Ca Salary Tax Rate

Although there are also a number of candidates who left within one year due to the overload work pressure. Details of the personal income tax rates used in the 2021 California State Calculator are published below the calculator this includes historical tax years which are supported by the California State Salary Calculator.

Chartered Accountant Average Salary In France 2021 The Complete Guide

These taxes will be reflected in the withholding from your paycheck if applicable.

Ca salary tax rate. California has ten marginal tax brackets ranging from 1 the lowest California tax bracket to 133 the highest California tax bracket. Profits tax salaries tax and tax under personal assessment. To find out how much personal income tax you will pay in California per paycheck use the California salary paycheck calculator.

Tax bracket start at 0 known as the tax-free rate and increases progressively up to 45 for incomes over 180000. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11488. Profits tax salaries tax and tax under personal assessment.

Tax rates vary depending on residential status. This results in roughly 18889 of your earnings being taxed in total although depending. California doubles all bracket widths for married couples filing jointly except the 1000000 bracket.

This is similar to the federal income tax system. - California State Tax. The California Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2021 and California State Income Tax Rates and Thresholds in 2021.

Are California residents are subject to personal income tax. California has a progressive income tax which means rates are lower for lower earners and higher for higher earners. Profits tax salaries tax and tax under personal assessment.

Bonuses and earnings from stock options are taxed at a flat rate of 1023 while all other supplemental wages are taxed at a flat rate of 66. The average monthly net salary in Canada is around 2 997 CAD with a minimum income of 1 012 CAD per month. Federal tax State tax medicare as well as social security tax allowances are all taken into account and are kept up to date with 202122 rates.

The UI rate schedule and amount of taxable wages are determined annually. In Canada income tax is usually deducted from the gross monthly salary at source through a pay-as-you-earn PAYE system. 505 on the first 45142 of taxable income 915 on the next 45145 1116 on the next 59713 1216 on the next 70000 1316 on the amount over 220000.

The EDD notifies employers of their new rate each December. That means that your net pay will be 42930 per year or 3577 per month. In California different tax brackets are applicable to different filing types.

Your average tax rate is 220 and your marginal tax rate is 397. Many of the people who have taken 2-3 attempts in CA Final started their career with one of the firms in Big 4 with a starting package of just 6-8 lakhs but in a span of 4-5 years there have maintained a position where they are earning an average salary of 24-25 Lakhs per annum. Additionally taxpayers earning over 1M are subject to an additional surtax of 1 making the effective maximum tax rate 133 on income over 1 million.

In all there are 10 official income tax brackets in California with rates ranging from as low as 1 up to 133. That means that your net pay will be 40512 per year or 3376 per month. New employers pay 34 percent 034 for a period of two to three years.

The maximum tax is 434 per employee per year calculated at the highest UI tax rate of. Each marginal rate only applies to earnings within the applicable marginal tax bracket. Go to Income tax rates Revenu Québec Web site.

If you make 55000 a year living in the region of California USA you will be taxed 12070. This marginal tax rate means that your immediate additional income will be taxed at this rate. Your average tax rate is 221 and your marginal tax rate is 349.

Filing 7500000 of earnings will result in 366421 of your earnings being taxed as state tax calculation based on 2021 California State Tax Tables. Profits tax salaries tax and tax under personal assessment. In addition to income tax there are additional levies such as Medicare.

Tax-rated employers pay a percentage on the first 7000 in wages paid to each employee in a calendar year. This places Canada on the 12th place in the International Labour Organisation statistics for 2012 after France but before Germany. Individuals on incomes below 18200 are also entitled to the Low and Middle Income Tax Offset LMITO.

In California these supplemental wages are taxed at a flat rate. 108 on the first 33723 of taxable income 1275 on the next 39162 174 on the amount over 72885. Use our United States Salary Tax calculator to determine how much tax will be paid on your annual Salary.

Yes residents in California pay some of the highest personal income tax rates in the United States. 1788 lignes Viewing all rates Location Rate County.

