Ca Salary Non-exempt

Non Exempt Salary in Los Angeles CA. The following is an example from the regulations.

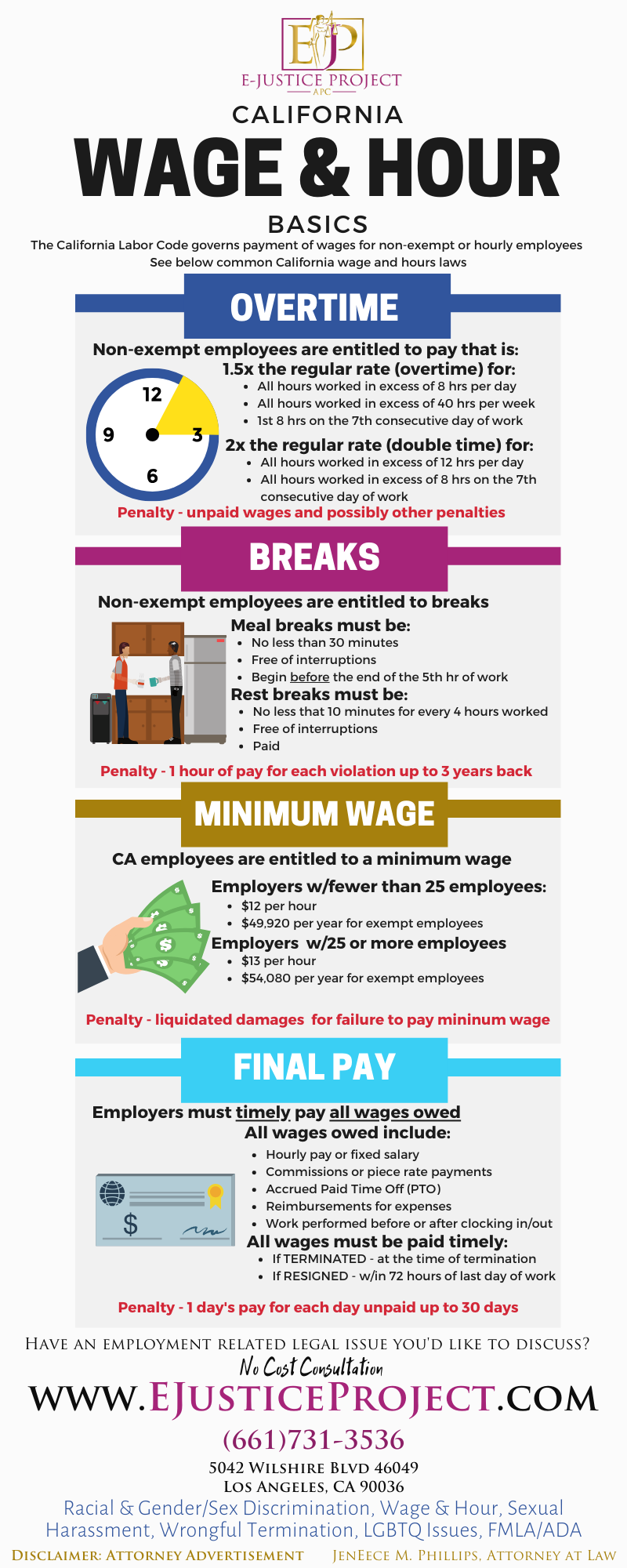

Meal Rest Breaks E Justice Project

Multiply the monthly remuneration by 12 months to get the annual salary.

