jialong The History Of Taxation In Australia The Colony Of Tasmania Was The First State To Impose A Tax On Income Ppt Download

Plus One Accountancy Notes Chapter 8 Financial Statements I Financial Statements Ii A Plus Topper Financial Statement Financial Accounting Period

Gross Vs Net Income Importance Differences And More Bookkeeping Business Accounting And Finance Finance Investing

Which Countries Use The Most Electricity Https Www Statista Com Chart 19909 Electricity Consumption Worldwi Electricity Consumption Electricity Infographic

Chapter 3 Exempt Income And Non Assessable Non

4 1 Gross Earnings Off To Work You Go Mathematics Libretexts

Https Www Icb Org Au Out 178914 Stp Allowances To Pay Event Coding Pdf

:max_bytes(150000):strip_icc()/GettyImages-904286032-4cc94e81854841989b260d5df5ae98d6.jpg)

Post a Comment for "Gross Income Meaning Ato"