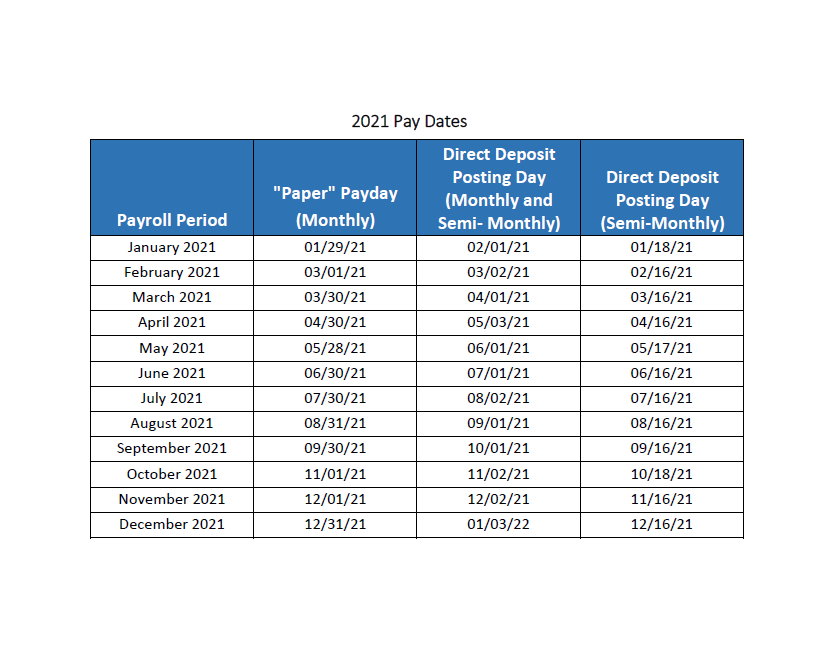

State Of California Payroll Calendar 2021 Payroll Calendar

What Are California S Income Tax Brackets Rjs Law Tax Attorney

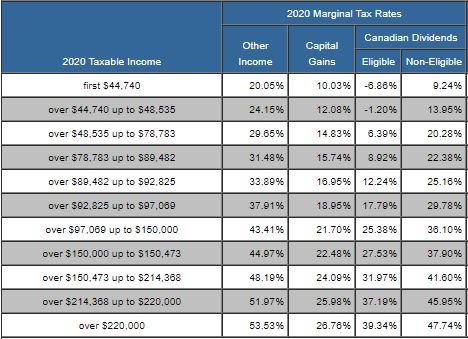

Taxtips Ca Personal Income Tax Rates For Canada Provinces Territories

Chartered Accountant Average Salary In France 2021 The Complete Guide

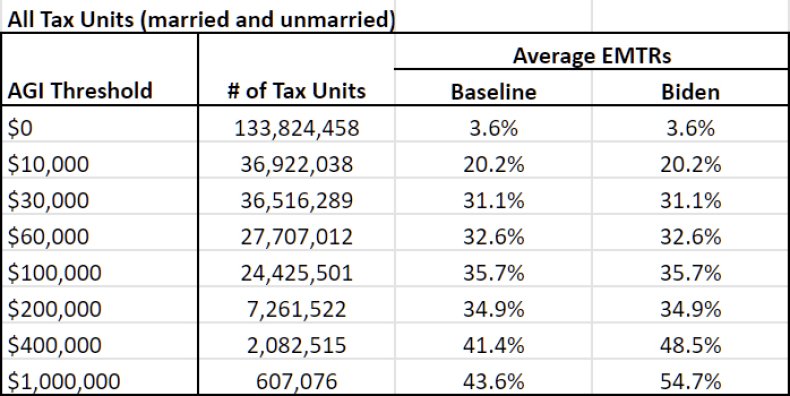

Joe Biden Tax Calculator How Democrat Candidate S Plan Will Affect You

Chartered Accountant Average Salary In France 2021 The Complete Guide

Taxtips Ca Ontario 2019 2020 Income Tax Rates

Irs Form 540 California Resident Income Tax Return

Taxtips Ca Canada S Top Marginal Tax Rates By Province Territory

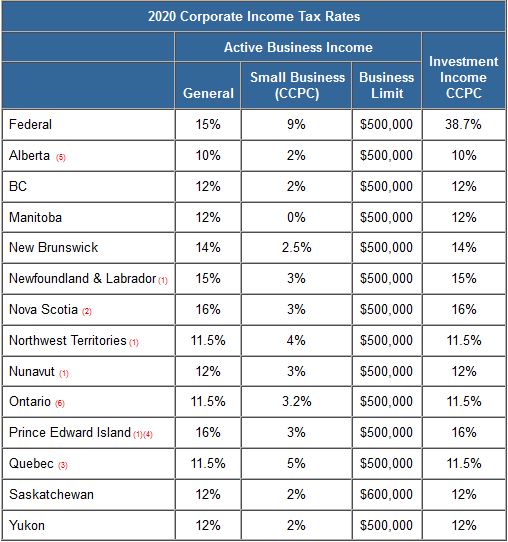