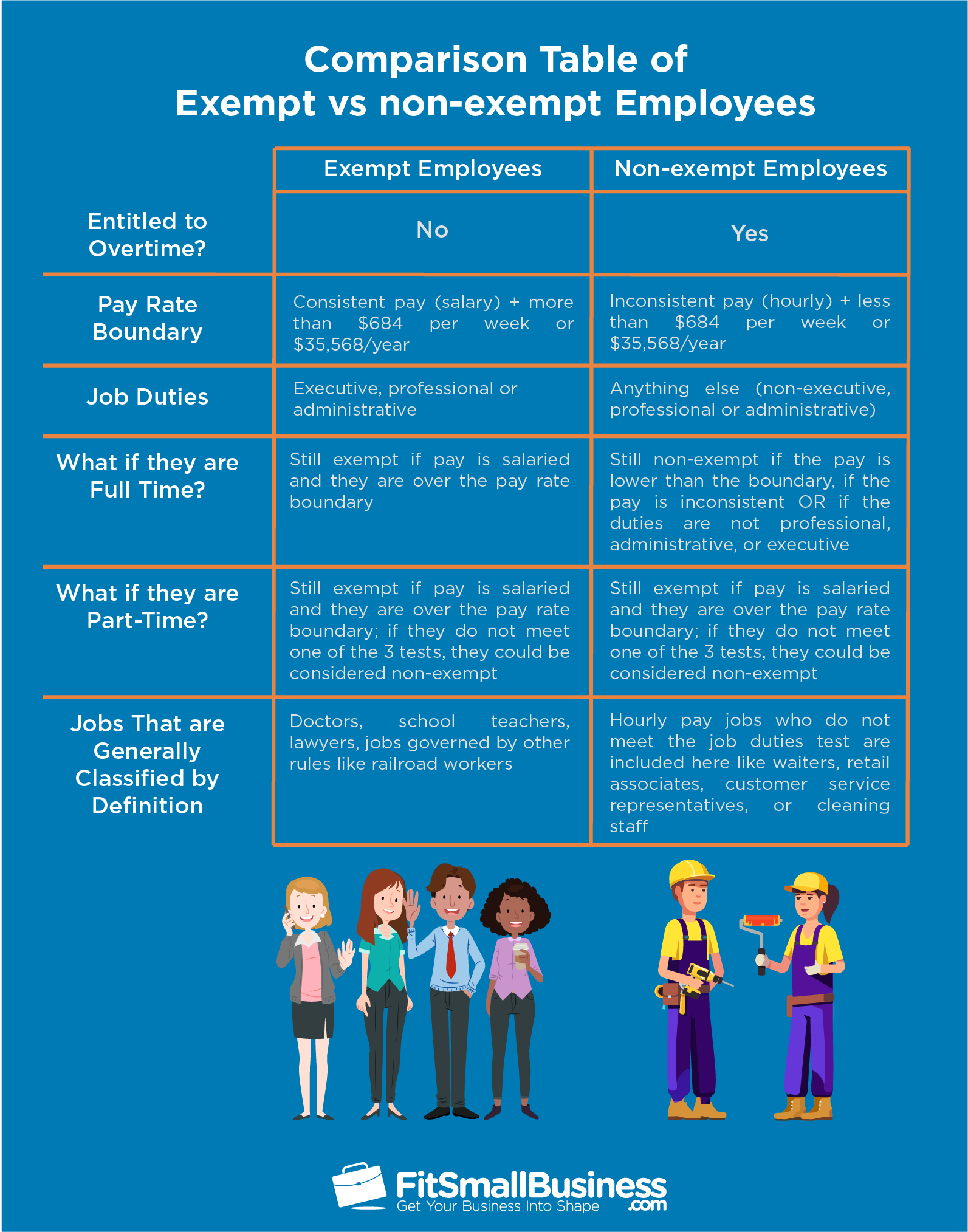

Ca salary non-exempt. The consequences of misclassifying a non-exempt employee as exempt can be significant. Discretion and Independent Judgment Most California employees who are classified as exempt customarily and regularly exercise discretion and independent judgment in their jobs. As a non-exempt employee salaried employees who work over the maximum number of hours should be paid based on California overtime laws.

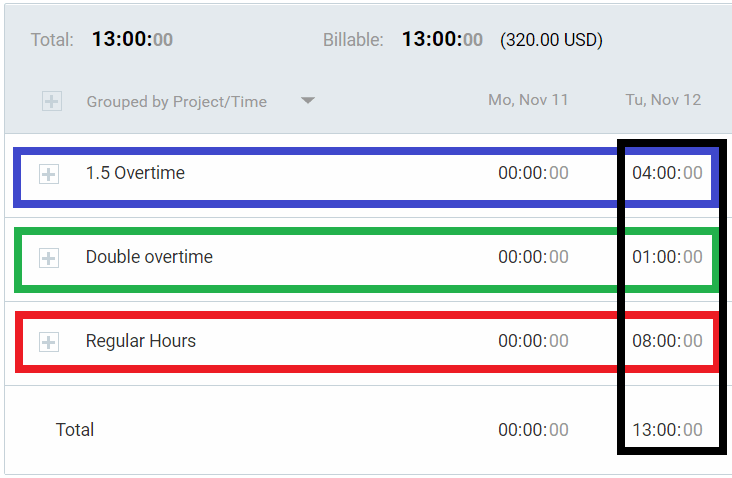

2021 California Salary Increases for Exempt Employees. Therefore the Computer Technician with a 40-hour workweek would earn 3966 for every hour that exceeds 40 hours within a week. In 2021 Tonis weekly salary should be no less than 52000.

The minimum annual salary is. 15 times the hourly rate. Salaries above this.

Most non-exempt employees are paid on an hourly basis. Salaries below this are outliers. Your salary must be at least equal to Californias minimum wage.

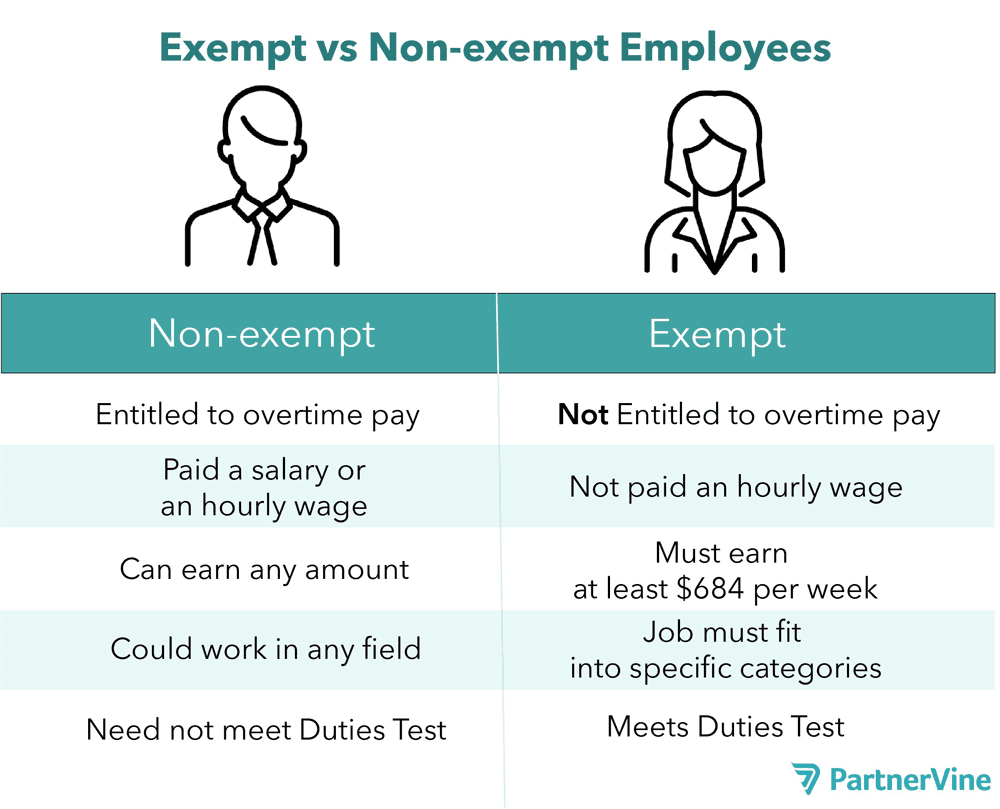

The Fair Labor Standards Act FLSA sets the national minimum wage and mandates that employees are paid time-and-a-half for all hours worked over forty in a week. Divide the weekly salary by the number of legal maximum regular. Non-exempt employees only have to be paid when they work so they may take partial and full unpaid vacation days whenever they are authorized.

28058 - 37057 15 of jobs 37058 - 46057 21 of jobs The average salary is 52469 a year. 9 lignes A salary for these purposes is an unvarying minimum amount of pay. 19058 - 28057 11 of jobs 36528 is the 25th percentile.

26992 - 35648 15 of jobs 35649 - 44306 21 of jobs The average salary is 50368 a year. Because you are a non-exempt employee your minimum salary depends on the number of hours you work during each pay period. This means that any California employee earning less than 58240 per year cannot be considered an exempt employee.