Taxtips Ca Business 2020 Corporate Income Tax Rates

What Is The Salary Of A Chartered Accountant Quora

Chartered Accountant Average Salary In France 2021 The Complete Guide

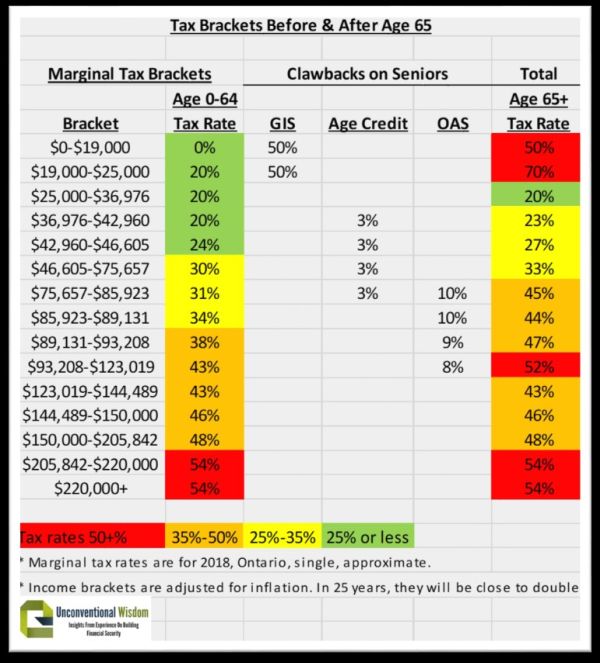

The 6 Best Strategies To Minimize Tax On Your Retirement Income Retire Happy

Chartered Accountant Average Salary In France 2021 The Complete Guide

How Are My Taxes Affected By Receiving A Lump Sum Of Income Www Chadpeshke Com

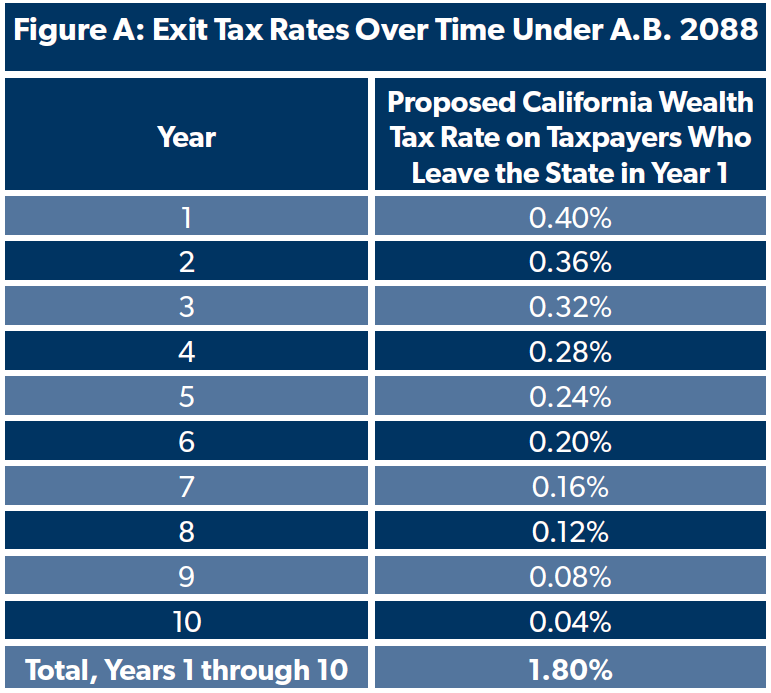

California Wealth And Exit Tax Would Be An Unconstitutional Disaster Foundation National Taxpayers Union

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Personal Income Tax Brackets Ontario 2020 Md Tax

Ca Income Tax Calculator July 2021 Incomeaftertax Com

Post a Comment for "Ca Salary Tax Rate"