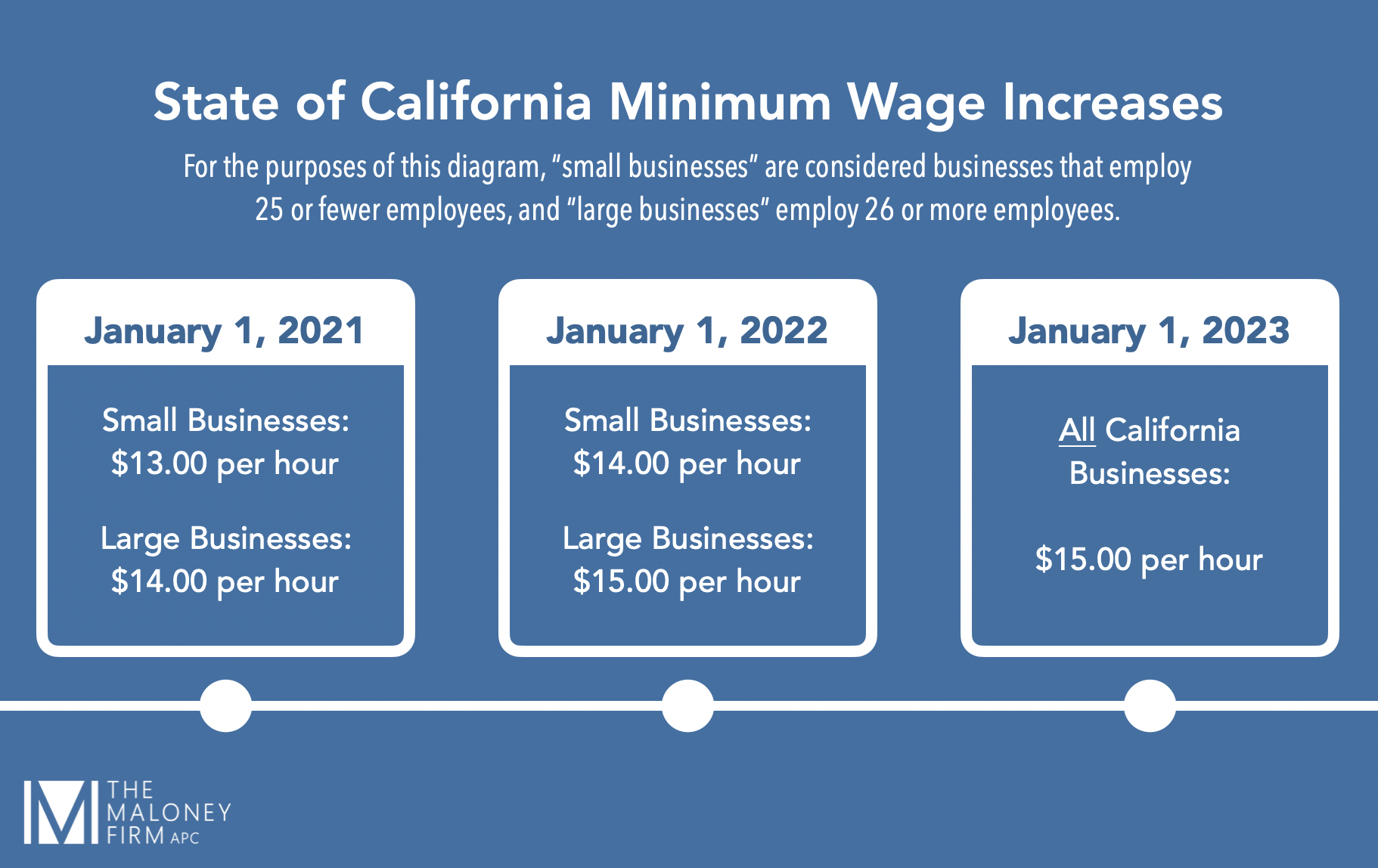

To pay a non-exempt employee a salary the employer pays the employee the fixed amount per week and pays overtime at a rate of 15x the employees regular rate. Non-exempt employees are awarded overtime pay although workers who are exempt are not. According to the Department of Industrial Relations for the State of California the minimum wage is 12 an hour for employers with 25 employees or less and 13 an hour for employers with 26 employees or more.

18334 - 26991 11 of jobs 35140 is the 25th percentile. An employer cannot ask a non-exempt salaried employee to work more than the maximum hours without providing overtime compensation. Salaries above this.

For individuals to qualify as exempt employees California requires that. Non Exempt Salary in Sacramento CA. Your state may require overtime in additional circumstances.

Non-exempt employees are required to make at least minimum wage. In the workplace you have two types of employees non-exempt and exempt. 46058 - 55057 19 of jobs 55058 - 64057 5 of jobs 68292 is the 75th percentile.

Exempt executive administrative and professional employees earn a salary of no less than two times the state minimum wage for full-time employment. Under the FLSA non-exempt employees must be paid at least the minimum wage for each hour worked and overtime 15 times the employees regular rate of pay whenever they work more than 40 hours in a workweek. Salaries below this are outliers.

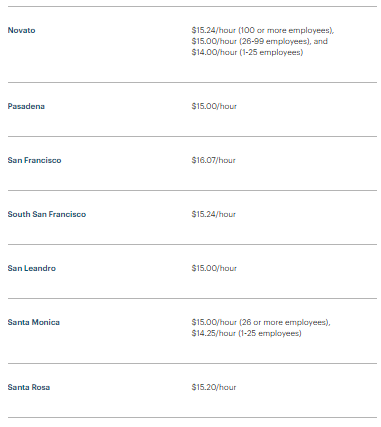

Toni works in a call center with about 20 other employees. In 2021 an employee in your situation is usually entitled to a minimum wage of at least 1300 1400 per hour plus overtime if you work more than 8 hours in a day or 40 hours in a week. Salary Threshold The salary threshold in California is two times the state minimum wage.

If you are paid a salary the regular rate is determined as follows. They perform exempt duties more than 50 percent of their work time. In California in a situation where a non-exempt employee is paid a salary the regular hourly rate of pay for purposes of computing overtime must be determined by dividing the salary by not more than the legal maximum regular hours in most cases 40 hours but this may be less than 40 hours where daily overtime is being computed to determine the regular hourly rate of.

44307 - 52964 19 of jobs 52965 - 61622 5 of jobs 65696 is the 75th percentile. Non- exempt salary is a fixed payment protected by FLSA or Fair Labor Standards Act which is a regulation that governs working hours minimum wage and overtime compensation. For 2021 this is 14 per hour X 2080 hoursyear X 2 58240.

In a second example lets look at an employer who works a 375 hour workweek. The overtime rate for salaried non-exempt employees is the same as hourly non-exempt employees. The regular rate in this method is determined by dividing the salary by the number of hours the salary is intended to compensate.

Employers that misclassify a non-exempt employee as exempt engage in wage theft by depriving the misclassified employee of the minimum and overtime wages meal and rest breaks and other privileges of California law afforded to non-exempt employees. Toni is paid a salary based on her working 40 hours a week. Divide the annual salary by 52 weeks to get the weekly salary.

Simply paying an employee a salary does not make them exempt nor does it change any requirements for compliance with wage and hour laws.

Hourly Vs Salary Pros And Cons Quill Com Blog

California Overtime Law 2021 Clockify

California Overtime Law 2021 Clockify

Exempt Vs Non Exempt Employees In California What You Should Know Workplace Rights Law Group

California S 2021 Minimum Wage Increase To Impact Exempt And Nonexempt Employees Lexology

Exempt Vs Non Exempt In California 2021 Perspectives Employers Group

California S 2021 Minimum Wage Increase To Impact Exempt And Nonexempt Employees Lexology

Employer Alert California Minimum Wage Increases January 1 2021 The Maloney Firm Apc

Exempt Vs Non Exempt Legal Definition Employer Rules Exceptions

California Salary Laws And When Must A Company Pay You By The Hour

Learn The Difference Between Exempt And Non Exempt Employees Guidelines For Both Types Of Jobs And Information Human Resources Humor Job Help Executive Jobs

Time Off Requests For Exempt Vs Non Exempt Workology

Overtime The Flsa And Exempt Vs Non Exempt Employees Partnervine

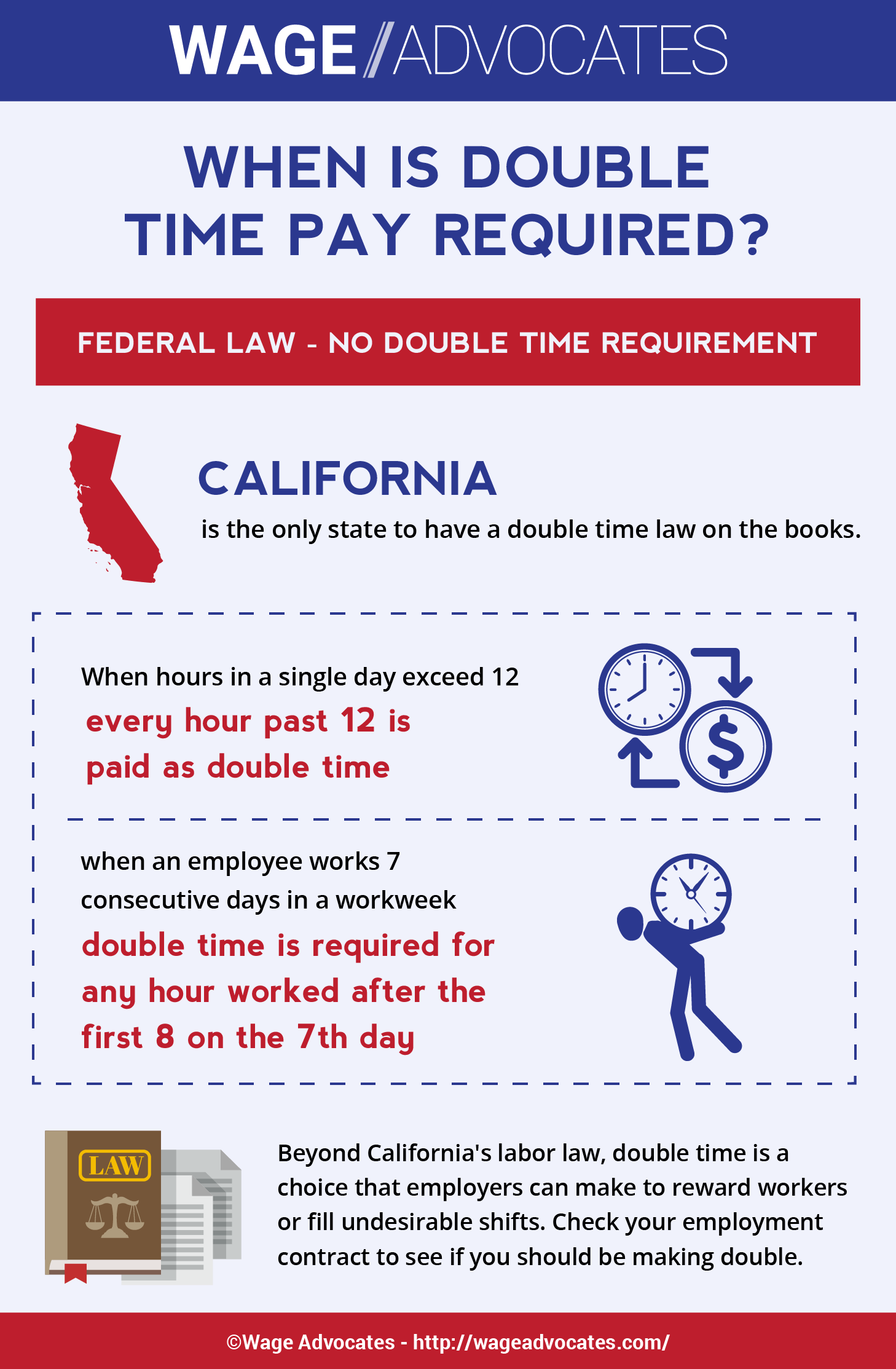

Double Time Vs Overtime The Difference In California

Exempt And Nonexempt Employees California Chamber Of Commerce

The Must Know Time Clock Rules For Hourly Employees Hourly Inc

Exempt Employees Misclassification Lawsuits In California

Overtime The Flsa And Exempt Vs Non Exempt Employees Partnervine

What Is Double Time Pay When Is It Mandatory Overtime Lawsuit

Post a Comment for "Ca Salary Non-exempt"